I have a confession to make. Until 2018 and the age of 31, I wanted nothing to do with our finances.

I was happy to be the breadwinner in our household, bring home a paycheck, and have Corey manage our money.

I wanted nothing to do with our finances because I felt conflicted and guilty about having and making money. I’ve spent the vast majority of my life (until 2021) working in nonprofit organizations focused on causes to make the world a better place: education reform, poverty alleviation, and economic empowerment.

I knew we were extremely well off compared to the people my organizations worked with, and I didn’t know what to do with that cognitive dissonance. If you want to read more about how I worked through this, I’ll point you to an earlier post “Why I Wanted to Be Poor: Debunking the Scarcity Mindset.”

As a feminist, I’m now a huge proponent of women having their own money and being full partners in the management of money in their households. I can’t believe it took me so long to get involved.

But, here we are… And, I can only change what I do in the future.

I am so lucky to have a partner who was so conscientious about our finances from the very beginning. Now that I’m a full partner in managing our finances, I’m here to pull back the curtain and share how we do it.

What We Do Annually

Early in our careers, when we first started managing our money, we kept a strict traditional budget with distinct categories. At the time, we made very low incomes and lived in a high cost of living area, so this was necessary.

Anti-Budget

After 5 years of career and income growth, we began to save quite a bit more money. We no longer felt like it was necessary to keep such a strict budget. Around this time, Corey heard about the anti-budget from Paula Pant on Afford Anything.

According to Paula, there are 3 easy steps to the anti-budget:

- Decide how much you want to save.

- Pull this off the top (i.e. automate it).

- Relax about the rest.

While the anti-budget eliminates the need to budget and track spending in specific categories, it is a fairly advanced way to manage your money. For the anti-budget to really work well, you need to already have a good handle on your expenses.

With this approach, you decide what your savings rate will be. But, you can’t decide this in a vacuum.

When we first started using the anti-budget in 2015, we decided to save 25% of our income. This was reasonable based on how much income we were projecting for the year and what we knew about our expenses from the previous year.

Each year, we’ll sit down together to create our new anti-budget. This year, we’re projecting that we will be able to save about 50% of our income. Here’s how we came to that number:

- We projected our gross income for the year (including Corey’s expected W2 salary and our income from the business) and did the calculations needed to determine what that would mean for our net income.

- We reviewed our spending from 2020 together and discussed areas where we thought we might spend more or less. Then we projected our likely spending.

- By subtracting likely spending from net income, we were able to determine our likely savings amount and savings rate.

Automated Investments and Savings

To fully execute the anti-budget and save money throughout the year, we pay ourselves first by automating our savings and investments. Here’s a list of the automated investments and transfers for our savings:

- Employer-Sponsored Retirement Account: Corey’s company offers a an empoyer sponsored retirement account that includes a match. We chose to max out that investment account this year through payroll deduction.

- Roth IRAs: We also have our bank accounts set-up to automatically transfer money each month into our Roth IRAs (which we max out each year). This year that equates to $500 per month.

- We also invest some money into a taxable investment account. This account will provide us some future flexibility since it is not directly tied to retirement.

- Lastly, we also automatically transfer additional money to our savings account at Ally.

Typically, when we need to replenish our emergency fund or save for a large upcoming expense, we will pause or lower the amount going into our taxable investments. Once, we’ve replenished our cash reserves, we again increase the amount. For the second half of 2021 and into 2022, we’ve paused automatic investments to our taxable account so that we can pay for our campervan and conversion in cash (and rebuild a 6-month emergency fund).

We also opened a Solo 401k for our business this year as well. At this point, we don’t automate investments into that account. Business income is inconsistent, so we’ve chosen to do this manually.

What We Do Monthly

While the anti-budget is quite a bit less time-consuming to manage than a traditional budget, you certainly can’t set it, forget it, and hope everything works out. There are two things that we do on a monthly basis to ensure we are staying on track.

