On social media, I often see exasperated people complaining that they can’t keep track of all the different flavors within the FIRE movement (Financial Independence Retire Early).

There are so many terms. How can we keep track of them all?

- What is the difference between FI and FIRE?

- Fat FIRE and Lean FIRE?

- Coast FI and Barista FI?

- And, finally what is Slow FI? How is that different from Coast FI?

There are so many different types of financial independence, that it’s hard to keep them all straight.

I can understand why this is so confusing, particularly for those who are new to learning about FI. But, I actually love that there are so many different flavors of financial independence.

Why?

Because I know that one singular path doesn’t resonate with everyone.

When I first learned about the FIRE movement (Financial Independence Retire Early), I was intrigued, but I wasn’t ready to jump on board. I was in a toxic job, and I wasn’t excited about continuing to work in that toxic job for another 10 more years just so I could retire early. And, this was exactly what it seemed like FIRE adherents were suggesting.

I didn’t see myself in the FIRE narrative. When I started hearing about different types of financial independence, I started to see what was possible. Only then did I decide to jump in.

I agree that having many different types of financial independence can be confusing. This is why I’m writing this post. In it, I will define and provide you with examples of people taking different approaches to FI.

I hope that you find someone that you resonate with.

Defining Financial Independence (FI)

First, let’s define Financial Independence. Financial Independence is when you have passive income that can cover your full expenses.

Someday, we will all want or need to retire. We will have expenses and no longer be able to work anymore. So, we’ll want passive income to cover those expenses. If you reach financial independence earlier, you can choose to quit working earlier or use your financial freedom in another way.

People approach reaching financial independence in 2 main ways:

- Stock market investing, and

- Generating passive cash flow

Many people choose to invest in the stock market. We recommend low-cost index funds that track the growth of the economy. There are two main ways that people can generate passive income from the stock market:

- Dividends – People can buy stocks that provide dividend payouts. Before they reach FI, people will often reinvest these dividends. After FI, they will often withdraw them to cover their expenses.

- Selling shares – The other way to generate passive income from stocks is by actually selling shares. From the trinity study, there is a 4% rule of thumb that says that for a 30-year retirement, you can withdraw 4% of your portfolio each year and never run out of money. Since the market will grow by approximately that rate (or more) each year, you will typically be withdrawing the gains.

Others choose to invest in passive cash flow. There are two main ways that people generate passive cashflow:

- Real Estate Investing: People can invest in a rental property and receive passive income from renters. As a note, this isn’t totally passive unless you use a property management company. Other options for real estate investing could include storage facilities and parking. For example, we rent out the extra parking spot in our driveway for $200/month. This certainly isn’t “quit-your-job-money,” but it is one stream of passive income

- Create a digital product to sell online: Once you create a digital product, you can continue to sell it online forever. This could include books, ebooks, courses, audiobooks, etc. To be clear, it’s important to know that this strategy typically requires a lot of upfront work to be successful. Some people also sell physical products and have the shipping taken care of by a fulfillment company so that it’s passive.

Groups within the FIRE Movement Focused on Early Retirement

First, I want to introduce you to FIRE (Financial Independence Retire Early). Then, we’ll discuss two variations on FIRE that are both focused on early retirement.

What is Financial Independence Retire Early (FIRE)?

Someone might say they have “FIREd” when they have reached financial independence and subsequently decided to retire early.

There are different takes on what early retirement actually means. It could mean choosing to never earn another dollar ever again. For others, it means choosing to do only things you truly want to do, and if you generate income from it, so be it.

There are many famous stories of people who have retired early:

- The blogger behind A Purple Life recently retired early at the age of 30 with just over $500,000 in investments.

- Tanja Hester who writes the blog Our Next Life and wrote the book Work Optional retired early in her late 30s.

- Carl Jensen, who writes the blog 1500 days, reached FI in fewer than his goal of 1500 days from when he started the blog. As a quick note, Carl now encourages people to enjoy the journey more. He said his journey to FI felt like a “death march.”

What is Lean FI(RE)?

Lean FIRE is distinguished from general financial independence in one way. People pursuing Lean FIRE spend less than the average American Family, which is $40,000/year. This means that people who are pursuing Lean FIRE are generally quite frugal.

If we use the 4% rule of thumb, people pursuing Lean FIRE could decide to retire early with less than $1 million dollars in their investments.

