I was fortunate to grow up in a household with a lot of space. My parents were known for buying a true fixer-upper, remodeling the home with their own sweat equity to increase the value. While we did not move around a lot, they did this several times during the course of their ~25-year marriage.

I was fortunate to grow up in a household with a lot of space. My parents were known for buying a true fixer-upper, remodeling the home with their own sweat equity to increase the value. While we did not move around a lot, they did this several times during the course of their ~25-year marriage.

It was pretty smart of them. They built a lot of wealth by buying a home, upgrading it, selling it with a lot of equity, and then applying the equity of the previous house to the next home. They did this three times while I was growing up.

My childhood home (where I spent ~14 years growing up) was a two-floor, 3,000 square foot home about 10 minutes from the downtown area of our hometown in southwest Washington. It was more in the country than in the suburbs, but not rural either. It’s more than appropriate to say that we had plenty of space inside and out.

My memories growing up are filled with activities that required a lot of space. There were plenty of nerf gun fights, building forts in the basement with our sectional sofa and a seemingly endless supply of blankets, and even racing around the neighborhood on four wheelers.

Through my childhood experiences, I formed a perspective that values a large home.

When Jess and I bought our first home at the age of 27, I began to uncover these subconscious beliefs that I had held since childhood. I had assumed that this would be our “starter home.” We’d live here a few years while advancing in our careers until we bought a larger, single family home.

Or so I thought.

Since discovering financial independence, I have begun to redefine my life’s priorities, including expectations around the size of our home. Adjusting your perspective is never easy, and my expectation around our home size is no exception.

A big part of this transformation has been applying the financial independence concept of “enough” to these deep-rooted expectations around our home. As part of this change, I have gone from always wanting more to now understanding our home as a mansion. We have more than enough.

Better yet, our home is filled with some of the finest luxuries that the world has to offer.

- Filtered water that is safe to drink

- Indoor plumbing with essentially unlimited access to hot and cold water

- Electricity

- Central heating and air conditioning (that can be controlled from my phone)

- Hardwood floors

- Stainless steel appliances

- Marble countertops

- Insulated windows

- Access to public transportation

- A driveway with two parking spots per unit

I could go on and on. And we’ve been able to accomplish all of this with a “measly” footprint of 1,000 square feet. While it may not seem like a lot when you compare it to the average US single family home, we no longer have any plans to upgrade our primary residence.

My Struggle with Wanting a Larger House

As I mentioned above, I have not always been such a huge advocate of smaller homes.

For the longest time, there was a little voice in my head that would tell me that we could afford to have a bigger home, with more of life’s luxuries. Reversing this script in my head started with understanding how my own personality and experiences shaped my perspective.

Learning to Stop Planning for Future Upgrades

Those who know me well know that I’m an avid planner. While I’m getting better at going with the flow, I like to plan things out well in advance.

It’s both a benefit and a curse. I’m great at analyzing competing options, but it’s also a challenge to know when to stop.

To give you a sense of how much of a planner I am, I started researching the best replacement car 3-4 years before we were ready to upgrade. We were very happy with our 2004 VW Passat Wagon, and I knew that VW stopped making the same model, so I needed to figure out the make and model of our next car.

I started to dig into online reviews, compare specs on similar models from other manufacturers, and so much more. I narrowed it down to either the Honda CRV or the Subaru Outback, and we decided to go with the latter.

I ended up deciding what car we would buy well before we actually needed to upgrade.

I never want to be forced to make a decision that could be sub-par because I didn’t have enough time to analyze it.

As someone who plans well in advance, I also pay close attention to details that other people would just accept. I overanalyze every little detail about our home in order to make our lives better, more efficient, etc.

Here’s a perfect example:

A few years ago we built a patio, converting our backyard from this:

To this:

This was a huge accomplishment. We built the patio by hand over the course of 4-5 full weekends a few years back. Side note: If you are interested in how we built the patio, I’ll likely dive into this in greater detail in a future post.

We now enjoy grilling and/or eating on our back patio 2-3x per week during the months when the weather is nice.

