Over the last year, we’ve had a running joke that Corey could quit his job when I made enough money with the business.

I’m the kind of person that takes everything a little too seriously…

For example, I rarely use sarcasm because I truly believe that every joke or sarcastic comment has (usually more than) a hint of truth.

As a result of my “serious” disposition, one of the main goals I set for the business was to generate enough income that Corey could quit his job.

In an annual planning process, I wrote this exact vision for my business.

“I run a passion-based, location-independent business that generates enough income that Corey can quit his job. I do this in a balanced way that brings me joy.”

How about that for taking things too seriously? I literally created my annual goal for my business based on a joke!

Now, here’s the reality. It is very possible that I’ll generate enough income from the business this year that would allow us to cover our expenses and still save a little. If it doesn’t happen this year, then it would almost certainly be the case next year.

Given this reality, I started to assume that Corey would be ready to quit his job once we were in a financial position that he could. In my mind, the thing that kept him in his job was the fact that we actually needed the income. If we no longer needed the income, he could quit… right?

It turns out that you probably shouldn’t create goals based on assumptions…

When I brought up the idea in conversation that Corey could quit his job within the next year, it felt like it came out of the blue.

And, I made more assumptions.

Since Corey is the more risk-averse of the two of us, I wrongfully assumed that the reason was about the money. I kept bringing up ways to become more confident in our numbers, but that wasn’t actually the issue for him.

Finally, a few weeks ago, we had a breakthrough. I was preparing to facilitate a recent class focused on overcoming your scarcity mindset. As part of this, I was working through our own numbers using the template for the class.

If you want to see a similar worksheet, check out this calculator I recently created.

One metric from this calculator – our expected retirement balance if we stopped contributing now – helped the most. It made it starkly obvious that we could transition now if we wanted to. In fact, if we never invested another dollar (and left our accounts untouched), we’d have 20% more than we’d need at the age of 60. And, this assumes a very conservative 5% inflation-adjusted growth rate.

This metric helped us align on the fact that we could make changes now. I also made it clear that the main reason why Corey wasn’t prepared to leave his job was NOT because of scarcity. He knew he could leave at any time.

But, he was choosing to stay (at least for now).

Instead, he was more focused on leaving a lasting legacy in his organization. He has already committed 8 ½ years to this organization whose mission he truly believes in. He started as the 4th employee. He has seen the organization grow to 40+ employees, and has worked his way into an executive leadership role.

His motivation was less about a fear of scarcity (as I assumed) and more about setting up this organization he’s come to love for success before he departs.

Understanding his true motivation was incredibly important for me. I was pushing him to quit so that we could start our new, location-independent life. But, I wasn’t taking into account what he wanted or needed to feel fulfilled. I was working on faulty assumptions.

Now, we can build a clearer vision taking into account both of our motivations. Now, we can focus on traveling as much as possible while not jeopardizing his ability to make a lasting impact on his organization.

With this new understanding, we’ve created a few potential 5-Year Plans that take both of our motivations into account.

Creating our Potential Five Year Plans

Saying that we have five year PLANS is intentional here. We used this new understanding to create a number of potential five year plans.

Brainstorming different plans allowed us to explore what middle paths could look like. Looking at different ideas takes into account both of our goals and motivations.

