Last week, someone said that they’d rather have experiences like taking an African safari than retire early. When I told them that seemed very aligned with Slow FI, they asked, “What’s the difference between Coast and Slow FI again?”

With so many flavors of financial independence out there (fat FIRE, lean FIRE, Barista FIRE, Coast FI, Slow FI, etc.), how it is possible to keep track of them all?

Although it can sometimes be confusing, I actually love that there are so many different flavors of FI or FIRE. So many people don’t resonate with the narrative of the white dude who works in tech and lives off $20,000/year. With so many different flavors of FI/RE, people start to see themselves in the story. They start to see possibilities for their own life.

Because of Coast FI and Slow FI, I actually fit into the FIRE movement. These terms have allowed me to find my people! Without that, I definitely wouldn’t be living the life I am today.

The point of this post isn’t to give a definition of all the flavors of FIRE. I’ve done that elsewhere. This point of this post is to make the distinction between two flavors of FIRE that are often confused: Coast FI and Slow FI.

Coast FI vs. Slow FI: What’s the Difference?

First, I will give you a basic definition of each term. Later in the post, I will dive into more detail about each of them.

Coast FI means that you already have enough saved and invested for your traditional retirement. The calculation (see below for more details) is based on your current age, desired retirement age, and expected expenses.

When you invest this money in the market for the long-term, it will grow to provide you with what you need for a comfortable traditional retirement. This means that each person will have a specific Coast FI number which is the amount of money you’d need to have invested at your particular age.

Slow FI is not a specific amount of money or financial strategy. It’s a philosophy that focuses on using the financial freedom that you gain along the path to FI to design a life you truly love.

Like slow living and slow food, Slow FI focuses on intentionality. Slow FI adherents are intentional with their money (much like FIRE adherents). But, they focus on using their money and time to live a better life that’s aligned with their values. They do this without sacrificing their long-term financial stability.

Now that I’ve defined these two terms, are you still confused? If these terms are new to you, I wouldn’t be surprised if you are. This is why I’ll do a deep dive into both of them.

What is Coast FI?

As shared above, Coast FI is the point at which you no longer need to save or invest for your traditional retirement.

Said another way, this means that you could decide to scale back work and only cover your actual costs. The money you’ve already invested will continue to grow to provide you with a comfortable traditional retirement at the age you choose. This assumes you invest in index funds that mirror the growth of the market, not in individual stocks or other risky strategies.

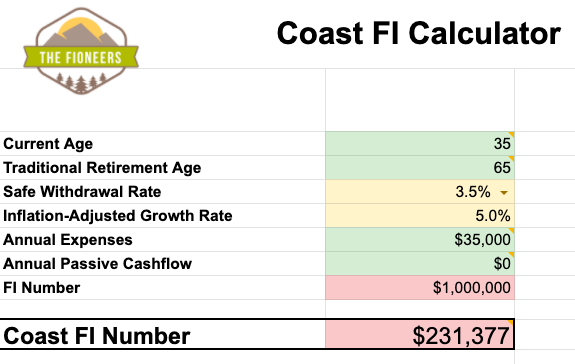

How do I calculate my Coast FI number?

The formula to calculate your coast FI number is as follows:

Coast FI # = FI # / (1+Expected Growth Rate)^# of years until retirement

This might look like gobbledegook to you. So, let me explain it in layman’s terms.

In this formula, the goal is to calculate your Coast FI number. You do this by taking your Full FI target and dividing it by 1 plus the expected growth rate to the power of the number of years you have until retirement. This means that you will multiply 1 plus the expected growth rate by itself that number of times.

To do this calculation, you’ll need to know:

- Your current annual expenses (or if you know your expected expenses in retirement will be very different from now, you can calculate your FI number using this amount).

- Your current age

- Your desired retirement age

There is one key assumption here: Using the 4% rule of thumb (from the Trinity study), your full FI number (i.e. the number at which you could retire and never run out of money) is twenty-five times your annual expenses. If you are a bit more risk-averse, you could do 28-30x your annual expenses.

When learning about Coast FI, the first thing people note is that they are blown away that the number could be so low. This is especially true for people in their 20s or 30s.