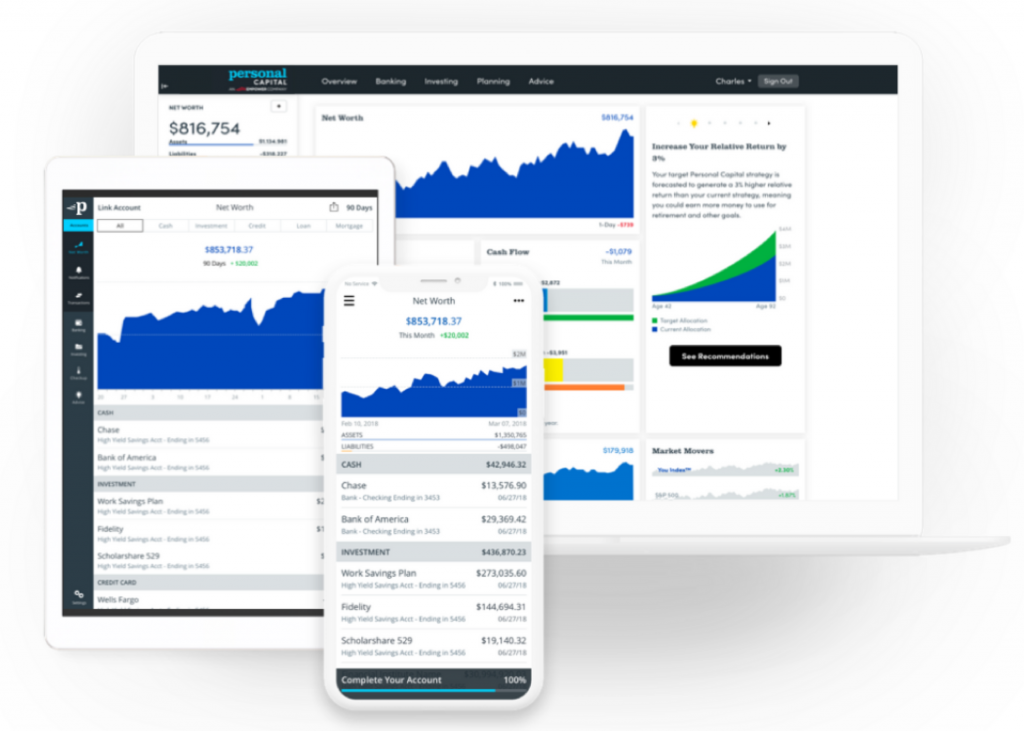

Review Our Spending On Personal Capital

While we don’t focus too closely on particular categories, we do review our spending each month using Personal Capital. This tool is extremely helpful for us. It pulls in expenses from all of our accounts and credit cards and puts them into categories.

Personal Capital is the most helpful free financial tool we’ve ever used. If you’ve never tried it, we encourage you to check it out today.

Since we know how much we (roughly) spend per month overall and in particular categories like groceries, restaurants, transportation, etc., we are able to fairly quickly diagnose if something is off.

There have been many times where we take a look at personal capital and realize that we’re spending more money than expected in a certain category. This will give us a quick wake-up call, usually to stop ordering so much take-out.

Track our Net Worth in Excel

Not only do we track our net worth using Personal Capital, but we also track our net worth manually in a spreadsheet.

We started doing this in 2011, before the days of Personal Capital. We’ve continued this because of the historical data and because we like to manipulate the data in ways that we can’t do within Personal Capital. We spend 5 minutes each month entering all of our assets and liabilities, referring to Personal Capital to make this process as easy as possible.

Our spreadsheet allows us to more easily calculate the annual increases in our net worth (both in dollars and percentage: annual growth rate).

We also track the time it takes us to save each $100K. This is quite motivating. It’s fun to watch and see that each $100K takes less time than the last.

What We Do on a Day-To-Day Basis

We’ve tried to make our finances as simple to manage as possible. Not only do we automate as much as we possibly can, but we also limit our accounts to three institutions (Ally, Fidelity, and Radius Bank for Business Checking). Here’s how we manage our day-to-day finances.

We Keep a One-Month Cash Reserve

We keep a minimum cash reserve equal to one month of expenses in our main checking account. This cushion ensures that there is no risk that we will overdraw the account because of our regular expenses.

