I’m excited to bring you this next Slow FI interview with Kathy, who recently scaled back work after reaching her Coast FI number.

In this interview series, I’ve interviewed many people with nursing or other healthcare backgrounds. In a field that’s so rife with burnout, it’s amazing to see the ways that people are shaping their work to fit their life.

I also truly believe that so many of these career structures could be available in other fields as well, so I’m excited to dive into this interview with Kathy.

1. Tell me a little bit about you.

My name is Kathy Kaye Retardo. I immigrated from the Philippines and relocated to California in 1998 when I was 20 years old.

I love to spend time with my fiancé, my family, and my friends. I also LOVE to travel and have been to 54 countries! I enjoy volunteering, listening to podcasts, and drinking boba tea.

Professionally, I am a professor (now part-time) teaching at one of the California State University Schools of Nursing. I also work per diem as a pediatric RN. One of my passion projects is to run a podcast called The Global Nurse where I interview Filipino nurses living and working outside of the Philippines.

2. What deliberate decision have you made to slow down and improve your life? Why did you decide to make this decision?

Last fall, I boldly decided to cut my hours and transition to part-time teaching in a hybrid role at the university. Now, I not only get to work less, but I also teach in person for only half of the weeks. The other half are asynchronous and online.

To share more about why I made this decision, let me share some context.

In the middle of the pandemic in 2020, I stumbled upon a fascinating concept that completely captured my attention: the FIRE movement. My journey into the world of financial independence began with podcasts like Choose FI and The Money Guy, where I absorbed valuable insights. I eagerly went deeper into more resources, including books, blogs, and YouTube videos seeking more knowledge and understanding.

I soon realized that a specific type of FIRE, known as Coast FI, truly resonated with me.

Jess’ Note: Coast FI is the point where savings becomes optional. Based on your age, you already have enough invested that will grow to provide you with a comfortable traditional retirement.

During this exploration, I stumbled upon a YouTube video titled Why I Love Coasting Financial Independence by Next Level Life. The interview featuring Jessica from the Fioneers on Choose FI further solidified my fascination with Coast FI. Intrigued, I realized that this concept aligned perfectly with my desired lifestyle.

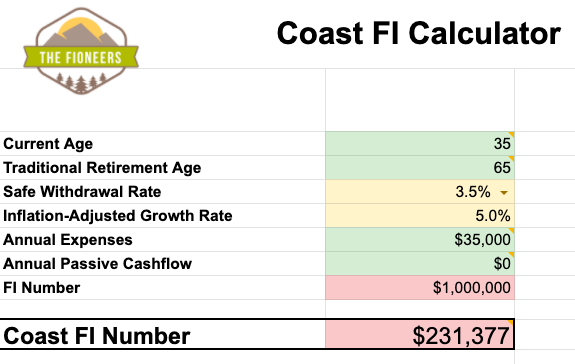

As I embarked on my Coast FI journey, I sought clarity and confirmation by using various Coast FI Calculators, including the one provided by you here on the Fioneers. Crunching the numbers brought a sense of confidence that I was on the right track.

Jess’ Note: You can download the Coast FI Calculator right here!

As I was learning about FIRE and Coast FI, I was working a full-time schedule as a nursing professor and working as a per diem nurse as well. On a weekly basis as a professor, I would teach one lecture, and I’d take two groups of students on two different days for nine hours of clinical training at the hospital. This would run for fourteen weeks in the spring and fourteen weeks in the fall. On top of that, I’d also pick up one or two 12-hour shifts each week working as a Registered Nurse in a hospital.

In November 2022, I reached my Coast FI number.

With this newfound knowledge, I mustered the courage to ask my dean to reduce my teaching workload. At first, he said he would consider it. He was able to grant me a part-time hybrid teaching role. Since there was a new nursing program being added at our university, he also put my name on the list of faculty who wanted to do 100% online asynchronous teaching.

When I reached Coast FI, I also scaled back my work as a per diem Registered Nurse. I now work with a nursing agency that hires me to fill in as needed if someone calls in sick. I now work 4-6 shifts/month and teach the hybrid class (Jan – May / Aug – Dec). I usually pick up the shifts on an asynchronous teaching week.

Without teaching over the summer, I’m planning to work 4 shifts/month. I’m going to relax, enjoy my summer, read, and learn new skills like photography, cooking, and sewing.

3. How has the decision to work less impacted your quality of life?

Even during the height of my career, I knew that I worked fewer hours than most people. But, clinical training with students can be long and tiring at times. And, working 12+ hour shifts as an RN can be exhausting, especially when I’m assigned to very sick patients.

When I discovered the FIRE movement, I finally realized the extent to which I could reduce my hours or even take a sabbatical from work.

During the pandemic, my fiancé and I actually took 2-3 months off to travel in Europe in 2020, 2021, and 2022. Now, I teach one class, and half of the time, it’s done asynchronously.

In a couple of weeks, I will find out about my new teaching assignment. If I’m granted a 100% asynchronous and online role, that would make me location independent.

If that happens, it would allow my fiancé and me to be anywhere in the world to travel, volunteer, and visit family and friends. And, I’ll continue to have income coming in.

We are currently in a unique position to seize the day and embrace the joys of life. We are in good health, and our parents do not yet require immediate care. Instead of solely focusing on early retirement, we are aiming to strike a balance between work and leisure, allowing us to savor the moments and create lasting memories.

4. How has taking this Coast FI approach and working less impacted your financial goals or timelines?

Reaching Coast FI provided me with the security I needed to enjoy life now. I’ve already invested for retirement. Now, I just need to wait and let compound interest do its thing.

Before discovering Coast FI, my focus was on pursuing full FIRE through aggressive investments. I soon discovered Coast FI though, and realized that full FIRE was not my goal.

