The end of COVID is still months away, and things are currently getting worse. Yet, with a vaccine, there is at least a light at the end of the tunnel. I can’t wait to hang out with friends in real life again, give people hugs, and go to events!

At the same time, I know that people are thinking about what it might look like to go back into an office and what the “new normal” for work will look like. I’m fortunate to have recently taken the leap to entrepreneurship, so I don’t need to worry about how my employer will handle it.

Yet, I have started thinking about friends, family, and the Fioneers community. I know that many of you are working full-time traditional jobs. And, many of you have had the flexibility to work from home over the last year. This option has not been available for healthcare workers and other essential workers. But, many more people have had more flexibility than ever before.

If you have enjoyed more flexibility as a result of COVID, you are probably wondering what will happen after the pandemic. Will your employer require you to go back to the “old normal” of going into an office every day? Will work from home be as widely accepted?

I’ve heard promising messages that the pandemic has helped employers think more critically about what kind of in-person presence is required. I’d still be worried that my employer wouldn’t take these things to heart.

I’ve heard from so many people that they don’t want to get back to “normal.”

Before COVID-19 hit, the vast majority of Americans (96%) wanted more workplace flexibility, and less than 50% got it. Now, more people than ever are working from home. This doesn’t mean it is an opportunity equally applicable nor that it will continue. To be clear, I still don’t think that working from home means that people necessarily have the flexibility they need to thrive.

You may be in a position where you want to negotiate to keep the flexibility you currently have. Or, you may be looking for an even more flexible work structure.

You don’t need to retire early to gain a tremendous amount of freedom and flexibility over your time. In this post, I’ll share 3 ways that you can gain progressively more freedom and flexibility while you still need to generate income. I’ll discuss concrete steps you can take toward a more flexible career.

1. Negotiate Flexibility within a Full-Time Job

There are a lot of ways to negotiate flexibility within a full-time job. Sometimes, your employer will allow you to negotiate this flexibility (or they might just offer it!). Other times, you can negotiate flexibility upon being hired into a new role.

Here are a few ways you could negotiate flexibility within a full-time job.

Telecommuting or Remote Work

Many employers have had a change in perspective about remote work because of the COVID-19 pandemic. Working from home has become more widely accepted. And, studies have shown that employees that work from home are actually more productive than employees that work in an office.

You may be wondering what the difference is between telecommuting and remote work. Telecommuting is when you work from a different location (perhaps your home) a few days per week. Remote work is typically when someone works full-time from home permanently. Your company may use different terms than this though, so you’ll want to see what terms are widely used in your company.

Telecommuting and remote work are beneficial for many reasons:

- It cuts out the time and stress from a commute.

- Many people are able to be more productive working from home.

- Working from home allows us to take care of life-maintenance stuff during the day a lot easier. Examples include: throwing in a load of laundry, overseeing home repairs, picking up kids from school, or heading out for a doctor visit on our lunch break.

My friend, Mel, who writes at Modest Millionaires negotiated a full-time remote work arrangement with her employer (a government agency) in the summer of 2018. She’s been working from home ever since.

Customized Work Hours or Condensed Workweeks

Depending on your job or your life situation, your employer may be open to working with you on a customized schedule. At my previous employer, any employee could request a customized schedule. It would be approved unless it conflicted with their job responsibilities.

There are many different options for customized schedules.

One type of customized schedule is when people shift their work hours. Sometimes, people will choose to work 7-to-3 or 8-to-4 instead of 9-to-5. I’ve also seen people work 6 hours during the day and 2 hours at night after their kids go to sleep. People with this schedule often seem exhausted, but it does allow them more time with their kids.

Another type of customized schedule I’ve seen is to work 40-hours over the course of 4 days instead of 5. At my previous employer, it was preferable to have employees who were willing to work after typical business hours. Because of this, working 4 ten-hour days was a viable work schedule.

There are many reasons why you might negotiate a custom schedule, including:

- Small children that you want to spend more time with during the day

- Taking classes in the evening

- Avoiding rush hour traffic

- Simply being a morning person and enjoying getting project-based work done before everyone else starts work.