More importantly, this also means we never use any mental bandwidth thinking about whether we have enough money in our checking account when bills are due. Throughout the month, our checking account fluctuates between one and two months of expenses based on our income and the timing of expenses.

We Automate Bills and Charitable Giving

In addition to automating all of our investments and savings, we’ve also automated all of our regular bills and charitable giving. Because we avoid debt when we can, we have very few reoccurring monthly expenses. Here’s a list of our regular monthly expenses that are all automated:

- Electricity (Utilities)

- Natural Gas (Utilities)

- Mortgage Payment, including property taxes

- Internet

- Streaming Services (we currently have Hulu and Disney Plus)

- Various charitable donations

Coupled with our cash reserve, this automation allows us to never feel stressed about money.

We Keep at Least Six Months of Expenses in our Emergency Fund

We also keep at least six months of expenses saved in our emergency fund. We have our emergency fund in a high-interest savings account at Ally Bank. This allows us to receive much higher interest than a normal bank.

Some people recommend creating separate accounts (i.e. sinking funds) for large upcoming purchases, like a new car, a down payment for a house, or a large home repair. We’ve chosen to keep one account in Ally and co-mingle our savings for these future large purchases with our emergency fund.

In fact, we are currently saving money to pay for our campervan and the conversion. This money is in our Ally account that also serves as our emergency fund, so we have much more than six months of living expenses in this account.

Once we complete the van build, we will very likely go back to about six months of savings in our emergency fund. Because we are both working and have other assets that we could pull from in a true emergency (e.g. Roth IRAs) if absolutely needed, we feel good about keeping the emergency fund at this level.

We Use Credit Cards as Much as Possible

All aspects of our finances are quite simple until we start talking about credit cards. We each have a number of credit cards that we’ve had open for a long time, and we also churn through credit cards for travel rewards.

We put the vast majority of our purchases on credit cards because we like to receive rewards for our purchases. We are not the kind of people who buy more things on credit than if we used cash. In fact, it’s the opposite. If I have cash, I burn through it because what I use it on is not actually tracked in our accounts.

We pay off all of our credit cards in FULL every month. It is not worth pursuing any sort of credit card rewards or travel hacking if you are going to go into debt to do it.

We have a few basic credit cards with no annual fee that we keep open for the credit history, even if we do not use them frequently. When a card has an annual fee, we consider whether the card benefits outweigh the cost. There are some cards we’ve chosen to keep open and others we’ve closed.

We actively pursue travel rewards. In the past few years, credit card rewards have paid for flights to Hawaii, Europe, Panama, and a number of domestic US destinations. While traveling, we have used credit card rewards for many hotel stays, Airbnb, local transportation, and activities. We estimate that we save about $2,000-3,000/year by doing this.

Even during COVID when we weren’t traveling a lot, we used travel rewards to cover things like:

- Part of a cabin rental up in Maine

- Flights to Washington to visit Corey’s family

- Flights and a rental car for our upcoming Napa trip this fall

Since we weren’t traveling much, we also converted some of the points into cash.

Travel hacking can be complicated, but for us, it is worth it. If you are interested in travel hacking, I’d recommend reviewing our Travel Hacking 101 post which will tell you about the types of travel rewards credit cards available and tips to travel for free.

Using credit cards in this way can be complicated, so it’s important to diligently track everything. This is why we keep a spreadsheet of all of our credit cards to track information like date opened, reward requirements, annual fee, etc.

Personal Finances are Personal

Managing your finances is something that evolves over time. We continue to make small improvements to our process. We haven’t optimized all aspects of our finances, but this is the method that works for us right now.

You very likely manage your money differently than we do, and that’s okay. The most important thing is that it’s intentional.

Everyone has to choose what is important to them, often at the expense of something else. We’d likely have a higher net worth if we were to keep a smaller cash reserve in our checking account and emergency fund and invest that money in the market. However, we prefer the peace of mind that comes with this larger cushion, even with the known opportunity cost of having less money invested.