Here’s the key part of this example: As we would walk down the steps from our second-floor condo, out the side door, and around the side of the house to get to the patio, there would be a small voice in my head that can’t help but wish for a more optimal setup. That voice would say something like:

“If only we could walk out of our kitchen through a slider door directly onto the back patio, it would make it so much easier to enjoy these experiences.”

I would then add this wish-list feature to a mental list of additional features that I would like in my next home.

And just like that, the planner in me would take an otherwise nice feature of our current luxurious home and start thinking about a bigger and better house.

Always wanting a bigger, better house is an easy trap to fall into for me.

Challenges with Owning a Condo Push Me toward a Single Family Home

Another common narrative that has pushed me to want a larger home is that I would prefer to own a single family home. Right now we own a condo. Our unit is one of two units in our building, with one other family owning the downstairs unit.

While owning a condo is very common in Boston, it comes with several annoying requirements, all centered around getting along with another family and their sometimes competing interests.

Our house is a self-managed HOA (Home Owners Association). This gives us greater flexibility on how we maintain the common space (e.g. the yard, back patio, driveway and exterior of the house, etc.).

We have condo documents and regulations like any HOA to help manage this, but they don’t mean much since we make decisions together all the time without adhering or even referencing the HOA documents.

While very much a positive, given that costs to common spaces are cut in half, it also means that we are forced to come to consensus on every little change.

Every. little. change.

Whether it’s the large decisions on which contractor to use to build a new front porch, or small things like what type of stones we want to use to create a barrier between the mulch and grass. If you haven’t picked out stones for a landscaping project, trust me, there are too many a lot of options.

Before we do anything, we have to get the approval of the other condo owners.

Life would be much less complicated if we did not have to make decisions about our home WITH another family.

Being able to make decisions about our home without this hassle would mean buying a single family home (SFH). By its very nature, a single-family home is going to be larger and more expensive. As you might imagine, SFHs also come at a premium in an urban setting.

Fortunately, we’ve been able to manage this through improving communication. We now talk about things well in advance and try to limit the impromptu improvements that any proud homeowner might do.