For example, let’s say three different people (Janet, Josh, and Elena) spend $50,000/year. Using the 4% rule of thumb, they would each need $1,250,000 to retire comfortably. But, they are of different ages. Janet is 25. Josh is 35. And, Elena is 45. Let’s assume they all want to retire at 65 for the sake of the calculations.

Their Coast FI targets are very different, depending on their age.

| Name | Age | Coast FI Target |

| Janet | 25 | $177,557 |

| Josh | 35 | $289,222 |

| Elena | 45 | $471,112 |

If you spend, $50,000/year, you’d need $1,250,000 invested in the stock market to retire. If you could save/invest $177k by the time you were 25, your traditional retirement would be set. You wouldn’t have to save any more funds for traditional retirement. This would also be the case if you could save $289K by 35 or $471K by 45.

I know these are still significant amounts of money, but they are quite a bit less than the $1.25 million that will eventually be needed. And the earlier you save and invest, the amount you need is lower.

This may all seem very complicated. It is. That’s why I’ve created a free downloadable spreadsheet that can help you calculate your Coast FI number and the timeline that it will take you to reach it.

What can I do when I reach Coast FI?

When you reach your Coast FI number, it certainly doesn’t mean you have to scale back and only cover your actual costs of living until you reach retirement age. This is certainly one option though.

Another option is that you could continue saving and investing. After you reach Coast FI, each additional dollar you invest can bring you closer to early retirement or other lifestyle goals.

The final option is that you can take a middle path. You could use the new feeling of freedom to start scaling back your worktime or income, even if you are still saving or investing at a lower rate.

If you decide to use the freedom afforded to you by reaching Coast FI, you have a lot of lifestyle design options at your disposal. You could choose to generate less income. This could allow you to scale back your work hours, accept a new job that you’ll enjoy more (even if it pays less), or become your own boss.

It could also allow you to spend more money for a period of time. This could allow you to do something like, buy an RV or campervan or take an extended sabbatical.

There are so many options available to you once you reach Coast FI.

What is Slow FI?

As discussed above, Slow FI is a philosophy (like slow food and slow living) that focuses on intentionality. Slow FI adherents are asking questions like, “How can I use the financial freedom I am building to intentionally design a better life?”

People on Slow FI paths are focused on working less (or doing something they actually enjoy to generate income). They do this, so they can invest more time in the things they enjoy and value: health, relationships, hobbies, travel, learning, curiosity, etc.

Slow FI adherents know they don’t need to wait until they retire early to do these things. Financial freedom is not all or nothing, and different stages of financial freedom can unlock new lifestyle designs.

What are the stages of financial freedom?