If you are new to managing your finances or are looking to improve how you manage your money, I’ll leave you with several guiding principles that inform our approach to money:

- Spend your mental energy on the areas that matter most

- Create a plan or goal and track your progress along the way

- Automate your investments and as much of your day-to-day activities as possible

- Save more money than you spend to buy back your time

- Make small improvements to your process over time

How have you chosen to manage your finances? Do you have any practices that seem counterintuitive but work for you?

Hey Mrs. Fioneer! Awesome insight here into what managing personal finances are like. I really like you and Mr. Fioneer’s strategy with an “Anti Budget”. I think it’s a great way to take off a lot of the pressure of the “grinding” period of becoming FI. Many find themselves trying to eek out the highest savings rate possible, which is fine if your ultimate goal is the earliest possible retirement. Yet, it can be a big struggle if you end up feeling like you’re sacrificing other enjoyment for it.

If you use Reddit at all and follow the FI sub, you’re likely familiar with the popular post on “Build the life you want, and then save for it” (link at the end). I feel as if the Anti Budget strategy is extremely important to ensuring you are building the life you want to live prior to getting to your retirement goals. Being able to spend on what you want without needing to worry about how it will affect your FIRE numbers will likely feel like a weight off many people’s chests. Definitely think many should try to employ the same idea when possible!

(https://www.reddit.com/r/financialindependence/comments/58j8pc/build_the_life_you_want_then_save_for_it/?utm_source=share&utm_medium=ios_app)

Hi Kevin,

Thanks for sharing this. I’m not really involved in the reddit community, but I really enjoyed reading this post. I agree that there are people who are focusing on FI at the exclusion of their life. That’s actually part of the reason why we started The Fioneers because we wanted to be a voice in the community to help show that the journey was as important as the destination and designing a life you want to live right now is just as important as saving for the future. We’ve actually been able to craft a lot for ourselves and we’re still evolving. I chose to work part-time about 6 months ago, and I’m LOVING the extra time to relax and take care of things outside of work in addition to working on my blog without feeling crazy busy all the time. We’re working on our blog and considering other side businesses as well since one of our goals is to eventually become location independent. We don’t feel like that must happen super quickly though, so we’re enjoying our life along the journey.

In fact, I wrote a guest post recently on Four Pillar Freedom about this exact topic about building a life I want to live now. If you are interested, here’s the link: https://fourpillarfreedom.com/how-im-buying-back-my-time-before-i-achieve-financial-independence/

Anyways, thanks again for the comment! Also, if you have any thoughts about how we could improve the template, please don’t hesitate to reach out.

Jessica

Hi Jessica!

That guest post was an awesome read. I think you basically hit the nail on the head about making your life meaningful and full to yourself. The difference in your questions about how you want your life to look with respect to your financial choices shows a great amount of personal growth. It’s something to be proud of for certain.

I, myself, am slowly coming to a point in my own life where I believe a similar reflection is necessary. While my job currently doesn’t make me feel quite so miserable, I don’t exactly LOVE it either. It’s hard to complain about a job that’s “just ok”, but I feel as if the lack of motivation/passion could end up slowly chipping away at my mentality towards work in general.

Eventually finding myself in a part time job seems like an extremely attractive option. I’m looking forward to reading more about your journey in what seems to be a familiar line of thinking. 🙂

Best,

Kevin

Hi Kevin,

I’d definitely encourage you to really think about what you’d want to be doing. For me, a job that’s just okay is fine for a time, if you are working toward something that you really want or something that enables you to do the things you want to do outside of work, but if it’s making you feel like your life is not as fulfilling as you want it to be, I definitely think it could make sense to consider next steps.

I recently read a book called – Designing Your Life – and it was really fantastic. I might recommend it as a tool for helping you to think through different ideas. It’s definitely helped me think differently, and I plan to write an upcoming post on it within the next few weeks.

Thanks,

Jessica

I’m working on an article that goes through some thoughts on the anti-budget system.

I think if it works for you and your family, that it is awesome! I agree with your assessment that it is an advanced way of handling your money.

I don’t want to go too in-depth on my thoughts and give away my article, but this is what I like about the anti-budget:

– Prioritizes saving

– Less time spent managing finances.

– Atoumation!

