In the summer of 2019, I had the opportunity to increase my work hours to 4 days/week. I started a new job in January of 2019 working 3 days/week. The job was advertised as part-time (3 or 4 days/week).

Because I was still learning to manage my anxiety and panic attacks, I chose 3 days/week. I intended to go up to 4 days/week after about 6 months (or when I knew my mental health could handle it).

Around the same time, we also started to better define what our ideal life would look like.

Through this reflection, we realized that retiring early was no longer a component of our ideal lives. We had recently come across the idea of semi-retirement, which sounded like the best of both worlds!

We still want to be productive and generate income. At the same time, we want to live a location independent lifestyle. We’d use our ample free time to focus on our passions and building strong relationships.

I had a vision that one day we could start generating income on the side through our blog and my coaching business. I thought $20K/year would be a great goal. Since we would truly enjoy generating this income, we could theoretically “retire” from our day jobs with less than a full-FIRE stash.

I got really excited about this idea. I created milestones for our financial independence journey. These milestones, like others I’d seen before, didn’t focus on the amount of money we’d need to fully retire early. Our milestones focused on how much active income we’d still need to generate for a semi-retired lifestyle.

These milestones would tell us when we’d need to generate $40K, $30K, $20K, $10K of active income. Then, we could live a semi-retired lifestyle while only pulling some money from our investments.

I was so focused on semi-retirement that I backed into my understanding of Coast FI.

I realized that there was also a point where I would have enough saved for retirement that I’d only need to cover my actual costs.

This was a completely new idea for me! Instead of continuing to save 40%, 50%, or even 60% of our income, we could choose to just cover our costs. We could, then, “coast” to retirement and focus on building an awesome life in the meantime.

This idea was transformational for me, and I wondered why I’d never heard about it before. I looked it up and realized that only a few people in the FI community were talking about it. When they did, they called it Coast FI.

I knew I needed to dig in and learn more.

What is Coast FI?

Coast FI is the point at which you no longer need to save any money to have a comfortable traditional retirement.

To say it in another way, Coast FI is when you already have enough saved in your retirement accounts that, if left to grow until the traditional retirement age, you will have enough to live on comfortably.

Each person’s Coast FI number is unique because it takes into account:

- Your current age

- The time horizon you have until you would like to fully retire

- Your current expenses

How do I calculate my Coast FI number?

To calculate your Coast FI number you can use a basic compound interest formula.

Coast FI # = FI # / (1+Expected Growth Rate)^# of years until retirement

First, I will explain this in layman’s terms, and then I’ll share how you get each number.

In this formula, the goal is to calculate your Coast FI number. You do this by taking your Full FI target and dividing it by 1 plus the expected growth rate to the power of the number of years you have until retirement. This means that you will multiply 1 plus the expected growth rate by itself that number of times.

Looking at this formula may seem very confusing. You might be wondering a few things:

- What is my FI number?

- What is the expected growth rate?

- What is my time horizon? How many years do I have until retirement?

Let’s walk through each variable.

Your Financial Independence Number

Your FI number is the amount that you will eventually need to lead a comfortable traditional retirement. You need to reach this number by the time that you choose to no longer work or generate income to keep your expenses the same.

To calculate your FI number, you need two pieces of information:

- Your current expenses (or your expected expenses at retirement if you expect that they’ll be very different than your current expenses)

- A safe withdrawal rate (SWR) that you are comfortable with. Many people are comfortable with a 4% SWR. This is the percentage recommended by the Trinity Study. They found that if people withdrew only 4% of their portfolio, they are very likely to not run out of money for a 30-year retirement. If you expect your retirement to be longer than 30 years, you may want to go with a safer withdrawal rate of 3.5%.

FI # = Current (or Expected Expenses) x (1/SWR)

Let’s work through an example. Julia currently spends $45,000/year. She expects her expenses to stay around the same amount throughout her life.

She enjoys her work and runs a business on the side. She doesn’t expect to fully retire until she reaches age 65, so she’s comfortable using a SWR of 4%.

