I met Raina at Camp FI earlier this year. When she introduced herself to the group, the first thing she said was that she was interested in Coast FI.

Since she led with this, I knew I needed to seek her out to learn more. As I got to know her, I learned that she was currently doing part-time contract work doing research and data analysis in the public health space. Plus, she had recently planned a month-long trip to Colombia to learn Spanish.

I was incredibly curious to hear how she had created this life for herself. As I learned more, I knew I needed to feature her story in a Slow FI Interview.

I hope you are as inspired as I am by Raina. Let’s get into the interview.

1. Tell me a little bit about you.

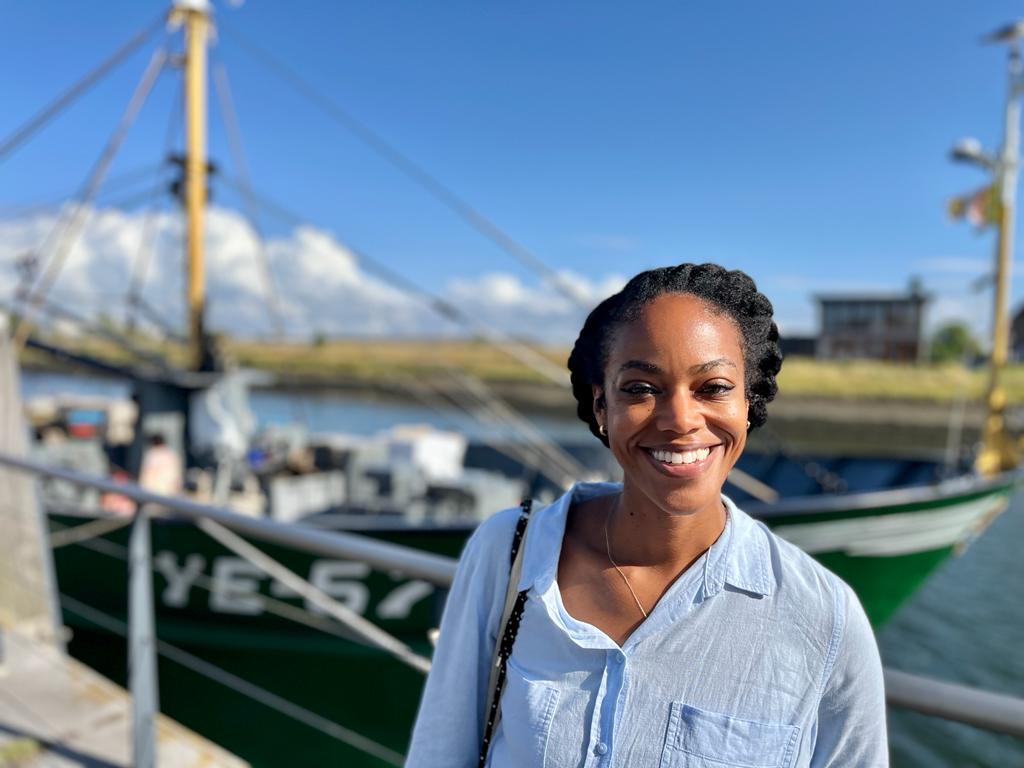

Hi, my name is Raina, and I am a New Orleans native, currently residing in Georgia. The things I enjoy most are spending quality time with loved ones, traveling, dancing, doing yoga, being outdoors, listening to music, and learning new things.

I currently work remotely as a consultant, which is a product of a seed that was planted about a decade ago, by a former mentor of mine. He told me that I could one day be an independent contractor/consultant (running my own business). I really looked up to him, so I believed him and today here I am.

When I started working in my current field about 7 years ago, I told another mentor of mine that I wanted to become an independent contractor/consultant after 3-5 years of working in my new field. He told me that it took him 20+ years to get to that point and I should expect the same. I kept the faith, and after 3.5 years of working in my new field, I started working as an independent consultant.

You may be wondering, how exactly did I get this consulting role?

It actually worked out in a very unexpected way!