Elyssa, who writes the blog Brave Saver, worked from 7-to-4 for about five years. Her reasoning for this was the limit the amount of time her young child was in daycare. Because her husband worked from 10-to-6, they were able to put their child in daycare from around 9 to 4:30 each day. This cut down on daycare costs and allowed them to have more time with their daughter.

Gwen, from Fiery Millenials, worked a 9-80 schedule for a few years. This meant that she worked 80 hours in 9 days every two-week cycle. This meant that she got every other Friday off. This allowed her to use less vacation time, schedule doctor appointments without taking time off, and run errands during the day.

Practical Strategies to Negotiate Flexibility Within a Full-Time Job

The first step to negotiating flexibility within your work is to figure out what options are already available (if any) at your company. Look in the handbook for a policy that covers flexible work, telecommuting, or remote work. Ask colleagues if they know of anyone who works a flexible schedule. This will give you a sense of whether something is already available or if you’d be treading a new path.

Since you may currently be working remotely successfully, it might be an easy conversation to bring up with your boss. You could approach it as a discussion about what would happen after a vaccine and things get back to (more) normal.

Finally, it’s important to demonstrate that you can work effectively from home (which will be easier if you’ve already been doing it) or in off-hours. You can also talk about the immense benefits of flexibility. These include improving retention, attracting top talent, and increasing productivity and engagement.

Building financial freedom isn’t necessary to negotiate flexibility, but it can provide you with a higher level of confidence. Having an emergency fund made me feel empowered to ask for what I wanted and know that I could walk away if they say no or if the work environment became toxic.

If you want to broach a conversation about more flexibility within your work schedule, check out these resources (including a remote work proposal template).

2. Work Fewer Hours

Another option to gain more flexibility now is to work fewer hours. There are many different ways you could do this:

- Negotiate reduced hours with your current employer: For example, one of my coaching clients has successfully negotiated to work 50%. Angela Rozmyn, who writes the blog Tread Lightly Retire Early, was able to scale back to 32 hours/week at her current employer after her son was born.

- Find a new job that has part-time hours: This is what I did. When I was ready to go back to work after I recovered from burnout, I found an organization that was hiring for a part-time role.

- Propose a job-sharing arrangement: Job sharing is when you have two part-time employees sharing one full-time job. The Happy Philosopher did a job share with another doctor. But, it isn’t just doctors who can do this. Carol, who writes a blog called Downsize your 2080, did a job share with another engineer while working for the federal government.

- Work Seasonally: In certain industries, it might be possible to do contract or seasonal work. This could allow you to work for a portion of the year and have several months of a mini-retirement each year. Some teachers talk about having summers off with fondness. But, this isn’t only available to teachers. Michelle, who writes the blog Frugality and Freedom, spent a few years working seasonally at art festivals. This allowed her to travel the world when she wasn’t working.

Practical Strategies to Work Fewer Hours

If you would like to negotiate working fewer hours, you can follow similar steps to negotiating more flexibility.

- Review your employer’s handbook to find out if there are policies that support a transition to part-time work.

- Talk to HR about the possibility and implications of working part-time.

- Reach out to colleagues to find out if anyone has worked part-time and what their experience has been.

- Review the handbook or talk to HR about how many hours you need to work to be eligible for company-sponsored health insurance. Sometimes, companies will provide benefits for part-time employees. In the US, most employers require you to work 30 hours/week.

- When you speak with your manager, discuss the potential benefits. Also, be clear about what a reduction in hours would mean for your job responsibilities. You don’t want to be in a place where you are expected to do 40 hours of work in 30 hours.

If you are looking for a new job and would like to find something part-time, I can share two strategies that worked for me.

The first strategy is to find a smaller company that may not actually need a full-time employee to do the job. When I accepted the part-time HR job, the organization only had about 25 employees. They did not need someone to work full-time to handle that number of employees.

The other strategy that worked was to apply for roles that were slightly below my capability and then negotiate to do the role in fewer hours. Because I knew everything about the role, I was also able to do it very efficiently. My former boss often said that I accomplished more in 3 days/week than any other full-time HR Manager she’d ever worked with.

Ultimately, I ended up choosing a role that was originally listed as part-time. I also applied to full-time roles and discussed working fewer hours with the manager during the hiring process.