So, let’s calculate Julia’s FI number:

FI # = 45,000 x (1/.04) = $1,125,000

Julia’s full FI number if $1,125,000. This is the amount that she would need by the age of 65 when she wants to retire.

Expected Growth Rate

There is a lot of debate about the expected growth rate of the stock market. Depending on how many years we take into account, this number could be anywhere from 8-15%. Because of market volatility, we encourage you to use the lower number 8% and then account for 2-3% inflation each year. This would bring your expected growth rate to a very conservative 5%.

As a quick note, this rate assumes two things:

- That you are investing in broad-based index funds

- That you are buying and holding the money in the accounts for many years/decades. The market is volatile, so it’s likely that a single year will not align with this growth rate.

You might see higher returns than 8% on average during the time that you are investing. At the same time, I think it’s better to plan using conservative assumptions.

Let’s go back to the example. Julia decides she wants to plan conservatively, so she also chooses a 5% expected growth rate for the stock market.

Time Horizon Until Retirement

You can calculate the time horizon until retirement simply by subtracting your current age from the age at which you’d like to retire.

Time horizon = Your desired traditional retirement age – Your Current age

Julia is 37. She’d like to be able to fully retire by 65. This means that her time horizon until retirement is 28 years.

Coast FI

Using all this information, we can calculate Julia’s Coast FI number.

Coast FI # = 1,125,000 / (1+.05)^28

By doing this calculation, we can see that the amount of money that Julie would need to be Coast FI at the age of 37 is $286,980.

This means that if she has this amount in her retirement accounts, she could decide to scale back her work and only cover her costs of living.

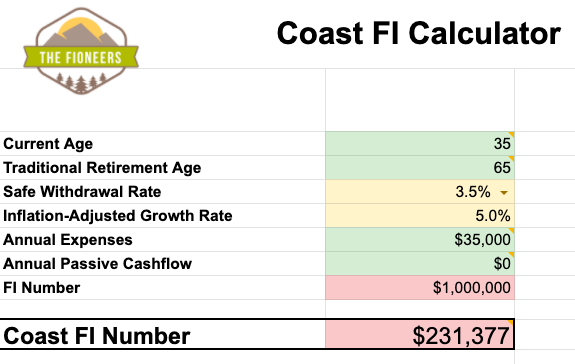

Download our Coast FI Calculator

You are probably thinking that this calculation requires a lot of work! Luckily, we don’t expect you to do it all yourself. I explained it so that you could have an understanding of the math behind the number.

If you download this template, you can add your information and determine your Coast FI number. With a few more items (such as current net income and current investment balance), this spreadsheet template will also calculate your timeline to reach Coast FI or Full FI.

What Can I Do After I Reach Coast FI?

We are big believers that you don’t need to wait until you retire early to design a life that you love. Financial Independence is not all or nothing. We gain a lot of freedom along the way to FI that we can use to improve our lives.

Once you reach Coast FI, you have three options:

- You can scale back income-generating activities and only cover your actual costs of living. You can stop saving for retirement!

- You can continue to save for retirement, but you can take your foot off the gas. You can save at a slower rate and make incremental lifestyle changes.

- You can continue pushing hard toward financial independence. If you are in a job you hate (or even don’t like a little bit), I’d encourage you to rethink this one.

If you decide to go with option 1 or 2, there are so many ways you can design your life along the way to financial independence.

Find a Job You Actually Enjoy

Last week, I published a Slow interview with David from City Frugal. David used the freedom that Coast FI provided to him by seeking out a new career that he would enjoy more.

He knew he was taking a risk by trying to switch career tracks in his current company. He knew that if he was turned down for the job, he could use the financial freedom he’s already built to take some time off to figure out what was next for him.

Sometimes a job you enjoy more will actually pay more, and you just need the confidence to go after it. Sometimes a better job will pay less, and that’s okay if you’ve already achieved Coast FI and/or can cover your expenses.