The things that I’m not so sure on:

– Budgeting has to be painful and time-consuming

– Giving up the details on exactly how much we are spending on different categories (the grocery store covers different type of spending in our case)

We are definitely at a place where we could implement the anti-budget, but I’m not sure it is the best option for us. Mainly because if we go into the grocery store without an idea in what number we are shooting for in the month, we are more likely to overspend. This might more related to our personalities though.

I’ll definitely link to this article from my post. I’m glad you found something that works great from your end.

Hi Chris,

I’ll definitely be interested in reading the article. I agree in some ways with the things you aren’t so sure on. We were budgeting in the days before good software, so it was definitely more time-consuming than it might be now for someone who uses an app.

Also, to be clear we do have an idea of what we plan to spend on groceries on any given week – but that’s more from experience than from a specific budget amount. For example – this is how grocery shopping goes for us now: On the groceries front, we go to Costco and get all of our staples for around $300-400/month. Then we get two misfits markets (cheap ugly but perfectly edible veggies/fruits) boxes/month = $20 each. Then our weekly groceries cost us somewhere between $35-50. We order our groceries online and $35 is the minimum order. I’m honestly sometimes struggling to get to the $35 threshold, so I’ll often brainstorm and buy something I know we’ll need in a future week. Or if I’m above $35 one week, I’ll go back through and delete things if I can live without them and wait until the next week, in case I’m below the $35 threshold.

And honestly, this only works because I already know approximately how much we spend. If we didn’t know how much we spent, the anti-budget wouldn’t work. However, if there’s a month where we’re above our usual spending, we can look at it and say – yes, I value that I’m glad we did that. Or we can say – yeah, I didn’t really value that, let’s not do that again next month. There’s definitely reflection involved – but we don’t put a specific dollar amount goal on it.

I also definitely agree that what works for you is based on your personality and maybe life stage. We’ve actually been able to trim $15-20K from our spending just by being intentional and using the anti-budget, so it works for us. I agree that it’s not necessarily the best option for some people.

Thanks for the comment! I’m excited to read the post when it comes out!

Jessica

You use a very similar approach to ours, including the amount of money you keep liquid and in an e-fund. We’re working on getting more intentional about credit card rewards.

We’ve used the anti-budget approach for several years, but in the last year have decided to get more aggressive with our savings. So, for now we pay more attention than normal during the year to try and squeeze out savings above even our normal anti-budget goals.

That’s awesome! I’d love to hear more about what it has looked like day-to-day to more aggressively save. Maybe a post idea for you? 🙂

Thanks,

Jessica

Outstanding post, comprehensive and concise! I volunteer teaching Personal Finance in high schools, your content will enhance my ability to educate our youth- thanks so much!

The most important excerpt- “While the anti-budget eliminates the need to budget and track spending in specific categories, it is a fairly advanced way to manage your money. For the anti-budget to really work well, you need to already have a really good handle on your expenses.”

Hi Ken,

Thanks for reading! I’m happy to hear that you enjoyed this content. I would agree that the anti-budget is likely not a great solution for people just starting out managing their finance. A more traditional budget might work better.

Since you teach Personal Finance in high schools, one resource that I might point you to is a post that we wrote on how we graduated from college debt free. I was very lucky to grow up with parents that helped me understand that taking on debt for education was not desirable. Here’s the link if you are interested: https://thefioneers.com/avoid-student-loans/

Thanks for reading,

Jessica

Great article, very detailed.

Is anti-budget similar to a normal budget with a bucket for savings, which you pay into first when income comes in? Robert Kiyosaki describes this type of savings technique, but it requires finding ways to generate the missing cash to cover any income shortfall.

Hi Joe,

I would say it’s somewhat similar, except that we don’t budget certain amounts for anything else besides savings. We say this is an advanced form of managing your money because the reason why it works is that we already know approximately how much we spend per month on things generally. So we don’t put in specific categories for any expenditures, but we do a look back at the end of the month to see if something was wildly off. Because we know approximately how much we spend and keep a 1-month cash buffer, we don’t need to find ways to generate the missing cash to cover an income shortfall. I imagine that this would certainly be more challenging for someone with variable income.