It started with me applying for a W-2 position. I was interviewed and eventually offered the role. But, after learning that the salary was a lot lower than what I was willing to accept, I discussed my goals, travel plans, and salary requirements with the organization. After a bit of back and forth, we found that it was mutually beneficial for me to work with them as a consultant instead of an employee.

Essentially, it started with me being authentic about my desire to work with them and them being authentic about what they needed. Together, we were able to find something that worked for us both. To date, I have been consulting with this organization for almost 4 years. This time also includes an 8-month break I took during the pandemic.

2. What deliberate decision did you make to slow down and improve your life?

Even working as a consultant, I experienced burnout. I felt like I wasn’t fully there at work. Since I always aim to give my best efforts, I felt like it was time to take a step back to reset and recharge.

It had also gotten to the point where I was so burned out at work that I had very little to give during quality time with loved ones.

Plus, there was a long list of things I wanted to do (or try) that I had been putting off for years.

So, I decided to quit working for a period of time. Originally, I didn’t know how long I would take off, but I had over two years of expenses saved.

3. How did the decision to take time off impact your quality of life? And, what happened next?

After taking a break, my quality of life improved significantly. I realized that it was okay, and I didn’t need to push myself so hard. The world did not, in fact, end because I stepped back to take a breather.

During that time, I was able to spend a lot of quality time with my family and friends. I also managed to check a few things off my to-do list.

But, I soon realized that I missed working and having some sort of routine.

Even though I could have taken two years off, I ended up taking only 8 months off.

Soon after I started thinking about going back to work part-time, I was contacted by my previous organization about coming back as a part-time consultant.

Just like that, after 8 months off, I went back to work refreshed and ready to get back into the swing of things.

With my new work schedule, I can work whenever and wherever I want. Since I like having a routine, I prefer to stick to a consistent schedule. Now, I have the benefits of both a routine and the added flexibility of part-time work.

Even while working part-time, I have been able to make progress toward so many of the goals I neglected while working full-time (and not working at all), including:

- Volunteering on a farm

- Traveling to Colombia to learn and practice Spanish

- Working on my blog (and relaunching it)

- Spending more quality time with family and friends (and having the flexibility to help them and travel to see them)

Plus, I can do all of this and pay attention to my natural rhythm. I get to stay up late and wake up late.

4. In your opinion, what things in your life contribute most to your happiness and contentment?

First and foremost, I see myself as a hopeful person, which I think I get from my mom. I have an immense amount of gratitude for the smallest things other people often take for granted.

With that being said, I think there are two main things that contribute to my happiness:

- Being able to do the things I enjoy (including spending time with the people I love and care about)

- Having a sense of Freedom

In order to do the things I really enjoy, I needed to turn inward and reflect on what I really wanted. I’ve been different from other people my whole life (and sensed that I wanted different things), but I was also a people pleaser. In the past, I did things because other people wanted or expected me to.

Now that I’m older, I care less about what others think. I focus on what I want because it’s my life to live. I can also be more authentic when I live my own life.

A few books and resources helped me to get to this point, including Your Money or Your Life, I Will Teach You to Be Rich, The Millionaire Next Door, anything from Richard Rohr and Eckhart Tolle, and Jamily Souffrant’s Podcast – Journey to Launch.

Having a sense of freedom means a lot of things to me:

- Freedom to take time off of work (fortunately, I can take time off and still cover my expenses, a blessing I don’t take for granted)

- Freedom to work as a woman (I know that in some places around the world, women aren’t able to work or earn money like men)

- Freedom to say No to the things I don’t want to do

- Freedom to say Yes to the things I want

- Freedom to move to another state or country if I want to

One thing that helped me recognize the freedoms I have was to delve into exactly what my enough point was, an important concept in Your Money or Your Life.

I asked myself these questions:

- How much was enough for me?

- And, if I reached this enough point, what was it inside of me that made me feel like I needed more?

- How could I turn that switch off?

One way that’s helped me turn the switch off and feel like I have more abundance, is to not only save toward my wants and goals but to also spend the money in those savings buckets. When I was saving and not spending, I always felt like I didn’t have enough. When I learned to spend the money and enjoy the fruits of my labor, I realized that was key to helping me feel like I had enough.