Negotiate Flexibility at Work

As you gain financial freedom, the relationship with your employer shifts. I used to feel like my employer held all the power. They would make a request, and I would acquiesce. Now, I see that it’s a two-way street. I also have power in the relationship. They need to provide me with a good work environment and interesting work, or I can leave.

One thing that you can do as you gain financial freedom is to set clearer boundaries around your work hours. You may even be able to negotiate to work a few days/week from home (even after COVID) or full-time remote work if that’s something you are interested in.

For example, my friend Mel, who writes at Modest Millionaires, negotiated a full-time remote working position long before COVID hit.

Reduce Your Work Hours

You may even be in a situation where you can reduce your hours with your current employer or find a part-time job with a new employer. A reduction in hours is usually accompanied by a pay reduction.

If you have reached Coast FI, this is okay as long as you can still cover your expenses. If you haven’t yet reached Coast FI, you still can do this as long as you can cover your expenses and save a little bit.

Angela Rozmyn, who writes Tread Lightly Retire early, was able to negotiate a reduction in work hours with her employer of many years.

I quit a full-time job in late 2018 and started a part-time job with a new organization in early 2019.

Seasonal Work

Once you reach Coast FI, you may not need to work all year round.

For example, I recently interviewed a woman named Kat. Now that she’s reached Coast FI, she works seasonally in her city’s public works department and does a few other odd jobs over the course of the year. From the seasonal work and odd jobs, she covers her actual costs.

Michelle, from Frugality and Freedom, would work short-term contracts in the arts industry each year. The money earned from these short-term contracts would cover her costs, and she’d travel nomadically for the rest of the year.

Freelance Work or Entrepreneurship

There are so many people who have taken a leap to work for themselves. They do this through freelance or consulting contracts or by building their own businesses.

Lance, who writes at Money Manifesto, became self-employed several years ago. He now works on both his freelance writing and his own business.

Lauren and Steven, who write at Trip of a Lifestyle, were able to pursue long-term travel arrangements because of Freelance work.

What will you do when you reach Coast FI?

Sometimes, it’s hard to imagine actually having financial freedom. For me, that was definitely the case. I started out with a very low income. Even after I grew my career over the next 10 years, I still had a feeling that I could lose everything at any given moment.

Over the last couple of years, I’ve been able to rid myself of this scarcity mindset.

Beyond this, I’ve also learned that financial freedom isn’t all or nothing. I used to think that you were either fully financially independent or you weren’t. There wasn’t any in-between.

When I was first faced with the possibility of using financial freedom to improve my life, I had a hard time figuring out what I’d want to do with it. I was on autopilot because I didn’t think I could actually choose what I actually wanted.

Fast forward to today, here is how I plan to use the freedom that Coast FI provides:

- Build the blog and my coaching business on the side of my part-time job

- If these income streams can cover our full expenses, we can quit our jobs and become location independent.

- If these income streams don’t cover our full expenses, we have a few options. We can work to build up additional income streams like investing in rental properties, or we could do contract work on a short-term basis. Or, we could continue our work until we have increased our investments to the point where we could semi-retire.

If you are struggling to figure out what you’d want instead, that’s okay! It took us years to figure out what we’d actually want if we could choose. In reality, we’re still defining our ideal lives.

If you want to get started, I’d encourage you to read my recent post about how to get off autopilot. It will provide you with a holistic framework to start defining what you really want.

Great clarification of Coast FI.

I am happy to know that I have reached that stage. In addition, right now I work about 2 hours per day and that’s enough for me to live on. In about two years, I will not have to work those 2 hours if I don’t want to.

Hi Alain,

Congratulations! That’s a really awesome place to be.

Best,

Jessica

Great post! I first learned about Coast FI thanks to your blog, and did the math to realize I was already there! It’s a very reassuring feeling.