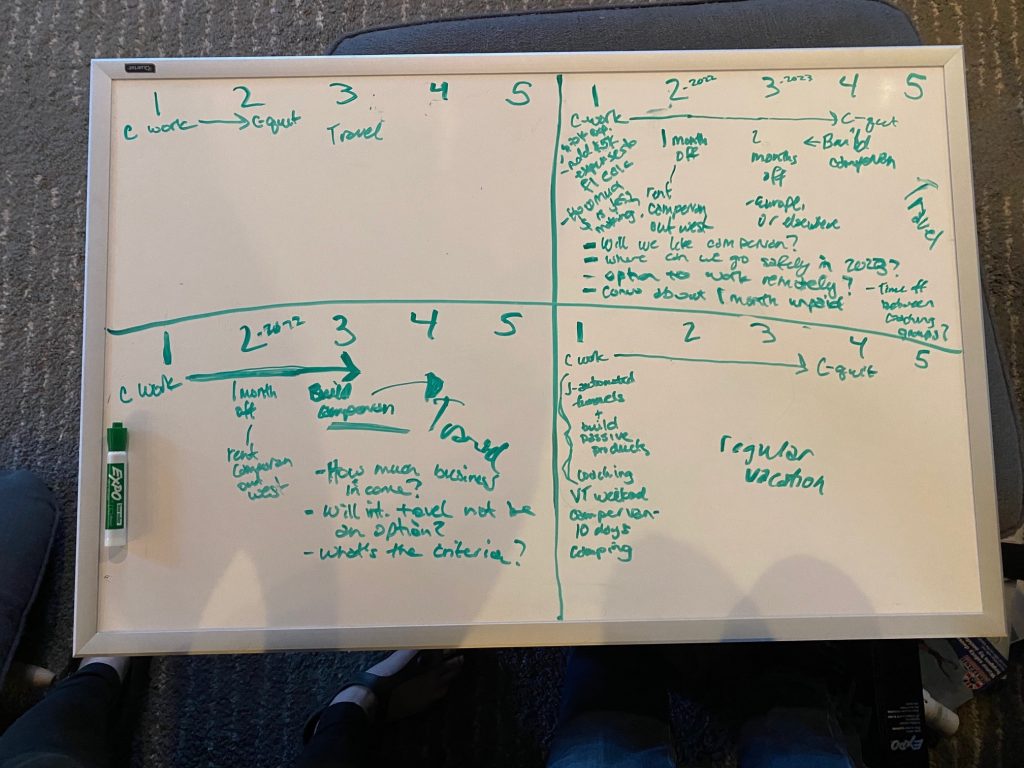

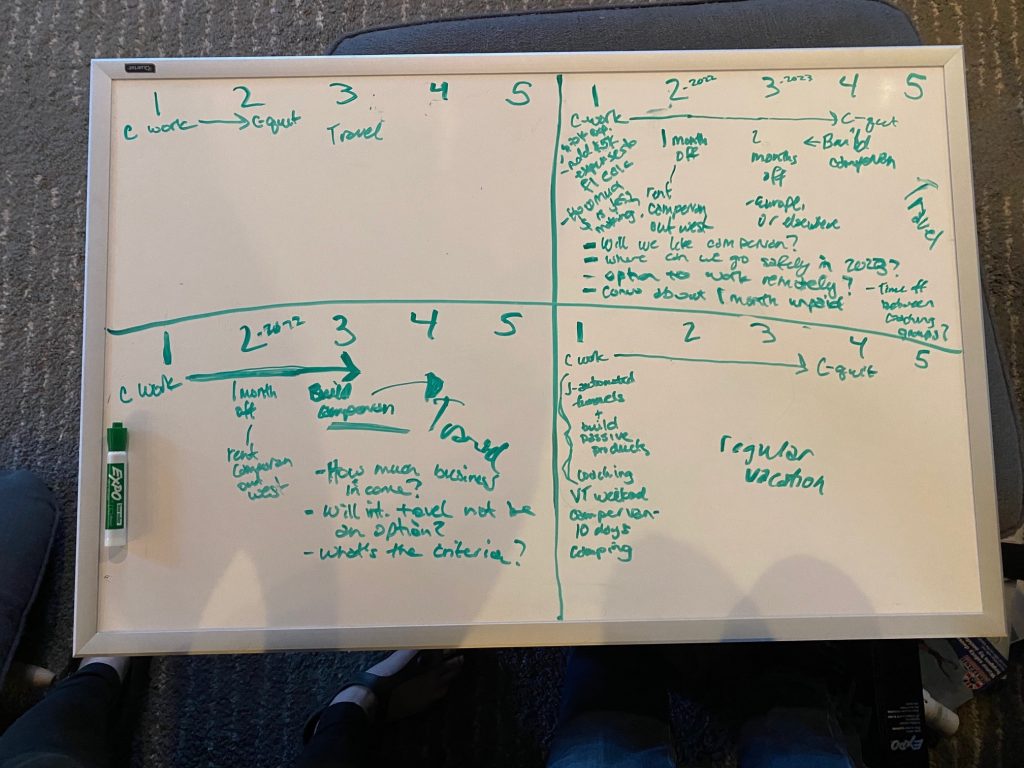

To do this, we literally used a whiteboard. On one side of the whiteboard, we put my ideal plan. On the other side of the whiteboard, we put Corey’s ideal plan.