Given my profession in academia, I have witnessed professors and deans working until the age of 80 with a level of flexibility that works for them. I’ve seen that working flexibly isn’t all that bad, and I very well may want to continue working in some capacity even after reaching FI.

I also know that I’m in a profession that is in high demand and there are many types of opportunities to work as a nurse that would fit my lifestyle. This reassurance has allowed me to re-evaluate my plans for full FIRE and prioritize enjoying life in the present.

The concept of Coast FI opened my eyes to possibilities I hadn’t considered before. I eagerly embraced this chance to live life on my own terms. It has allowed us to choose a path that aligns with our current desires and aspirations, ensuring a fulfilling and enjoyable journey ahead.

Because of Coast FI, I don’t need to keep saving aggressively and investing until I am 65. Instead, I get to have more time freedom now to spend time with loved ones, travel, volunteer, and experience new things.

5. What enabled you to make the decision to work less?

Having resources – books, podcasts, blogs – and following people on Instagram who are part of the FI community helped me stay focused and achieve my goal of reaching Coast FI.

Having so many helpful financial tools at my disposal helped me to trust the numbers. When I put my numbers into the calculators and net worth tools, that was all I needed. I finally said I can do this! I set up a time to meet with my dean to discuss working part-time.

6. Were there things in your life you adapted so you could continue to work toward your goals?

The biggest thing that I changed was that I started investing in index funds (equities) rather than only putting money away in a savings account. Previously, I was very risk-averse. But, the pandemic provided me with a valuable opportunity to delve deeper into the realm of personal finance.

Upon discovering the FIRE movement, my mindset shifted.

I dove into resources from the Personal Finance Club, Nurses Investing for Wealth, and the Money Guy. Their informative content inspired me to go deeper and gain a solid understanding of investing. I began by focusing on understanding the intricacies of pension and retirement accounts offered through my workplace. Additionally, I revisited my Roth IRA, which I had opened in the early 2000s.

With newfound knowledge and confidence in personal finance, I became more courageous and decided to open a brokerage account. This step allowed me to explore investment opportunities beyond traditional savings accounts.

Now, I also track my expenses, and I became more mindful of my spending. I use the value-based method of spending, meaning that I am happy to spend money on things that I value and cut costs elsewhere. My top values for spending are food, travel, and experiences. Now, we stay in nicer hotels or Airbnb when traveling, and I buy better quality groceries to support my long-term health.

7. How did your pursuit of FI help or hinder your decision to work less?

When I discovered FI in 2020, it shifted my mindset. I no longer assumed that I needed to work full-time until 65. I could achieve financial freedom earlier. That knowledge has motivated my journey toward financial independence and building a life aligned with my passions and values.

Now that I’m pursuing Coast FI, I realize that I can break free from this traditional mindset and use the financial freedom to build the life I want a lot earlier.

8. Why and when do you think someone might consider “downshifting?”

You can consider downshifting when you have a few essential pillars in place:

- Solid emergency funds

- Paid-off high-interest debts

- A feeling of financial security (reaching Coast FI was for me)

It’s also important to check in with yourself and ask, “Is this the type of life I want to live?” This allows you to take an inventory of what you really want your life to be like. Currently, my fiancé and I are in the experimentation phase and trying to figure out different locations where we might want to spend 3-6 months per year. As we do this, we’ve noticed that we enjoy a lot of things that don’t cost much, such as:

- Spending time and talking to each other

- Brunch at Home

- Walking in the Park

- Hiking

- Drinking coffee and boba tea

- Working out at home

- Reading

- Watching movies

- Spending time with family and friends

We love to do the things that allow us to savor the moment and not feel rushed. These are the moments that make us happiest and most content.

9. What advice do you have for someone considering a similar decision?

First, it’s important to know your “why”. What is your underlying motivation to pursue FI in the first place? Take time to reflect on your aspirations, goals, and values.

Once you have clarity, it will serve as the driving force and guide your decisions and actions. You can then develop a solid financial plan.

Lastly, expand your knowledge through learning and connecting with a supportive community. Doing this will help provide clarity, direction, and ongoing support on your path.

Thank you so much, Kathy, for sharing your story with us!

There are so many things that we can learn from Kathy’s story. First, it’s that you can forge your own path. Kathy did that early in her career. She didn’t need to keep working full-time as a bedside nurse. She decided to transition to teaching while continuing to do part-time nursing. Then, when she reached Coast FI, she was able to scale back her workload as both a professor and a nurse.

It can be easy to look at others’ situations and think, “There are so many more options in other fields, but not mine…”

On the contrary, I think there are many parallels to these options in other fields as well. For example:

- Sabbaticals or career breaks can be taken in any field. You just need to negotiate for them or quit and take time off between jobs.

- You could transition to a new role that’s a better fit with less (or more) of certain responsibilities.

- Negotiating part-time work would allow you more time for yourself.

- Doing temporary or contract work in almost any field could give you tons of flexibility.

One thing that Kathy knows is that work is not the enemy of freedom or happiness. Working too much or working in a job that makes us miserable is. Kathy has seen people work with flexibility into their 70s and 80s. Seeing that opened her eyes to the fact that she’d be happy to work for longer if she had the flexibility to live the life she wanted to live along the way.

Coast FI can provide the confidence to work less and live more. That is certainly true for Kathy.

If you’d like to connect with Kathy and follow her journey, you can find her in the following places:

- Instagram: @wayfarerDNPnurse and @theglobalnurse

- Blog: Moments and Journey

- Podcast: The Global Nurse

I am grateful to be interviewed by Jessica of the Fioneers. I hope that our conversation can inspire someone to embrace their authentic life and live on their own terms

Kathy – thanks so much for doing this interview! 🙂

great read and inspiring