I’ve been fortunate enough to reach Coast FI at a very young age (25), so I’ve been thinking a lot about how I can take advantage of it. I like how you outline the options. I’m currently not interested in retiring early, going part time, or becoming an entrepreneur, so here are the tweaks I’m thinking of:

1. Purchasing things if I want them, within reason. Easier said than done when having sticker shock! But if I know I value it (buying myself time or experiences, giving to charity, etc) and can afford it, I’m working on moving past the price and just going for it.

2. I love my job, but in the next few years I want to try finding a similar job in a different industry, that I think will let me do more good in the world. I’m encouraging myself that it’s okay if I take a pay cut to do so.

3. Negotiating flexibility for travel. I’d like to travel for a month in a row every year or two, either taking the month off and traveling to many places, or working remotely and living abroad in mostly 1 place for a month.

4. Continuing to save the excess beyond that, adding to my peace of mind that if my situation or desires change in the future, I’ll be ready.

Any ideas are appreciated! What am I missing? 🙂

Hi Jess,

This is awesome! I love that you are in a position where you can already decide that you want to write your own script. You are in such a good position to negotiate flexibility.

Thanks for sharing your story!

Jess

Hi, I am not sure about something. You wrote that FI # = 45,000 x (1/.04) = $1,125,000 is Julia’s FI number when she retires at 65. However, I would think that this is the number she needs NOW. Because at 65, her expenses won’t be 45,000, it would be quite a bit higher with 28 years of inflation at 2% or 3%. Right? Shouldn’t we calculate how much expense she would have in 28 years and multiply that number with 1/0.4?

That you for sharing the spreadsheet and formulas!

Hi Karine,

Good question. When I calculate the Coast FI #, I use a 5% return rate to account for inflation. Since I account for inflation elsewhere in the equation, I don’t need to account for it again in the FI number. You could choose to account for inflation in either the number or your expected return, but you don’t need to do both.

I hope that helps,

Jessica

As I suspected, I am happily within the CoastFI range. And I estimated a 4% return rate just to be a little safer.

And, I have been working part time by choice for a while now (though I have many confounding factors with my son and cancer treatment. Only recently is it really by choice). Then the pandemic came and now I’m not working at all!

My struggle is that part time work in my profession, which I’m not enjoying in my current capacity pays so well it is hard to contemplate a career change. Nevertheless, I’m exploring my options, continuing to look for ways to reduce spending (hard at this point) as well as find new avenues of income.

But at least retirement is on cruise control!

Hey!

This is great to hear that you are in such a strong financial position. It’s also okay to have your job fund your lifestyle if you are working toward things that you enjoy during your non-work time. I’m definitely not one to say that everyone should love their job! 🙂

Thanks for sharing!

Jess

I was amazed to discover that I was Coast FI. Amazed because for years, all I had was that FIRE number and it seemed impossible to reach, and I was getting so disheartened. With this realisation, I can now let go of my unhealthy detachment to money and not get so terrorised about holding down a job. I realise, as well, that with my rental income + part-time job + occasional freelance work, I can live very well and happily indeed. Thanks! Such a useful calculator.

Hi Liz,

I love this! I am so happy to hear that this helped you.

Best,

Jess

Thank you for this article and your blog in general. I found both while searching for the term “Coast FI,” so your article is well-timed. It is probably a more searched term given the state of the economy and people figuring out where their FI or FIRE plans fit in.

I am the same way. I am roughly 38, looking to reduce my medium/high level stress workload to a part-time/seasonal workload at age 40. That work should be enough to meet at least half of our annual expenses, with my wife having the flexibility to do the same whenever she is ready to downgrade her work stresses. I would have more time to take care of our daughter, exercise and pursue other passions, including helping people with some basic financial literacy questions.

So… I did our “coast FI” number and found that, using a real rate of return at 4% (7% less 3% inflation), we ended up being able to completely forgo work at age 51. That’s with a 0% savings rate starting today, so if we manage to make it over the next couple of years to age 40 with our current salaries/savings, we would reach coast FI a couple years before the goal of age 50, with some wiggle room to spare.