To be clear, these were only our ideal plans at the very beginning of the conversation. Our perspectives shifted over the course of the conversation.

My ideal five year plan included Corey quitting his job at the end of year 1 so that we could start traveling for a few months each year. Corey would join me as an entrepreneur. We’d continue to build the business both on the road and when we were at our home base.

Corey’s ideal plan was to stay in a similar situation for the next 3-4 years. That would allow him to feel like he could wrap up his job and make a lasting impact.

To be clear, we both knew that each of our “ideal” plans was not realistic and did not take into account both of our goals and motivations (which is why those plans aren’t built out above). So, we set out to create middle paths that would take into account what we both wanted.

This is where the magic happened!

When we took into account both of our goals, we were able to create plans that were more than compromises. We are just as (if not more) excited about these plans!

Middle Path #1 (More Conservative Option)

As we brainstormed different options, we came up with a slightly more conservative middle path. This path would include Corey working with his employer for another 3-years while taking longer breaks to travel. I would focus on building up the business and putting more systems in place so that we could generate more revenue in less time.

This five year plan also includes:

- Pooling up Corey’s vacation time to take a full month off in 2022 to take a campervan trip out west.

- After 10 years of service at his organization, Corey can hopefully negotiate to take a sabbatical in 2023. If we added some vacation time to it, we could take two months to travel around Europe (or another international location).

- Buying and building out a campervan in 2023-2024, so that we are ready to use it when Corey quits his job in 2024.

Middle Path #2 (More Aggressive Option)

The more aggressive plan is similar to the more conservative plan above. It just moves the timeline for quitting up one year. So, in this plan, Corey would work for his employer for another 2 years before joining me as an entrepreneur.

In this plan, we’d still pool up vacation time to take a full month off in 2022 to take a campervan trip out west.

The key difference in this plan is that Corey would quit his job in 2023. We could still do the international trip in 2023 and build out the campervan to be complete in 2024. Or, we could move up the timeline for the campervan to 2022-2023. This would allow us to travel around to national parks in 2023 instead of going internationally.

Evaluating Our Five Year Plans

Creating these different plans provided options. Now, we can assess each plan according to our motivations.

As I shared above, Corey’s main motivation for the next few years is to make a lasting impact in his organization. I also know that he cares about continuing to build financial freedom, and wants to have fun and travel (to a lesser extent than I do).

My core motivations right now are to:

- Help people design lives that they truly love

- Practice everything that I teach – to design my own life to be one where I can thrive. For me, that’s a life that’s filled with impact, fun, good health, strong relationships, creativity, and adventure.

- Support Corey in making the impact that he wants to make as we prepare to make a transition.

To be honest, I am able to fulfill the vast majority of these core motivations right now. The only things that Corey quitting his job enable are more adventure and more fun (since I actually like hanging out with him).

One thing that I realized is that Corey doesn’t necessarily need to quit his job for me to be able to expand the role of adventure and fun in my life. By pooling up vacation time and taking a sabbatical, we’ll be able to travel a significant amount in the next few years.

Both plans allow me to fulfill the desire for adventure that I’m looking for. In fact, I don’t even like the aggressive plan more than the conservative plan. Both sound really exciting to me!

How to Make Your Own Five Year Plan

I definitely encourage people to plan ahead as they are designing their life. Planning ahead allows you to:

- Start experimenting to figure out if you know what you actually want (or if you need to adjust things)

- Create a plan for what you need to do between now and then to make your vision a reality.

Creating a five year plan for yourself can be daunting. And, creating a five year plan if you have a partner can be even more challenging because you need to balance multiple desires and motivations. Within this section, I’ll share tips for you to do this as an individual, and also include ways to align with your partner as well (if you have one).

Step 1: Create a Vision for What You Want

In order to create this vision, I definitely encourage you to follow a lifestyle design process. Within this process, you:

- Explore the elements of your ideal life: What you love to do, your core motivations, and how you can organize your life in a way that will work for you (with your strengths, personality characteristics, and limitations).