Financial Foundations Needed to Work Fewer Hours

If you would like to work fewer hours, there are a few important financial building blocks that need to be in place. Ultimately, you want to make sure that you can still cover your everyday expenses and save for retirement.

There are a number of options that can meet this condition, including:

- Having a high enough income that scaling back would still allow you to cover your expenses and save (even if you are saving less).

- Reducing your expenses, so that a lower income could cover expenses and still allow you to save.

- Having another stream of income that could help you to cover your expenses or increase your savings. This could be dividends, side hustle income, real estate cash flow, or if you have a pension of some sort.

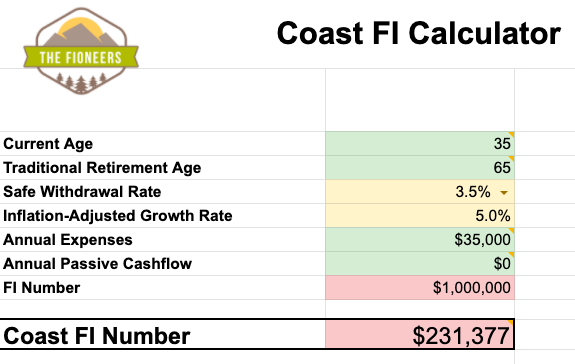

If you’ve already reached Coast FI, this means that you only need to cover your actual expenses. You no longer need to save and invest. The money that you’ve already saved will continue to grow to provide you with a comfortable traditional retirement. If you scale back after reaching this point, you have even more flexibility.

If you want to calculate your own coast FI number, I’d encourage you to download our free calculator.

3. Becoming Self-Employed

If you don’t want to be dependent on the whims of an employer to provide you with flexibility, you can become your own boss.

There are two main options for becoming self-employed:

- Doing freelance, contract, or consulting work in your field: This means that you are still doing work for another individual or company, but you are doing it on your own time-table. They tell you the result they want but have no control over how you actually do your work.

- Starting your own business: This could include creating your own products and services that you sell directly to clients or customers. People can also generate additional income by advertising or promoting someone else’s products.

While starting your own business can be quite challenging, I’ve heard from so many people that it’s 100% worth it.

I recently took the leap to entrepreneurship. So far, I’ve enjoyed the flexibility of my days. I can wake up without an alarm clock and slowly sip a cup of coffee before working for a few hours in the morning. I can then take the dog for a walk, do some yoga, or even read a book before jumping back in. For example, I wasn’t feeling particularly motivated after lunch the other day, so I spent about an hour reading for pleasure before jumping back into writing.

Ultimately, I’m hoping that being self-employed will allow Corey and me to be location independent so that we can slow travel for a few months each year. This isn’t the case yet, because Corey is still working full-time, but we are working toward it.

Michelle, who runs the blog and podcast Michelle is Money Hungry, has been freelancing and running her own business since she quit her job in 2015. In my opinion, Michelle has self-employment figured out. She now only works 10 months each year and chooses to have a 4-day workweek. She frontloads all her work on Mondays through Thursdays so that she can have long weekends. She also enjoys working from anywhere. Her favorite places to work are outdoor patios.

Practical Strategies to Become Self-Employed

Since I’m a new entrepreneur, it doesn’t make sense for me to share practical strategies for starting a business. If you want to start a business, there are some incredible people who can help you create multiple streams of income and start a business. I’d recommend:

- The Ultimate Side Hustle Starter Kit from Jannese of Yo Quiero Dinero. Jannese is a side hustle extraordinaire. In 2020, she generated over $100,000 from her side hustles (AND she still has a full-time job). While enrollment isn’t open at this moment, you can sign-up for her waitlist to be the first to hear when enrollment will be opening again.

- The Launch Your Side Hustle Course from Daniella of I Like to Dabble. Daniella won an award this year for having the best side hustle content She now has 9 different streams of income from her side hustles. Most of all, she enjoys what she does.

If you want to start a passion-based business but aren’t sure yet what you want to focus on, I’d encourage you to check out a recent post I wrote about “Passion Hustles.” This is what I call the fusion between side hustles and passion projects.