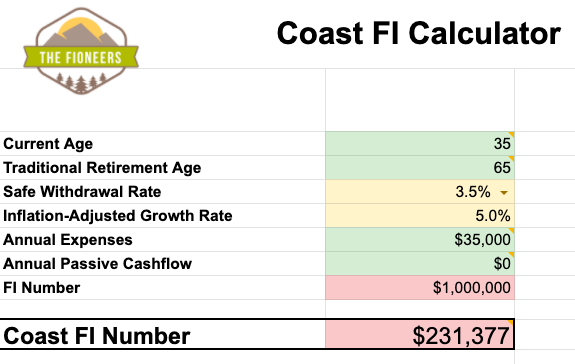

As you’ll see below, I haven’t reached FI (nor even Coast FI yet), but I still feel like I have enough at this moment.

Reaching this point has given me the freedom to say “yes” to the things I want more of (quality time with friends and family, travel, new experiences, yoga classes, concerts, Spanish classes, giving to people and causes I care about, etc.). It also gave me the freedom to say “no” to the things I didn’t want (working to the point of burnout, waking up early, spending on things I did not want or enjoy, buying a house, etc.).

Ultimately, I think my happiness and contentment are a result of both external circumstances and an internal state of mind. I now realize that I have a lot of freedoms, and I need to use those freedoms in life-giving ways.

I am grateful for all of these freedoms. This gratitude leads to happiness and contentment.

5. How did taking a break from work and going back part-time impact your financial goals or timelines?

Once I started working part-time, I plugged numbers into a compound interest calculator. From this, I realized that I could save and invest a set amount for 4-5 more years. At that point, I’d reach Coast FI and could let my money coast for 9-10 more years and reach full FI by the time I was 49.

I also did an alternative scenario, where I increased the contribution to my retirement by $1,200 each month. I found that it would only shave off 2-3 years of time. Since I enjoy working and my work is very flexible, I decided to spend this additional $1,200 on things that give me life energy today rather than retiring earlier.

I decided to spend the extra money on:

- Shopping/Entertainment

- Yoga (or other workout) classes

- Lessons (guitar, swimming, sailing, and Spanish)

- Vacation

- Self-Care

At this rate, I’ll reach Coast FI in 4-5 years. At that point, the amount of money I’m currently investing will be freed up. Then, I’ll be able to choose to continue investing, work less, or spend more. I don’t know what I will decide when I get to that point, but I have time.

I’m making the most out of my time right now, so I don’t think I’ll miss the 2-3 years of retiring sooner.

6. What enabled you to make this decision?

Figuring out what enough means for me and doing the calculations helped a lot. I can sometimes create problems in my mind with no solutions. But, once I put them down on paper and look at the numbers, I realize how irrational the problems I created in my mind really are.

Also, I’ve realized how much I enjoy and thrive in a life that has some routine built in. Routine isn’t the enemy of freedom. It, in fact, helps me work toward my goals. This realization allows me to be comfortable with working longer.

Lastly, I think about how much my ancestors would have loved to live a life like this. Who am I to work so hard when there is simply no need for me to do so? I have worked very hard throughout my life (and have no regrets about it). I have laid the foundation and have reached the point of enough. I don’t need to keep pushing for more money I don’t need.

7. How did your pursuit of FI help or hinder this decision?

The pursuit of FI helped my decision. Because of FI, I got to a point where I was financially secure. I understood my spending, and more importantly, my values and what was important to me. From this, I realized that I enjoy flexibility and freedom. Without FI, I don’t think I would have gotten as creative about taking time off or having a flexible schedule.

Plus, the FI community helped me realize that I wasn’t alone. I knew I wanted to take time off and travel, but I thought I was the only one. When I met others with the same goals, I realized it wasn’t a pipe dream. It was actually attainable.

8. Were there things in your life you adapted to make it work better so you could continue to work toward your goals?

One thing I did was downsize my life a bit. I am currently living with my family in Georgia. I am paying rent, but it is a lot less than I would pay if I had my own apartment (like I did while I was working full-time). I make enough that I could get an apartment, but it makes sense for me to stay with my family since I travel so much. This year, I have already traveled for 15 weeks.