- Explore the variety of lifestyle design options: Different options are available when you build financial freedom. It’s also helpful to articulate what options will be available to you within the next few years. For inspiration, I’d encourage you to check out over 30 interviews in the Slow FI interview series.

- Test and experiment with different options, so that you can see what you actually want and build your confidence to dream even bigger.

- Use what you learn to inform your vision and goals.

The vision for what you want will evolve over time. For example, I’ve been actively working on designing my life since 2018. My vision has gone through many iterations because of experimentation and the confidence that has provided.

Here is how my vision differed over time:

- In 2018, my vision was to go back to work part-time. Then, I’d likely increase my hours until we reached FI.

- By 2019, my vision had shifted. I wanted to keep working part-time and build a business on the side that would allow us to semi-retire within the next 5 years.

- By 2020, my vision was the eventually (within the next few years) get to a place where I could quit my job to run my business full-time. Then, we could take more of a Coast FI approach.

- By 2021, I knew that my business would eventually cover us financially. This means we could be location-independent entrepreneurs even earlier than we originally thought.

Do you see the progression? I had an inkling in 2018 that I’d like to try entrepreneurship. That was the year that I started this blog. But, it took the progression of building it, trying things out, and building confidence over time to create the vision I currently have for my ideal life.

Without trying things out, my dreams stayed small. You don’t gain confidence until you start taking action, repeatedly!

Communicate With Your Partner (If You Have One)

If you have a partner, it’s important to make sure that you are communicating with them about your thought process and how it’s shifting over time.

While I talked with Corey about what I was learning this whole time, I remember a few specific conversations or decision points:

- Fall 2018 – We discussed me returning to work part-time and why I chose 3 days/week rather than 4 days/week (although the plan was to increase my hours eventually).

- Spring 2019 – We decided that I wouldn’t increase my hours to continue focusing on the blog and potentially building up a business. I also remember a distinct conversation we had in Panama after I read Work Optional about potentially taking a semi-retired path.

- Summer 2020 – I had recently started my business with some success. We discussed what could happen if I could get the business to a place where it would generate significant income allowing me to quit my job within the next couple of years. Depending on how much the business generated, we could take a semi-retired approach in a few years or a Coast FI approach (and still cover all our costs).

- Fall 2020 – As my business was continuing to grow and I filled my coaching program within 3 days, we finally saw the track record of success we were hoping to see. After some frustrations at work, we decided that it would make sense to quit and focus on the business.

Now, in the spring of 2021, I am a full-time entrepreneur. The business is doing as well (or better) than expected. This could allow us to transition much sooner to the lifestyle that we were envisioning post-FI. This is the situation that spurred our recent conversation.

Had we not been discussing our plans all along the way, it would have been A LOT MORE DIFFICULT to get on the same page about our plans for the next 5 years. So, if you have a partner, I urge you to start having these conversations on a regular basis if you don’t already.

Encourage Your Partner (if you have one) to Explore Things that Interest Them

When you are working through a lifestyle design process, you only have control over what you do and the process that you go through. I’ll say this again… you cannot control the process that your partner goes through to explore their own passions and interests.

You can, however, encourage them.

It feels a bit weird to be sharing this as a “strategy,” since my focus was on being generally supportive and wanting Corey to explore things that made him happy. But, I suppose it is a strategy!

When your partner gets excited about something, the best thing that you can do is support their interests (just as you are exploring yours)!

Corey has recently discovered a love for Disc Golf. He has a ton of fun doing it, and I know he’d love to play more of it after he quits his job. Who knows? Maybe he could even compete in a professional tour someday with more practice!

He’s also started watching tons of YouTube videos about vanlife and campervan buildouts. I thought this was really cool, so it was easy to encourage. To be honest, he seems a bit more excited about actually building out the van, and I’m way more excited about traveling in it. But, it’s exciting to see our passions intersect.

I also know that he doesn’t have a ton of time to explore his passions since he still works a lot. But, I do know he has a lot of interests and ideas, so I know he’ll have other things he wants to try out in the future. He’s certainly not going to be the kind of person who is bored after he quits his job.