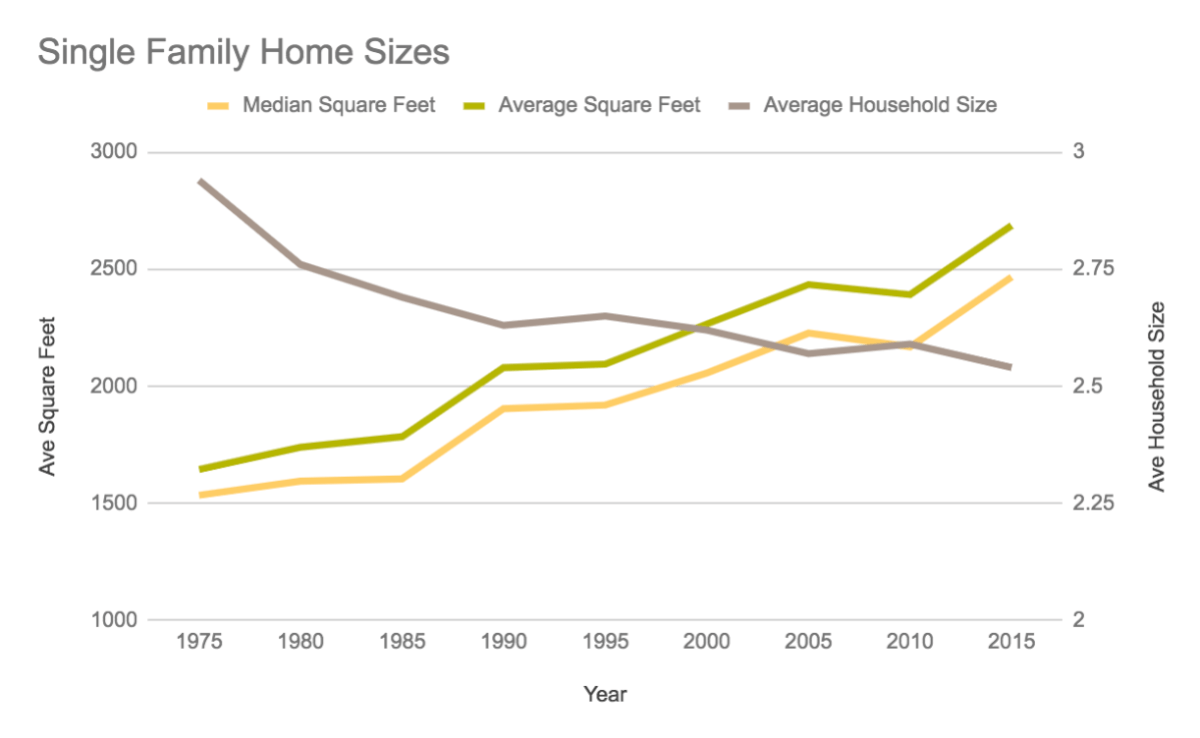

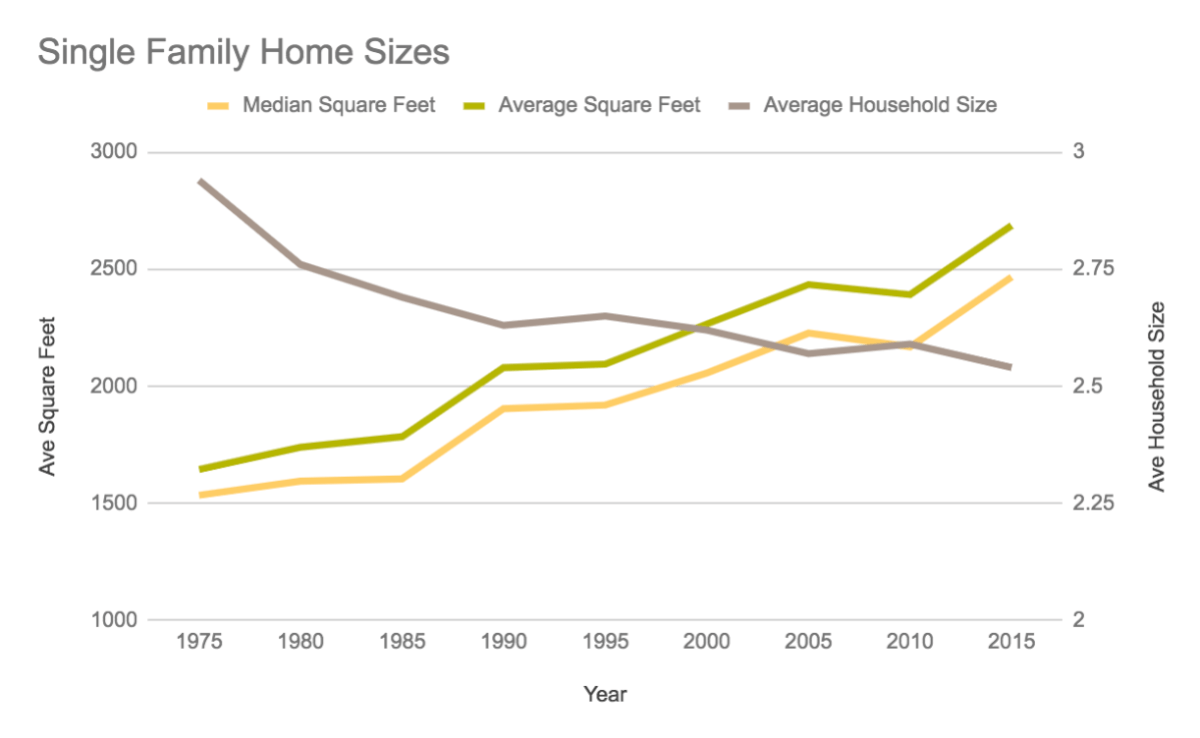

Historical View on Average US Home Sizes

In an effort to find a healthy balance for this struggle of wanting a larger house, I did some research into the average home size for the United States. The information that I discovered has proven to be very helpful to combat the popular narrative of always wanting a larger home.

My first large discovery was that the average home size is a lot larger than it used to be.