Financial Foundations to Become Self-Employed

If you want to become self-employed, there are important building blocks that you’ll want to put in place. Some of these building blocks aren’t 100% necessary. For example, there are many people who start their own businesses or become self-employed after being laid off.

However, if you are currently employed and are worried about taking risks, you can minimize the risk by taking these steps.

- Increase your emergency savings: This is especially helpful if your business is not already covering your costs of living before you become self-employed. Oftentimes, people who are self-employed have a variable income. Some months will be up and others will be down, especially in the beginning. Having emergency savings will help to weather the down months.

- Know your numbers: Have a clear understanding of how much you typically spend each year and what your bare-bones budget looks like (if you needed to scale back). With this information, you can more easily project how much money you need to generate to cover your expenses and save.

- Solid Retirement Planning: If you’ve already saved some money for retirement, there’s less pressure for the business to cover your expenses and the amount you need to save for retirement. It can give you more time to ramp up the business with less anxiety.

- A Plan for Health Insurance (at least if you live in the US): You will want to think through your options for health insurance. If you have a spouse who still works full-time and receives health insurance, that is ideal. If not, you’ll want to look into the costs of utilizing COBRA awhile you can or getting health insurance from the market place.

Corey and I are incredibly risk-averse people. Corey is even more risk-averse than I am. For me to take the leap to entrepreneurship, we felt like we needed a lot of things in place already.

We have already reached Coast FI. This means that we could decide that we no longer wanted to save for retirement. We could simply cover our costs until the age of 65.

I also started my business on the side while working part-time. I took the leap when my business income for 2020 covered half of my salary and my projected income for 2021 covered my salary.

Since Corey still works full-time, we have the ability to stay on his health insurance while I continue to build the business. This provides us with a lot of buffer.

You definitely don’t need to take as safe a route as we did if you want to become self-employed.

Envision Your Ideal Life. Then Determine the Career Flexibility Needed.

Sometimes, people who pursue financial independence see financial freedom as all or nothing.

When people take an all-or-nothing approach, they often take this perspective:

- I’m either fully financially independent and I can spend my time however I want to, OR

- I need to work a full-time, stressful job until I reach full financial independence.

This is a false dichotomy. Financial freedom is a spectrum. New levels of financial freedom provide more lifestyle design options and more flexibility.

The first step to figuring out how to use your financial freedom now is to envision what you really want in your life. After I went through a self-discovery process (and recovered from burnout), I actually realized that meaningful work is a part of my ideal life. This means that I don’t need to work a full-time, stressful job until I reach FI just so that I can do work I love.

I can figure out how to do that work now while building up the flexibility needed to travel and have time to focus on the things that are most important to me.

As we come out of this pandemic and figure out what our new normal will look like, we all have a great opportunity to envision what we want and work toward it.

What kind of flexible career would you like to obtain in 2021?

This is an excellent and timely summary of the BEST questions to be asking ourselves right now.. whether you’re on the path to FI or not!

Hi Nick,

I’m so glad you enjoyed the post! I agree – these questions are relevant for everyone right now!

Jess

This is a really great resource for people looking for more flexibility in their work lives. Thanks for including links to others’ flexible work life stories. I’ll be checking them out!

Hi Emily,

I’m so happy to hear you appreciated the post!

Best,

Jessica

Great post which really highlights how even before reaching FI, you can structure you life in such a way as to reap some of the future FI benefits.

Thanks, Brendon!

I love all of this! So practical but also offering so much hope. Two years ago, I scaled my side-project writing from part-time to full-time, and since then have been working my way back to part-time by aiming for the same yearly income but taking on better paying and less stressful/work-intensive gigs. 🙂 My partner also just negotiated a 32 hour work week… it’s hard to do when you don’t have a great caring company, but after years of becoming indispensable to them, they were willing to go there!

Hey! That sounds amazing. It sounds like you all are making some big shifts!

Congrats!

Jess

I have realized that flexibility in my career is worth more than predictability. But there are risks to being self-employed or any of the other strategies you mention.

Hey,

That is very true. You definitely need to enter any of those with eyes wide open.

Best,

Jessica