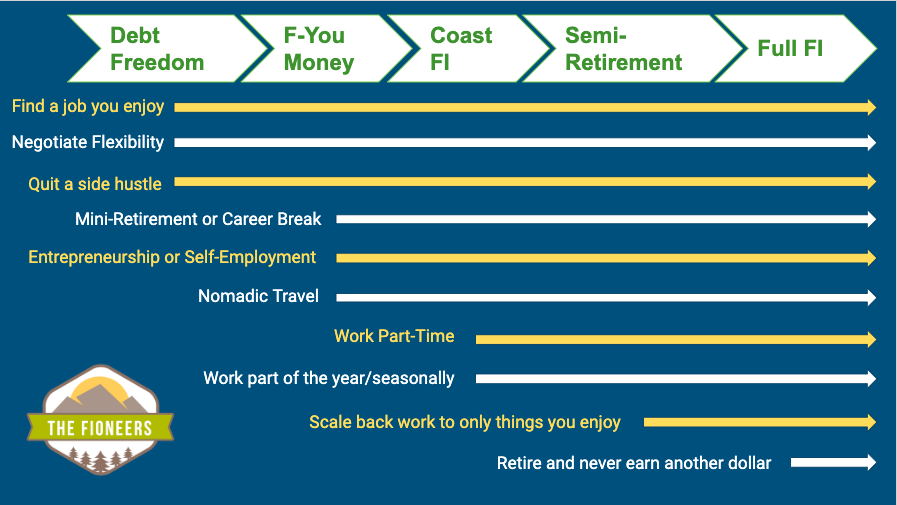

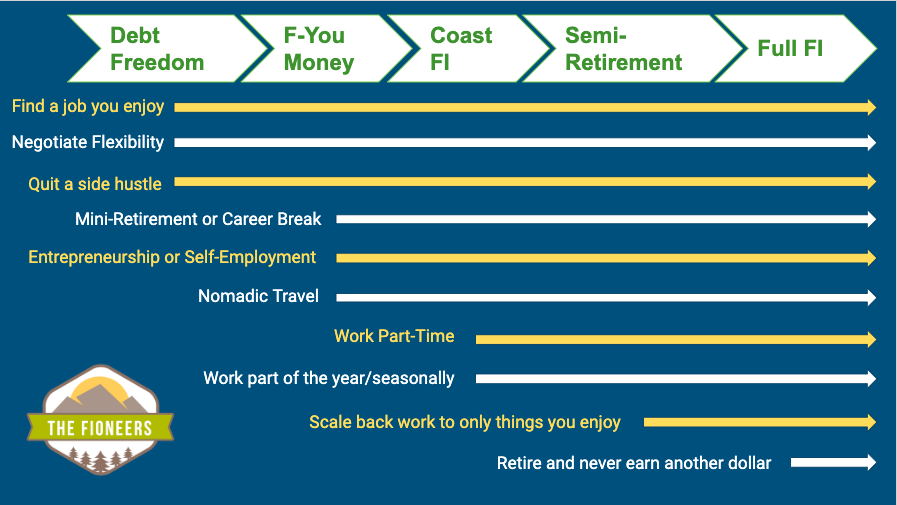

For those pursuing financial independence, I think of 5 different stages that people progress through along their path to FI. There are other stages before and after these. Since these five stages unlock different lifestyle design options, this is where we’ll focus.

The stages include:

- Debt Freedom: You can define debt however you’d like here. Your focus could be freedom from all debt, bad debt, or high-interest debt. The key thing here is that when you pay off debt and rid yourself of additional monthly payments, you reduce your expenses. Having lower expenses provides you with new options.

- F-You Money: This is when you have enough cash on hand in an emergency fund or other liquid investments to get out of a bad situation or take advantage of an opportunity. To have F-You Money, you’d need at least 3-6 months’ worth of expenses in your emergency fund. To provide a feeling of freedom, some people may feel like they need 1-2 years of expenses readily available.

- Coast FI: Coast FI is the point at which you’ve already saved enough for a comfortable traditional retirement (see above for more information).

- Semi-Retirement: Semi-retirement is when you can cover your expenses partially with passive income from your investment portfolio. But, you still need to cover part of it with passive income from part-time work or your own business. Some people call this Barista FIRE.

- Full Financial Independence: This is when you can cover all of your expenses with passive income from your portfolio.

What lifestyle design options are available to you on a Slow FI path?

There are so many different lifestyle design options that are available to people as they build financial freedom.

I’d like to note something important about the chart below. These options aren’t necessarily linear. Some people start businesses when they are still in debt. Others can generate a high enough income from part-time work to do this before reaching Coast FI. Depending on your circumstances, you might be able to access some of these lifestyle design options even earlier.

The purpose of this chart is to show that for most people, building financial freedom will provide them with new lifestyle options.

The only lifestyle design that’s not available until you reach full FI is retiring and never earning another dollar. All the other options are available long before reaching FI.

Coast FI and Slow FI are Related But Different.

Coast FI is simply one stage of financial freedom. If you take a Slow FI approach, you can decide to use the financial freedom that Coast FI (or any other stage of financial freedom) provides to design your life (and maybe even design a life you don’t want to retire from at all!).

This is my goal. I want to use the financial freedom I am building to make many small shifts in my life over time. When I finally hit my FI number, I hope that nothing will need to change. It’ll just be another day because I’ll already be living my ideal life.

I’m only 42% of the way to FI (and that could be even lower now because of how the market is currently doing). But, I have already utilized so much of the financial freedom I’ve built.