Step 2: Make Your Five Year Plans

With some clarity of what you want, you can start to generate your 5-year plans. To create your 5-year plans, you’ll want to do a few things:

- Work through your finances

- Understand your core motivations

- Create a variety of plans that would make you happy

Work Through your Finances

When you are designing your life and making future plans, it’s so important to have a deep understanding of your finances. You can’t just know what the numbers are; you have to know what they mean for your life today.

You’ll want to ask yourself:

- How much F-You Money do I have?

- Have I reached Coast FI?

- When could I semi-retire if I wanted to?

- If we kept going at our same pace, when we would reach FI? Do we really need to reach FI by then?

Working through the meaningful FI metrics can help to provide you with a feeling of freedom to start making bigger shifts in the short-term. Download your own version of it and work through your numbers here.

For us, working through these numbers has been incredibly valuable. By working through the numbers, we recently realized that though we are only ~35% of the way toward our actual FI number, we are past Coast FI.

This means we could stop investing now. If we only covered our actual costs until 60, we’d have 20% more than what we’d actually need to retire comfortably. If we decided to drop down to a 20% savings rate now, we’d still reach FI by around 45.

That all seems so crazy and allows us to feel a level of freedom to make changes in the short term.

If you have a partner, make sure that you work through the numbers (and what they mean) together.

Articulate Your Ideal and Understand Your Core Motivations

Spend time articulating what you want the next few years of your life to look like.

- What do you want to do for work?

- How do you want to spend your time?

- Where do you want to live?

Reconnect with your core values and motivations. If you’ve been focusing on designing your life, these will hopefully be on the tip of your tongue.

If you have a partner, it’s also important to ask what their ideal looks and their motivations behind it.

I clearly understood my own motivations because I’ve been focusing on lifestyle design over the last 3 years. But, I did a terrible job of understanding Corey’s motivations.

I assumed that Corey’s perspective was a result of a fear of scarcity when, in actuality, that wasn’t the truth.

When starting to discuss what you want, make sure to ask, “Why do you want to do this? Why does this feel important to you?” Then you can uncover different motivations and work through limiting beliefs (your own and your partners) in this process.

Create a variety of different plans

If you are doing this on your own, I’d encourage you to think through a variety of options. In my lifestyle design program, I encourage people to create 3 different distinct life plans. I originally learned about this approach from a book called Designing Your Life.

- Life 1 is what you already have in mind.

- Life 2 is what you would do if the core component of life 1 were no longer an option (it simply didn’t exist anymore).

- Life 3 is what you would do if money or status were no object. If you could suddenly make a living doing anything and you were no longer worried about what other people thought of you, what would you do?

I did this activity back in 2019, so I didn’t feel like we needed to follow this exact model again this year. We’ve been experimenting and have a lot more clarity about what our ideal life looks like.

If you are working through this with a partner, I’d recommend clearly articulating your ideal and having them do the same. This allows you to brainstorm options that will meet the needs/motivations of each of you.

This is why we used a whiteboard. On one side, we put my ideal. On the other side, we put Corey’s ideal. This allowed us to start brainstorming options that could bring each of our ideas together.

Step 3: Experimentation and Next Steps

One really important benefit of creating plans is that you can figure out the actions to take to:

- Test out your five year plan to see if it’s what you actually want

- Plan and prepare to actually make things happen in the timeline you hope for

We can think and plan all we want. But, until we try things out, we’ll never actually know if we like it. For example, one of our plans is to build out and travel in a campervan. But, it’s important that we don’t buy a van and invest all the time, energy, and money into building it out until we actually see if we like it!

We assume we’ll like it. We love camping, being outdoors, and traveling to new places. But, our current camping set-up is:

- Not that comfortable. Sleeping on camping mats is only okay for a few nights at a time.

- Hard to set up and pack up. Surely, tents have gotten way easier over years, but it still takes time and energy. It seems like a lot of energy to set up and break down camp to be somewhere for only 1-2 days.

- Not great for food preparation. When we only have a camp stove, no sink, and only a cooler for perishables, we are quite limited in what we can make.

The hope is that a campervan will help us solve these problems. Yet, we won’t actually know if we like it until we try it!