In fact, the square feet for the average US single family home has grown significantly over the past 40 years. According to the US Census Bureau (including an older historical chart and a more recent report showing 2015 numbers), from 1975-2015 the average home size increased 63% and over 1,000 square feet, increasing from 1645 SF to 2687 SF.

From 1975-2015 the average home size increased 63% and over 1,000 square feet, increasing from 1645 SF to 2687 SF.What’s also remarkable, is that during this same period, according to Statistica the average household size (i.e. number of individuals) has decreased 14% from 2.94 to 2.54.

With the increase in square feet and a decrease in the household size, this means that the average square feet per person have almost doubled (560 to 1068 SF/person) from 1975 to 2015.

The average square feet per person have almost doubled (560 to 1068 SF/person) from 1975 to 2015.Here’s an overview of the data pulled from those two sources, summarized by showing data in 5-year increments.

| Year | Median Sq Ft | Ave Sq Ft | Ave Household Size | Ave Sq Ft / Person |

|---|---|---|---|---|

| 1975 | 1535 | 1645 | 2.94 | 560 |

| 1980 | 1595 | 1740 | 2.76 | 630 |

| 1985 | 1605 | 1785 | 2.69 | 664 |

| 1990 | 1905 | 2080 | 2.63 | 791 |

| 1995 | 1920 | 2095 | 2.65 | 791 |

| 2000 | 2057 | 2266 | 2.62 | 865 |

| 2005 | 2227 | 2434 | 2.57 | 947 |

| 2010 | 2169 | 2392 | 2.59 | 924 |

| 2015 | 2467 | 2687 | 2.54 | 1058 |

Here’s also look at a visual representation of the data:

When you look at the trends, there are a couple of other observations or notes to be made about this data:

- The largest increase within a 5 year period was 19%, happening from 1985 to 1990. This was an increase of almost 300 square feet.

- The 5 year period from 2005 – 2010 was the only half decade with a decrease in median/average house size (using round 5 year increments, that is). If you think that Americans have finally come to their senses, you’d be wrong. The subsequent 5 year period had a significant 13% increase.

- This information only represents single family homes. I suspect that SFH data is more readily accessible, especially as I could not find other data on other types of properties.

Personal Takeaway from Average Home Size Data

Everyone will have their own personal takeaways after seeing the historical trends on the average size of single-family homes. I found it extremely helpful to provide some context and a new framework to combat the constant desire for more.

In thinking of our family as part of the larger trend, it gave me a new perspective on how we should approach our housing situation.

Most importantly, instead of asking what else I would like in a future home, I am now asking how much is enough?

Strategies to Combat the Pressure for a Larger Home

While I used to dream of a larger home for a long time, I have since de-prioritized it. Instead, I would much rather keep our current home and have a lot more freedom, reach financial independence sooner, and so much more.

In order to fully convince myself, I have identified a number of techniques that help combat the pressure to buy a larger home.

1. Calculate the savings by not upsizing your house, both in terms of annual savings and the time impact on achieving financial independence. This can be a great motivation for keeping your expenses to a minimum.

For example, if we were to upgrade to a single-family home in the same neighborhood, our mortgage payment would increase approximately $1,200 per month. This is $14,400 in additional expenses each year. Based on our current savings rate, it would also postpone our FI date approximately 3 years and 5 months.

Whenever I’m feeling the itch to buy a larger home, I can then ask myself: Would I rather have an extra 42 months of financial freedom, or would I rather have a larger home? I find this to be a really effective strategy.

2. Focus on what you do have. It can be easy to get caught up in thinking about additional things you would like in your home. Instead, think about all of the luxuries you do have and reflect on how grateful you are to have your current home.

For example, after traveling to parts of the world (including our recent trip to Panama) that do not have clean water, I’m always grateful to have clean water. There’s something about being able to open your mouth in the shower.

3. Think about the most commonly used places in your home. If I had to guess, the most 3-4 most frequently used rooms in your home are:

- Bedroom

- Living room

- Kitchen

- Bathroom

For me personally, I spend a lot of time in bed and sitting on the couch (whether I’m reading, playing games on my phone, watching TV, or even hosting friends). I only spend time in the kitchen when preparing food. I spend very little time in the spare bedroom or dining room. This helps reinforce how little space you actually need.