Thanks for the comment,

Jessica

Awesome, yes, this is pretty much the same way we manage our finances. We started using Betterment’s Two-Way sweep into our cash reserve (savings), which means all net deposits (after pre-tax stuff is taken out of paychecks) goes into checking where it fills up to a certain point. When the bucket is ready to overflow, Betterment sweeps the excess into our short-term savings. This goes towards large purchases and serves as a cash buffer.

Automated withdrawals occur for Roths, UTMAs, and brokerage accounts and then I’ll manually sweep over funds from savings if I think it’s grown too large. This system generates a minimum of 38-40% savings for us each month so we don’t sweat it if we overspend a bit for a month. I consider any transfers to high-yield cash reserve as savings and I track that as a separate line item monthly.

The Frugal Engineers also recently just posted about how they handle large purchases by annualizing the cost: https://thefrugalengineers.com/2020/01/06/how-we-use-engineering-economics-to-budget-for-large-expenses

I will probably take that extra step to help figure out what minimum the cash reserve should contain.

Because I wanted to track these savings categories more granularly, I actually built a free small offline-friendly app that syncs to Dropbox so I can pull it up wherever I am to check my SR and update my numbers. It’s at https://reachfi.app, I built it for the FI community but anyone can use it.

I’d be interested in what you think! It is not as powerful as something like OnTrajectory but focuses on the monthly/yearly savings rate calculations. It uses the formulas from Big ERN.

Hi Kamran,

Thanks for sharing! It’s definitely powerful to automate the investments because then you hardly even need to think about it to know that you money is getting put to work for you.

I’m definitely curious to check out your app.

Thanks for sharing!

Jessica

Here’s a PF tweak that we use:

A few years ago we had a credit card that got compromised and fraudsters ran up thousands of dollars. The bank sorted it out and it didn’t cost us anything in the end, but it was painful to identify & contact all of our service providers (utilities companies, Netflix, Apple, Amazon etc) to transition them to the replacement card.

To prevent this from happening again, we opened a debit card account dedicated to direct debits & automated card transactions. We never carry that card in our wallets, never use it in shops, never use it in an ATM, and never use it online. It always remains in a secure location.

A fixed amount gets automatically transferred to that account each pay packet, so there is always money to pay utilities bills etc on time. It is truly set & forget. Win #1.

If any of the cards that we do use online, at shops or at ATMs gets compromised in the future, then none of our direct debits / automated bills will be impacted. Win #2.

Hi JD,

That’s a great idea! That certainly makes it easier so that you don’t have to deal with the hassle in the future. I’m glad that the tank sorted it out for you.

Best,

Jessica

I love the anti-budget! When I started on my FI journey I used to read that I needed a budget so I went ahead and started using the zero based budget, but I hated it. It felt very restrictive to me and I decided to quit (I dislike having to categories all my expenses and set an amount for every month). It wasn’t until I got serious (I wanted to become debt free) that I realized there were more budgeting methods out there. Thus I began using the “Pay Yourself First” Method and I love it, it has definitely worked for me and now I am debt free (since 2019).

Really enjoyed reading your article!

Hi Sunem,

I’m so glad that it worked for you! Traditional budgeting has sometimes felt restrictive for me as well. I’m a lot more motivated to do it this way!

Best,

Jessica

We stopped automating bills since we liked to check where our money was spent. We are much more likely to review paper statement than an online statement.

That makes sense! I’m glad you figured out what works best for you!

Budgeting decisions in a family should be a joint decision. One line person makes all the decisions it results in resentment.

I agree. It took a while for me to come around, but I’m glad I did.

I really like the blog and everything. I do think you’ll run into a ceiling of how successful this blog can get without being more transparent about your numbers like other FIRE bloggers. Just my two cents for someone who’s nosy and reads a lot of this stuff.

Hi Ken,

That’s a risk I’m willing to take at this point. It hasn’t seemed to impact us too negatively so far. At this point, we are paving a path to eventually stop being anonymous, so we don’t want our specific numbers on there once we make the transition.

Best,

Jess