The same goes for just about anything. You’ll want to see if there are ways you can actually test things out, such as:

- Starting a business on the side of your day job

- Taking a sabbatical from work (or simply use vacation time) to try out aspects of your plan

- Go live somewhere for a month before deciding to move there permanently

- Trying out new hobbies

- Etc.

Planning out your next 5-years in detail will also help you to understand the actions that you will need to take today to prepare for a transition.

For example, we can’t quit and decide to travel in a campervan tomorrow. It would require us to save the money we’d need, buy a van, and determine how we’d want to build it out. We’d also need to find a place where we can do the buildout and actually build it, etc. This is a process that could take multiple years.

You may have similar things in your plan that will require you to adjust the structure of your finances or to start taking action now.

The Experiments and Next Steps We’re Starting Now

To experiment and to make our plan a reality in the next few years, we have a lot that we need to do.

Here are a few things we need to do:

- Campervan: We are taking a 10-Day campervan trip this summer to visit Maine and New Hampshire. This will give us our first taste of whether we enjoy it. If it goes well, we’ll plan to take a month-long campervan trip in 2022 to travel out west. We also need to continue learning more about the specifics of vanlife (where do people actually stay off-grid safely, etc.) and the process for building out a van.

- Slow Travel: Besides the campervan experiment, we envision traveling for a few months each year. Some of it would be international (since we want to travel to 100 countries together before we die). So, in 2023, we’re hoping to slow travel for 2 months in Europe (or another place depending on COVID).

- Building the Business: I will continue to build the business. I will continue to facilitate group coaching (which I know I LOVE since I’ve already experimented with it). Over the next 6 months, I’m also experimenting to determine the right volume of clients to work with at any given time. I’ll also focus on building automated systems and passive products (which will require a lot of experimentation). These kinds of things happen naturally as businesses grow (but also require intentional effort). They will hopefully allow me to achieve similar results in less time, so I can focus on the things that really light me up!

- Corey’s Transition from W-2 Employment: A 2-3 year timeline also helps Corey to start thinking about the actions he wants to start taking now to help his organization be to a good and sustainable place by the time he would leave. This would include ensuring the team is set up for success and preparing a successor.

Creating a plan is so helpful because we are able to start taking action now.

If we waited to have this conversation until 2-3 years from now, we wouldn’t be able to start our experimentation until then. But, we’d also feel pressure to make changes quickly, so we might make sub-optimal choices.

We also wouldn’t have time to put the action steps in place to start making our plans a reality. We’d be scrambling to figure out what to do, and the shifts would take a lot longer than we expect them to.

We are creating plans now, so that we can make our vision a reality!

What are your plans for the next 5 years?

This is a great post and with perfect timing for our situation, as we are expecting to reach Financial Independence by early 2022.

I retired last year as we adopted a more Slow FI approach hoping to start living the life we loved today, even if it took a little longer to reach FI. However, my husband continues to work to help us cross the finish line. Luckily, he gets a lot of fulfilment from his job, though I’m realizing I may have had some false assumptions as to how much based on recent conversations we’ve had now that “work optional” is quickly becoming a reality.

I LOVE the idea of independently creating our ideal 5 year plans and comparing/adjusting. I want to make sure our near future and plan is something that we are both excited about. We have a young child, which complicates things, but I think your approach will help us clarify our vision, so thanks!

I’m so happy to hear this is helpful! I can’t wait to hear what you all decide to do!

Oh amazing! Congratulations. This is a very detailed post. Loved reading it and all the knowledge you shared. We are on our FIWOOT journey too and hopefully can make it happen soon. However, it is trickier as we are just on 1 income with 2 kids so a bit slower but definitely possible.

I’d love to see some numbers though in your report. I have a monthly report of our passive income and all other sources including side hustles on my site. Maybe you have it somewhere shared on the site?

Hi Mr. Dreamer,

Thanks for your comment. Yes, I can definitely imagine that it’s a bit thicker (but not impossible) one 1 income with 2 kids! We have DINKs (dual income no kids), so things are a bit accelerated for us.

Unfortunately, we don’t share specific numbers on our site. We always speak in percentages for privacy reasons. A few notes though – right now, we don’t have any fully passive income. If any stocks have dividends were are reinvesting them. For awhile, we rented out our extra parking spot in our driveway (we live across the street from a train station in Boston proper) but we don’t currently have a renter. From the business, we’ve generated a very small amount (if any income) from the blog this year. We don’t do ads and only have a few affiliate links. The vast majority of my business income comes from my coaching and courses. We don’t have any other side hustles.