There are a few notable people who fall into this category:

- A Purple Life who I mentioned above spent less than $16,000 in 2020.

- Jacob from Early Retirement Extreme (who is one of the earliest and most extreme of FIREes) wrote an article a few years ago about how he lived in $7,000/year

- Jessica from Financial Mechanic spent less than $20,000 in 2020. If she knew that her spending would stay the same throughout her life, she could already claim FIRE status. But, she plans to spend more in the future, so she’s aiming for a higher FIRE number. Regardless, I’d be very surprised if Jessica ever spent more than $40,000 in a year though, which is why I’m putting her in the Lean FIRE category.

For someone who spends $40,000, they’d need approximately $1 million invested. For someone who spends $20,000, they’d need approximately $500,000 invested to be able to retire early and hopefully never work again.

What is Fat FI(RE)?

Fat FIRE is the opposite of Lean FIRE. According to Physician on FIRE, who created the Fat FIRE concept, people are pursuing Fat FIRE if they plan to retire and live on more than $100,000/year.

This means that financial independence is for people at all spending levels. It isn’t just for the ultra-frugal, as the media might lead us to believe. People who want to spend more than $100,000/year can still reach FI. They will simply need a larger portfolio.

If you use the 4% rule, someone who wants to spend $100,000/year will need a retirement portfolio of $2.5 million.

Groups within the FIRE Movement NOT Focused on Early Retirement

There has also been a growing wave of people who are pursuing financial independence but they aren’t sprinting toward the finish line. They are focused on designing lives that they love along the way to FI.

What is Slow FI?

Slow FI is a mindset or approach to financial independence that focuses on using the financial freedom you gain along the way to FI to design your ideal life. If you are pursuing financial freedom for the purposes of living a better life that is more aligned with your values (and you’ll eventually retire someday), you are pursuing Slow FI.

Slow FI can take many forms. In our pursuit of Slow FI, I have made the following decisions:

- To take a 6-month career break to deal with severe anxiety and panic attacks

- To go back to work part-time as my mental health was continuing to improve

- To not increase my hours (even though my mental health had improved), so that I’d have time to work on passion projects and start my business

- To quit my job to become a full-time entrepreneur even though my business income from 2020 only covered half of my previous salary.

These decisions were not made to optimize our financial situation. They were made to optimize our quality of life.

So many people have made decisions to improve their quality of life by:

- Finding a job they enjoy more (even if it pays less)

- Working fewer hours

- Becoming a freelancer

- Starting their own business

- Working part-time

- Negotiating full-time remote work

- Taking a sabbatical

- Becoming semi-retired

Slow FI means you are finding a better balance between your financial goals and your quality of life.

If you’d like to read about the stories of people taking Slow FI paths, check out the 20+ interviews in our (award-winning) Slow FI interview series.

What is Coast FI?

Coast FI is when someone no longer needs to continue to save for traditional retirement. This means that you’ve saved and invested enough (hopefully in low-cost index funds) that if you leave it to grow, it will provide you with a comfortable traditional retirement.

When you reach this point, it means that you could choose to only cover your actual expenses with active income. This means you could decide to generate less income. This could provide you with more time to focus on passion projects and activities that don’t necessarily generate income.

For example, my friend Mel, who writes the blog Modest Millionaires, recently decided to take a 1-year sabbatical to test out her Coast FI plans. She’s planning to work part-time on her business to cover half of the family’s expenses. If the experiment works, she may never go back to traditional employment.

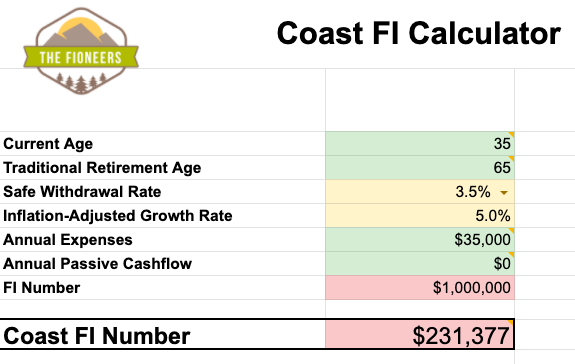

To calculate your own Coast FI number, you need to incorporate two pieces of data.

- Your annual expenses

- The time horizon you have before the traditional retirement age (i.e. the amount of time your investments have to grow).

If you’d like to calculate your own Coast FI number and the timeline it would take you to reach it, sign-up for our free newsletter below.