4. Visualize all of the unused space in your current home. Similar to the third technique, also remind yourself of the unused space whenever you are thinking about how you could use more space. If you have a spare bedroom that is only used for guests, consider how infrequently it is used. You are less likely to buy a home with another bedroom (i.e. going from 2 bedrooms to 3 bedrooms) if you are aware that you already have a bedroom that is only used 10-20 days per year.

5. Calculate and compare your square feet per person to the average from 40 years ago (560 SF/Person). There’s no requirement to compare yourself to current day averages. People were surviving just fine 40 years ago, so push yourself and see how you compare to the average space per person without 40 years of space inflation.

6. Test Your Lower Limits. While I’m not advocating for living in a tiny home, think about how small of a space you could live in comfortably. I’ve found gamification to be an effective tool to combat unhealthy social norms. Similar to how we calculated our cost per meal per person when we made big cuts to our food spending, find ways to push yourself when it comes to your living arrangement.

You don’t have to move to test your theory. You could try it out by renting a small local Airbnb apartment for a few days and go about your normal routine, house sitting for friends, or a number of other hacks.

7. List out Reasons Why You Want a Bigger House. If you find yourself wanting a larger home, write out the reasons that are driving this thought. Evaluate if any of the reasons you have listed are similar to the following poor excuses for buying a larger home:

- To grow into it

- To encourage out-of-town friends/family to visit more often

- To entertain friends more frequently

- To build more equity

- I deserve it because I work hard

- I can afford it, so why shouldn’t I have nice things?

- It will be our forever home

8. Think about what you value most. All things in life come with an opportunity cost. Since we do not want to relocate, buying a larger home for us would lower our savings rate and effectively push back the date that we would reach financial independence. Instead of focusing solely on your home, figure out what you would have to give up to buy a larger home. Then ask yourself if it is worth it to you. For us, we’d prefer to keep our freedom and our 1,000 square feet mansion.

When you apply all of these techniques, I believe that you will begin to see the world of home ownership through a new lens. For example, instead of seeing a 1,000 SF as a starter home, you may just see it as a luxurious mansion or even your forever home, with plenty of space to live comfortably.

This is definitely something I can relate to. I’ve just bought my first place – a modestly sized one bed flat. And I’m already thinking about how I want to convert it to a 2 bed. But that would purely be for the relatively infrequent occasions I have out of town guests. I live alone so should be content with the space I have. On a per use basis a spare room probably wouldn’t be much value for money.

Thanks Fretful Finance. What techniques do you use to keep yourself content?

I’ll let you know when I’ve discovered them! I think weighing up the extra space in terms of the months or years it costs in early retirement is probably most helpful. I’ve reconciled myself to delaying investing in my FIRE fund by a year to save for an extension but if upon getting a quote it turns out it will take much longer to save the money then it will be a case of going back to my spreadsheets and calculating what that costs me in terms of retired life.

Yeah some of the reasons for wanting a bigger home are pretty specious. Mine’s about 1,200 square feet (not including the guest house, which was tacked on at a later date), and there was plenty of room for two people who were home all day every day. Now that it’s just me, it feels even more spacious. And I have a guest room that functions just fine for out-of-town visitors. No need for hundreds more square feet. Plus, the living room/dining room is an open floor plan, so I can have people over just fine without them feeling cramped. And let’s not forget that more square footage = higher utilities. Which is huge in Arizona, especially since I’m home all day and so have to cool the house constantly in the spring/summer.

There are plenty of things I’d change about my house if I could. Or if I won the lottery maybe I’d upgrade to a slightly nicer (but probably similarly sized) house. But you can’t beat the mortgage for this place. I did the math and even with all of the equity (it’s going crazy in this market and I bought at the low end), my mortgage payment would *still* be higher if I were able to put half down on a nicer place. There’s just no need for that!

1200 SQFT for one person does sound like a lot, especially when you compare it to the average per person from 40 years ago. Higher utilities is something to be conscious of. Another great reminder that the expenses compound.