Best,

Jessica

Fun post! I love the idea of experimenting with various scenarios to test out what you might enjoy or not enjoy during retirement. We’re focusing on that now, too.

My husband is already retired, and I’ve continued to work to help catch up our retirement savings after a late start. Plus, my job provides health insurance & many other benefits for our whole family. Due to COVID and working from home for the past year & a half, I have a ton of vacation time built up. I’m planning lots of little trips this year & next (mostly domestic trips to National Parks and such) that will help us refine our plan.

Currently, I’m working on getting some local housesits done to build up a profile with great references. Being able to housesit will give us another option for inexpensive travel, in addition to camping, hotels or Airbnb.

Hey! Thanks for sharing. It sounds like you have a lot of experiments in-store as well! Best,

Jess

This was an amazing and thorough post. It’s nice to see how you transitioned and iterated your vision for your life. I also love the 5 year plan brainstorm and discussion.

Since I left my job, my vision for my next 5 years has morphed quite a bit. Heck I was only taking a mini-retirement, then now realized I could FIRE or close to it.

But then the finer details of life need tended to. I can’t just retire and do nothing, boredom would come on quick. I started AR and am working through what FIRE looks like for me. And my vision and goals are still formulating.

But it is also dependent on my wife’s as well. And we are working on it daily/weekly!

So thanks for this great post!!

Hey! Thank you so much for your comment. It can definitely be a challenge to take two people’s visions into account when planning for your ideal life (and knowing that things will shift over time as you try them).

I wish you all the best as you continue to figure this out!

Jessica

This was a great story. If Corey is able to negotiate that sabbatical, please post any details that you can on your blog! I am so contemplating negotiating and asking for a sabbatical, I am sick and tired of working for another company who doesn’t care about me in the slightest.

Hmmmm… you don’t seem to realize that 5% inflation-adjusted growth in your savings is most decidedly *not* a conservative assumption!

There is the major issue of Sequence of Returns Risk, where a bear market early in retirement can maul your portfolio as you are taking withdrawals from it, and so later returns that got you up to the 5% inflation-adjusted growth wouldn’t be able to make up for the earlier portfolio depletion.

There is also the issue that even with a 100% equities portfolio, 5% inflation-adjusted growth – while it’s happened more than 50% of the time – is not at all guaranteed when stock prices relative to earnings are as high as they are now. And if you do have 100% (or close to it) equities in your portfolio when you retire, you are taking even greater sequence risk than a more typical retirement start portfolio with somewhere between 50% and 75% equities.

Hi Andy,

I think we have different risk tolerances and that’s okay. 5% inflation adjusted feels safe/conservative to me – especially because we haven’t been increasing our costs much with inflation.

To be clear, when we do get closer to full retirement, we will switch to a more bond-heavy portfolio at least for the first few years of retirement to hedge against the sequence of returns risk.

To be clear, we are not actually planning to “retire” anytime soon. We plan to continue generating enough income to cover our expenses for years to come (Coast FI), leaving our investments untouched. So, we wouldn’t be depleting the portfolio in the near future, so a downturn would have much less of an impact on us.

Does that make sense?

Thanks,

Jess

Jess,

Thanks for the response. That you’re not actually planning to “retire” and live off your portfolio/savings makes all the difference.

I actually agree fully that unless you are within a few years of retiring, you are best off keeping 100% of your nest egg in stocks. Because if you are continuing to save, or even just leaving your savings untouched for 10+ years, you shouldn’t worry about short run stock market risk, and in fact for anything additional you save you’re actually better off if the stock market goes down in the short term.

When you are at or close (say, 30), 5% inflation adjusted is an optimistic, not a conservative, assumption for the averages even for the next 10-15 years. It might happen, but there’s an awfully good chance it will not.

So I’m actually in agreement with your plan itself, even as I take huge issue with you characterizing your return assumption as being conservative in any sense of that word.

“(say, 30),” above is supposed to read “(say, less than 5 years) to retirement,”