I can completely empathize with some of your earlier struggles with your career, burnout and anxiety. At times in my career, I was not a good person to work with or work for. I let certain stresses from management erode my job both at work and at home, and my coworkers and my wife have suffered during some of those points. But, like you said, you get the right help and you work daily to first become better to yourself, and then better to everyone else. I look forward to catching up on the rest of your blog.

Hi John,

What a great insight! I’m sure you’ll make the decision that’s right for you and your family.

Best,

Jessica

This is a great article. I had never thought about Coast FI until I starting seeing it throught the twittersphere a couple of weeks ago, and then I came across your article. I have actually read it a couple of times. My wife and I are not to Coast FI yet, but every month we work on saving 60% or more of our income to hit FI. Learning about Coast FI gives us a quicker goal to hit, which will give us more freedom in the future. Thank you for your knowledge and your formula. This has been quite helpful with out financial goals.

Hey! I’m so excited to hear that it resonated with you!

Best,

Jessica

Great article! My husband and I are Coast FI but had planned to work at least through next May or until he end of 2021 before quitting our jobs. We’d take some time to live and travel frugally before assessing whether to go back to work seasonally.

However, things at work may be changing for the unbearable, and we might want to do this a little sooner (travel in these times would mean camping and seeing our parents and just generally enjoying being on the same schedule).

How much cash savings do you recommend before transitioning to semi-retirement? We have $25k between checking and emergency fund, but it seems like too little of a runway, especially during the pandemic when our seasonal job opportunities could disappear temporarily.

Hi Kathleen,

Honestly, I think it depends on how confident you are in being able to find a new job or generate income through a side hustle. I’d recommend having at least 1 year of living expenses if you aren’t planning to work for at least 6 months. This would give you a 6 months runway to figure out what’s next without depleting your emergency fund below 6 months.

I wish you the best of luck,

Jessica

One year seems like a great guideline, Jessica. Thanks for a great blog! I appreciate the alternative perspective on early retirement.

This is amazing. Thank you for writing this post. I am in a similar situation with Elizabeth Tai that my FIRE number is stressing me out in my daily life to the point that it took the joy out of the work that I used to be excited about. Now that I am aware of this, I can finally took my foot off the gas and enjoy life a little bit more 🙂

Hi,

I’m so glad to hear it! Liz is so awesome and has really made some significant shifts in her life! I wish you all the best,

Jessica

I struggle with calculators like this one because 1) I expect my expenses later on to be much more than they are now as a single 24-yr old living with roommates and 2) it assumes that everything I’m not spending in a current year is going to investments, which isn’t true because of various sinking funds I keep in cash, both for short term expenses (like bike repair) and long-term more FI-like expenses (down payment, six months off fund, etc). That being said, it is reassuring to plug in my current numbers and see that, at my current lifestyle, I will reach Coast FI in less than 2 years! Just in the nick of time for me to take a six-month sabbatical, or “mini-retirement” as I’ve seen people write here. I know I want to work part-time in my 30s, so reaching Coast FI by that point (on whatever I determine to be a more accurate FI number by then) will be the milestone I am shooting for. I definitely expect to revisit this post and calculator often!

I’m so glad we found this resource! I have a question regarding other assets than the stock market? We have a investment property which is our largest asset 9 (and almost paid off) our home (paid off). We also have money in our IRAs and a 403b. Would we calculate our number differently?

Hi Tammi,

For rental properties, you’d include the amount that you get in a year as passive cashflow. This then reduced your overall FI # since you’ll have passive cash flow and don’t need to cover your full costs through your stock market investments.

Best,

Jess

Hello Fioneers ! Thanks for sharing this wealth of info. I really am benefiting from it. My question is, as a Canadian we receive CPP and OAS (similar to social security) typically at 65 if you choose to retire then. Am I to calculate that amount as part of passive income amounts along with say rental property income if we will have this at retirement as well? Thanks much!