This is such a reasonable approach to curbing the urge to upsize.

Your first point, “Calculate the savings by not upsizing your house” is something I’d also advise doing.

Math always makes tough decisions a little clearer. 😉

This is definitely a share-worthy article. I’m bookmarking it for future use!

Hi Chrissy,

Thanks for sharing! Yes, it’s hard to argue with math. 🙂 We’ve definitely found that it can help make decisions much clearer.

I’m glad to hear this was helpful for you!

Best,

Jessica

This is a great post! Before I hopped on the FI train, I always pictured a bigger home. I thought that it’s just what you did. You lived in an apartment, got married, then moved into a house, right? I couldn’t imagine starting our lives together in a tiny little one bedroom apartment. Before my fiancé moved in with me, I was nervous that this one bedroom was not going to be enough space. After he moved in I was surprised at how comfortable our living space still was! We are making it work in a very small space, 1000 square feet would feel huge! Lastly, it’s a little embarrassing, but we have a hard enough time keeping our tiny apartment tidy some days, I couldn’t imagine having more space to care for at this time in our lives. Although we probably won’t stay in our apartment forever, I know that “upgrading” doesn’t mean we have to take on more space than we need. We can continue to save our money and our time by buying a smaller home in the future!

Hi Rebecca,

Thanks for the comment! It is pretty crazy how much your perspective changes when you start to think about the tradeoffs. And yes, we have a hard time keeping our place clean as well.

Thanks again,

Jessica

Great research! It still boggles my mind that 1000 sq. ft. is considered “small” in most of US.

The first 3ish years in Shanghai, I lived alone in apartments under 400sq. ft. Then I moved to into a 2BR 1,000 sq. ft space with my husband. My sister then moved in as well. It was a huge upgrade, and I found I simply filled the space up with stuff. The 1000 sq. ft. apartment felt so spacious for the three of us.

That is, until we visit homes in the U.S. It’s all relative, and spending some time in big cities and abroad puts things into perspective.

Exactly. I feel like 1,000 square feet is pretty huge, but when we go to visit family or friends who live in the suburb and have a house, it’s hard to imagine what we’d do with all of that space. I definitely feel like we have too much stuff!

We live in a small apartment with no walls and no place for guests. At first my wife thought it was crazy, but when I pointed out that to have that extra bedroom with walls meant we would each have over a 40 minute commute and it would cost us $3,600 more per year in housing cost, she started warming to the idea.

I then used my trusty calendar to show her that in the last 3 years we had out of town guests 4 times. We are now located close to a hotel and the 3 times we have had guests in this latest three years we have simply paid for their hotel stay.

Total savings is around $8,000 in housing costs and untold savings in mental health, fuel, and maintenance costs from not having ridiculous commutes.

Thanks for sharing! That’s a very interesting way to look at it. Commuting 40 minutes is the worst – that’s the argument that would do it for me!

Nice post. Ah yes the pressure!

1. Do NOT pay heed to what OTHER people think about your space/living situation. They are NOT you. You need to do what works with YOUR goals, lifestyle choices, etc.

2. Keep it simple and use storage pieces. Feel like you need more storage and so need a larger space? I love how kitchens get cluttered. The counters full of gadgets (how many times do you use the blender?), cabinets filled with specialty cookware, bakeware, dishes, and a drawer full of cooking tools used very rarely, if it all (I am looking at you funnel). Streamline. USE furniture storage solutions that work for you. We had a small apartment with 2 kids and a cat. The kids had a day bed and a captains bed and we had a taller bed with a foam mattress which meant TON of space under to store things (toys, clothes, books/papers, luggage (with stuff IN it of course). The coffee table was a bench with a lidded top that doubled as a seat for the kitchen table. The sofa even had built in storage! End tables and nightstands that are cabinets are good too. A desk with a hutch helps. Look at tall armoire/wardrobes that take up less horizontal space.