What is Semi-Retirement?

While Semi-Retirement isn’t technically a “FI,” I wanted to include it anyway. Semi-retirement is the step that you can take between Coast FI and full FIRE.

Once you reach Coast FI (and if you continue to save and invest), you will soon get to a place where you can track how much active income you’d still need to generate.

For example, my friend Rebecca (who, by the way, has an awesome donation-based investment course) realized in 2020 that if she could generate a small amount of active income each year, she could semi-retire. She didn’t have to work for 2-3 more years to make sure her FIRE plan was rock solid.

It actually all depends on where she and her partner decide to live long-term. If they choose a cheaper place to live, she may never need to work again. If they choose to live in a more expensive area, she may need to generate up to 4-figures of income each year.

She realized that she could do that by dog-sitting, opening new credit cards for cash back, or picking up odds and ends consulting projects.

If you’ve already reached Coast FI and would like to understand how much active income you’d still need to generate, check out our FI milestones calculator.

What is Barista FI?

Barista FI is a type of semi-retirement. Barista FI is when you take a part-time job that you enjoy that can provide you with a paycheck, health insurance, or other benefits. The term Barista FI was originally created because Starbucks offers benefits to part-time workers.

To be clear, you do not need to literally get a job as a barista to be considered Barista FI. Any job that you enjoy could put you in the Barista FI category of semi-retirement.

For example, we have a Slow FI interview with a woman named Kat who considers herself Barista FI. She’s gotten to a point where she only takes on fun jobs. She works with her local public works department, sits as a model for an art class, and works at a local health food store. She enjoys her work, and it gives her plenty of time to focus on things in her life outside of work.

Our Approach to Financial Independence

Our approach to financial independence has shifted many times over the years. Our example shows how your perspective and approach can shift drastically.

Before I knew about financial independence, we were already pursuing FIRE. My husband knew about financial independence. He’d constantly push us to save just a little bit more money each year so that we could shorten our working careers. To be completely honest, I was pretty resistant but eventually gave in.

As I mentioned above, when I first learned about FIRE, I was not ready to jump on board. I was already working in a toxic environment, and I couldn’t imagine sacrificing the next 10 years of my life so I could retire early.

So, we started to discuss how we wanted our approach to Financial Independence to be different. We heard many stories of people who reached FI who thought it would solve all their problems, and it didn’t. It just created new and different problems.

We wanted our approach to be different. We wanted the journey to be as remarkable as the destination. While we hadn’t created the term “Slow FI” yet, we were starting to live out this approach.

Soon after these conversations, our commitment to this approach was tested. We passed with flying colors and have improved our lives significantly. A few examples of this include:

- Taking a 6-month career break to focus on my mental health

- Going back to work part-time and eventually (when my mental health had improved), using my free time to start a business)

- Taking the leap to entrepreneurship before my business covered my full salary (although it’s likely to exceed it this year!)

Understanding Coast FI helped us realize that we could start using our financial freedom to improve our lives today. When we realized that we no longer needed to save for traditional retirement, we realized we could take our foot off the gas and intentionally design our lives.

Within the next few years, we’ll likely scale back even more. Corey will (hopefully be ready to) quit his job so that we can become fully location independent entrepreneurs. My guess is that we’ll continue to take a Coast FI approach, meaning that we’ll continue to cover our expenses doing work we love. But, we could also decide the scale back at some point and take a semi-retirement approach.

To be clear, this doesn’t necessarily mean that we couldn’t or won’t retire early. We’ve made so many decisions to optimize our quality of life. Yet, one surprising thing is that it hasn’t slowed down our path to FI as much as we expected to. Taking time off and working part-time enabled us to reduce our emotional spending and spending on convenience. Working part-time enabled me to start a side hustle that eventually has become my main gig.

Even with all these changes, we could likely still retire early in our 40s if we wanted to. The likelihood is that we won’t. We are designing our lives along the way to FI so that when that day arrives, nothing in our life needs to change.

Write Your Own Script on the Path to FI

There is no singular approach to pursuing financial independence. As you build financial freedom, you get to decide what you uniquely want to do with your life.

You could:

- Retire Early

- Find a job you enjoy more

- Work less

- Become self-employed

- Start your own business

- Take a sabbatical or career break

- Negotiate full-time remote work

- And so much more…

When you build up your financial freedom, you get to explore the options and design a life you truly love.