By being free from student loans and credit card debt (I do have a mortgage), I have been able to improve my life in the following ways:

- In my first year out of college, my mental health was suffering. Because I had no debt, my expenses were low enough that I could reduce my work to 4 days/week to get treatment.

- In my second year out of college, I knew I needed a new job, but we were in the middle of a recession. I decided to take a job through AmeriCorps (the domestic version of the Peace Corps) and made $11K (before taxes) that year. It was a huge challenge, but we did it, and it set me up for a career in nonprofit.

- A few years later, when I was offered two jobs at the same time (with a $15K pay difference), I took the lower-paying job because I knew I’d enjoy it more.

Paying off debt can allow us to make different decisions to prioritize our health, well-being, and work we’d actually enjoy.

When I realized I had F-You Money, it gave me the freedom to do a few things, including:

- I took a 6-month career break (using medical leave) after a mental breakdown in 2018 to recover and learn to manage severe anxiety.

- I quit the toxic job that was causing the anxiety without having another job lined up yet.

Reaching Coast FI has allowed me to design my life in so many ways:

- When I went back to work in 2019, I found a part-time job that would allow me to work 3 days a week, so I could focus on my mental health.

- When my mental health improved, I chose not to increase my hours. This allowed me to continue focusing on building The Fioneers and my coaching business.

- I quit my part-time job and took the “leap” to entrepreneurship when my business could cover about 50% of our collective expenses. My ultimate goal is to cover 100% of our expenses, which would allow Corey to quit his day job.

- Instead of continuing to save aggressively, we decided to funnel money toward buying and building out a campervan. This will support our goal of being location-independent. Spending more reduced our savings rate to about 20% for 2021. It will be similar for 2022.

While we have reached Coast FI, we are taking a middle path. We are using this feeling of freedom to scale back and design our lives now. Our goal is to coast to a retirement date in our early 50s. This means that Corey will likely continue working full-time for another 1-2 years (thought he might get a 2-3 month sabbatical in 2023).

Learning about Coast FI and taking a Slow FI approach has allowed us to slowly (but steadily) design a life we don’t want to retire from.

This is a great explanation of coast vs slow FI: I’ve mostly thought about different types of FI as different types of destinations people choose to go, but it’s definitely educational to see the viewpoint that these different types of FIs are different phases of the FI journey.

I think looking at it as different parts of the journey is useful for me because if I’m at coast FI but leanFIRE yet, I can give myself credit for reaching coast FI instead of beating myself up for not having reached leanFIRE.

For sure! They are definitely milestones along the path. And, anytime, you can decide to use the freedom they afford you!

Thanks for the explanation! That makes things much more clear. I’ve always felt I didn’t fit into FIRE because I focus a lot on lifestyle design in the present. I resonate with Slow FI.

We still save mindfully for retirement, but we want to have a life we love now, in our 40’s. We took a sabbatical in 2019 and traveled around the US with a teardrop trailer, we both work less than full-time, and next month we’re gearing up to rent our house out for a couple of years so we can try living in some new places.

I will continue to work part-time, but my husband will use some of our FU money to take a break from working as an arborist for 20 years and think about what he might want to do next.

We know too many people who are older than us who are having health issues, have passed away early, etc. We’re not taking that chance.

We’re living it up now, while also living beneath our means, having a healthy savings account, and continuing to save for retirement.

Thanks for everything you share on the blog! It’s always inspiring!

Hi Megan,

Thank you so much for sharing your story, and I’m so glad you feel like you can see yourself in this “flavor” of FI. I can’t wait to hear more about your journey!

Jess

Hi Jessica,

Great explanation of the two terms. I particularly like your Janet / Josh / Elana example. If Janet can earn the national median salary of $75K after graduating at age 22, and keep living like a student on $16K/year for just three years, she’s Coast FI!

As we approached FI, that gave my wife the confidence to not only drop to half time, but also to negotiate a completely new kind of position for herself at her company. Now she is much happier with both the number of hours she works and the kind of work she does. Another incredible benefit of pursuing FI!

Hi Corwin, ‘

I’m so glad to hear that this has provided your wife with more freedom! Thank you for sharing,

Jessica