Hey,

Yes, you could put that into passive income at that point, since you don’t need to do anything to receive it.

Best,

Jessica

Excellent article Jessica! We are more mature and recently learning of the FI concepts. So most of our thinking had been based on traditional retirement models. We have however began to implement principles of FI based on where we are.

We were already of the mindset to choose our preferred lifestyle versus working until ‘65’. We both work independently now doing what we love with total flexibility. We have minimal expenses, love to travel (hopefully again soon).

We left our corporate jobs comfortably me at 38 and my husband at 55. I focused on saving (through independent consulting projects and financial education) and he maintained the expenses and our lifestyle. Again, today we both are totally independent and we love it. The most important thing is keeping expenses minimal, and no debt and of course your savings strategy based on now FI projections and for some CoastFI.

I’ve now integrated these concepts as I teach on money matters. As people are openminded to concepts like FI it’s life transforming in many ways! Even if you grasp the concepts a little later on. 😉

Great work, and thank you for all that you share!

Joy!

Rita

Thank you so much for the calculator! The explanation really helped, too. I’d been struggling to get my head around what these calculators were really telling me.

For the first time, I feel like this goal is an attainable one. I would LOVE to reduce my work to part-time… and with my current savings it looks like I might be able to do this in under 5 years!

Hi Jessica! Thanks so much for this helpful summary, I’ve referenced it many times over the past few months. My husband and I are getting closer to CoastFI, largely thanks to investing in low-cost index funds in our early 20s. I’ve always assumed a very conservative 5% real rate of growth, as you’ve suggested here. With that assumption, we’re about 5-6 years away from CoastFI. However, my husband thinks we can reasonably assume a 6% real rate of return, calculated as: 8% growth + 1% dividends – 3% inflation. With a 6% return, we’re already at CoastFI.

We probably won’t make any big lifestyle changes right now either way because we both like our jobs… but who’s right?? Does your suggested 5% take dividends into account?

Hi Madison,

We are not taking into account dividends, because not everyone invests in dividend stocks. 6% is a totally reasonable assumption. You’ll just want to watch the performance over time.

Best,

Jess

Thanks for the great breakdown of Coast FI and the calculator. I had been so focused on FI for the last 5-10 years that I never took the time to consider Coast FI, till recently. And in good time, LMAO, according to your calculator I’m right around my Coast FI number at a time when I’m going to go part-time with my current employer, or take a mini retirement. Either way, it’s time to Coast to FI, and look forward to it.

Congratulations! I’m excited to hear that you’ll get to use some of that financial freedom to improve your life today!

Is the “Investing Ballance” number meant to be everything we have invested in low cost index funds? Meaning all our retirement accounts? Or is that meant to be investments outside of retirement?

Hi Andy,

By investing balance, I mean everything invested in low-cost index funds. This could include retirement and taxable investments (outside retirement). Some people also have a certain percentage in individual stocks, crypto, bonds, etc. Based on your portfolio, you’ll want to choose a growth rate that you are comfortable with.

Best,

Jessica

New to coast FI concept so had a clarifying question for my own understanding.

Am I correct in my thinking that coast FI basically means I can downscale my job such that it only needs to cover my living expenses?

If so, does that mean if I have coast FI amounts in one account, and then in another account where the dividends pay for my living expenses (but doesn’t grow), then I am actually just regular FI?

If you have dividends that cover your full living expenses, then yes, you’d be regular FI.

Thank you, I have often said I aspire to work for a temp agency, having minimal skills it gets a laugh from people not familiar with FIRE. I’m wondering how people account for a pension and Rental real estate. It won’t be a full pension as I started at 42. I might be able to get to 20 years, but I am vested. I figure the rentals will supplement the pension. I am investing in index funds as well but feel cash poor as repairs are needed on my properties.

Hi Wendy,

I’d encourage you to take a look at this post and calculator that incorporates more of the nuances like pensions and such: https://thefioneers.com/financial-metrics/

Let me know if you have questions,

Jess