3. Find out what space and furniture you are comfortable in. Do you need a 14*12 living space versus 10 *12 feet? How far is too close to be to the bookcase/ TV. How many people Normally are in the space (regular sofa versus a sectional) and is there room to bring in a spare dining chair during those times you might have a few others over? Is smaller sized furniture OK (42 round dining table versus 54. A more shallow sofa – I like them better as I am short!). Where can you combine spaces? My living space was also where my kids had most of their toys. My husband had his desk in our bedroom for years.

4. The Bathroom. Yes folks do shower in the AM versus the PM to help with hot water issues. A bath JUST for guests should be a luxury. How big? Do the makeup and hair in the bedroom at a mirror. Do you need a tub and a shower? No.

In my married life we have lived in spaces as small as about 700 sq feet to about 4000. Anywhere from 2 people and a cat to now with 2 cats and 6 people in about 1700. If it was just me I could see 300 being very spacious if laid out correctly.

Thanks for sharing! FYI stumbled on your blog via links in another (get rich slowly which I highly recommend).

Hey!

Thank you for sharing all of your tips! These would all definitely help.

We are also in the process of decluttering and streamlining and lot of things, so I think our space is going to feel even bigger.

I’m so glad you found the blog!

Jessica

You are welcome. A site for uncluttering I have used is unclutterer . It appears it is no longer being updated but it is still up and has years of tips etc. 🙂

Wonderful! Thanks for the tip! I’ve been loving Rose Lounsbury lately! She just did a 12-day challenge that I joined (but we’re continuing through the full 31 days of this month!

Terrific counter-culture values – chudos to all who have contributed to a wise community.

My wife and I have visited Buckingham Palace, Bellas Artes in Mexico City, the Kremlin in Russia, every State and large city in USA and soooo much more all while totally enjoying our 350 sq ft palace of a home for the past twenty-five yrs!

The additional savings in home owners insurance, property tax, interest on mortgage, expenses for heating & cooling and no accumulation of stuff (where would we put all the stuff we don’t need or use?), provides unimaginable freedom and contentment.

In this digital age when people can disconnect from each other while sitting in the same space, who needs 2000 sq ft of living space?

Since our 28 year old son left for college six years ago we have embellished our little palace to be even more of a delight!

Downsize while you can — less truly is more!

A needed correction:

Since expanding our condominum the total living space related to my post this hour is 960 square feet. It is sweet!

Wow! That’s awesome! Thanks for sharing! It is pretty interesting to go and see these massive palaces in other places and try to imagine people living there. It’s hard to do!

Best,

Jessica

I felt like I was reading my own experience!

I grew up on a farm in a 5 bedroom farmhouse. When we got engaged, my husband and I bought a 1000 sq ft “starter home” on 1/2 an acre that we expected to live in for less than 5 years, build some equity and upgrade to a “nice house.” 8 years later we only sold it because we happened upon a very unique home on 36 wooded acres in the country that we fell in love with. As it is, our new home is only about 1500 sq ft. For just 2 of us, that’s still a lot of sq footage per person but still much smaller than most these days.

It’s great to see other people embracing the smaller home as well.

Hi Lisa,

It really is amazing what can happen when you start questioning the societal norms of having larger houses. Living in a smaller place will provide us with so much more freedom. Plus, we don’t have to clean a larger house!

🙂

Best,

Jessica

The struggle between wanting space and not wanting to spend outrageous amounts of money is real! I grew up in a 1500 sq ft house with 4 people. There were times when I felt it was cramped. Now I have a blended family of 7 people in a 1300 sq ft apartment. It really is cramped! We are making it work, but there are basic things we need as a large family that this amount of space just doesn’t meet.

We have discussed building a house, but ultimately you still have to have the how much house is enough conversation. If the space is functional and extremely well organized, we could be comfortable at around 2000 sq ft. There’s just never going to be a case where I’m buying a 4500 sq ft house. The mortgage and monthly bills alone is a firm “no” from me.

Hi Lakin,

Thanks for your comment! Wow, 7 people in 1300 square feet. I can imagine that feeling cramped. Good luck figuring what to do next!

Best,

Jessica

One thing that I did not notice anyone mentioning. Small house living can enable you to do the kind of work that you truly enjoy doing, even if the pay is not great. Or to be able to afford to retire, and stay in the home that you’ve put so much of yourself into.