The other thing I needed to do was to get clear and realistic about how much I wanted and needed to save (without over-saving). For my other goals, it’s been important to get into a routine that allows enough space and time to work toward them.

9. Why and when do you think someone might consider “downshifting?”

I would encourage people to downshift for a few reasons:

- If you are feeling burned out

- If there’s something you’ve been wanting to pursue but haven’t because you don’t have the time, mental space, or energy

- If you are feeling overwhelmed or have lost your sense of direction. Sometimes when there is so much going on, we are overstimulated and can’t hone in on what drives us.

If any of these things are true for you, you could consider downshifting when you get to a place of financial stability. You want to have an emergency fund plus some additional savings that would cover your expenses during your time off so that this time of downshifting isn’t stressful.

10. What advice do you have for someone considering a similar decision?

Do it! Take the leap!

First, make sure you have a plan in place to give you some peace of mind. I’m a Taurus, so I like plans. I think it’s helpful to have a bit of a plan in place so you can check your progress. But, also remember, it’s okay to shift away from your plans. Listen to yourself.

Also, take time to turn inward and reflect on what you’d like to do or explore. When I took time off, I was finally able to explore things I’d been thinking about for years. I found that I enjoyed some of the things and didn’t enjoy others.

Testing things out gives you a nice taste of what the post-FI life you imagine feels like before you get there. It wouldn’t be good to work so hard for so many years to get to the end and realize you don’t even enjoy the thing you dreamed about.

Also, if you downshift to explore your ideas, you may find you want to continue working or start pursuing something you are passionate about. You may also find creative ways to incorporate the things you enjoy into your life after you upshift work again.

Thank you, Raina, for sharing your story with us!

There are so many insights from this interview.

Raina shares a blueprint for how she set up this part-time, contractor role. First, she was open and authentic in the interview and offer process with her current employer about her goals and what she wanted. This is a good reminder that there are some employers who understand (and even embrace) the fact that we are people with lives and goals outside of work. When they couldn’t meet her salary requirements, this was an opportunity for her to negotiate a contractor role. This saves the company money because they don’t have to cover benefits or taxes, and Raina gets more freedom.

I’d also like to note that it’s amazing how many opportunities for part-time and/or contract work arise when the company is faced with offering that or getting nothing at all. This certainly worked for Raina.

This happened for one of my clients who recently quit his job to take a year-long sabbatical. Upon quitting, his company asked if he’d consider working as a contractor, doing only as much work as he wanted to on his own schedule. He’s now working about 10 hours/week for them and can dial it up or down at any time.

Next, I also want to note that Raina is a great example of the fact that you don’t have to already be Coast FI to scale back to part-time work. If you can still generate enough income to continue saving and investing, you can scale back earlier and still reach Coast FI and full FI. Raina did the calculations and realized that she could reach Coast FI in 4-to-5 years. Then, she could coast to Full FI From there. She could push and reach FI a couple of years faster, but she’s enjoying her life now. There’s no rush.

Lastly, I want to leave you with Raina’s inspiring words about freedom.

“I now realize that I have a lot of freedoms, and I need to use those freedoms in life-giving ways.”

Are you using the freedoms that you have in life-giving ways?

If you’d like to follow Raina’s journey, you can find her in the following places:

- Blog: Her Granddaughter

- Email: Hergranddaughter (at) gmail (dot) com

Awesome interview! So many things resonated with me here. Sending positive vibes to Raina. Having the freedom to take time away from work to do what you want or need is invaluable for so many reasons.

One of the most important quotes for me was, “When I was saving and not spending, I always felt like I didn’t have enough. When I learned to spend the money and enjoy the fruits of my labor, I realized that was key to helping me feel like I had enough.” I had to learn that lesson as well. It felt pointless to constantly work hard, save and take care of everyone else, and never do anything for myself. Purchasing a bike as a gift to myself woke me up and started me on a journey to focus on my personal health.

Thanks for sharing.