How We Are Managing Our Money as Entrepreneurs

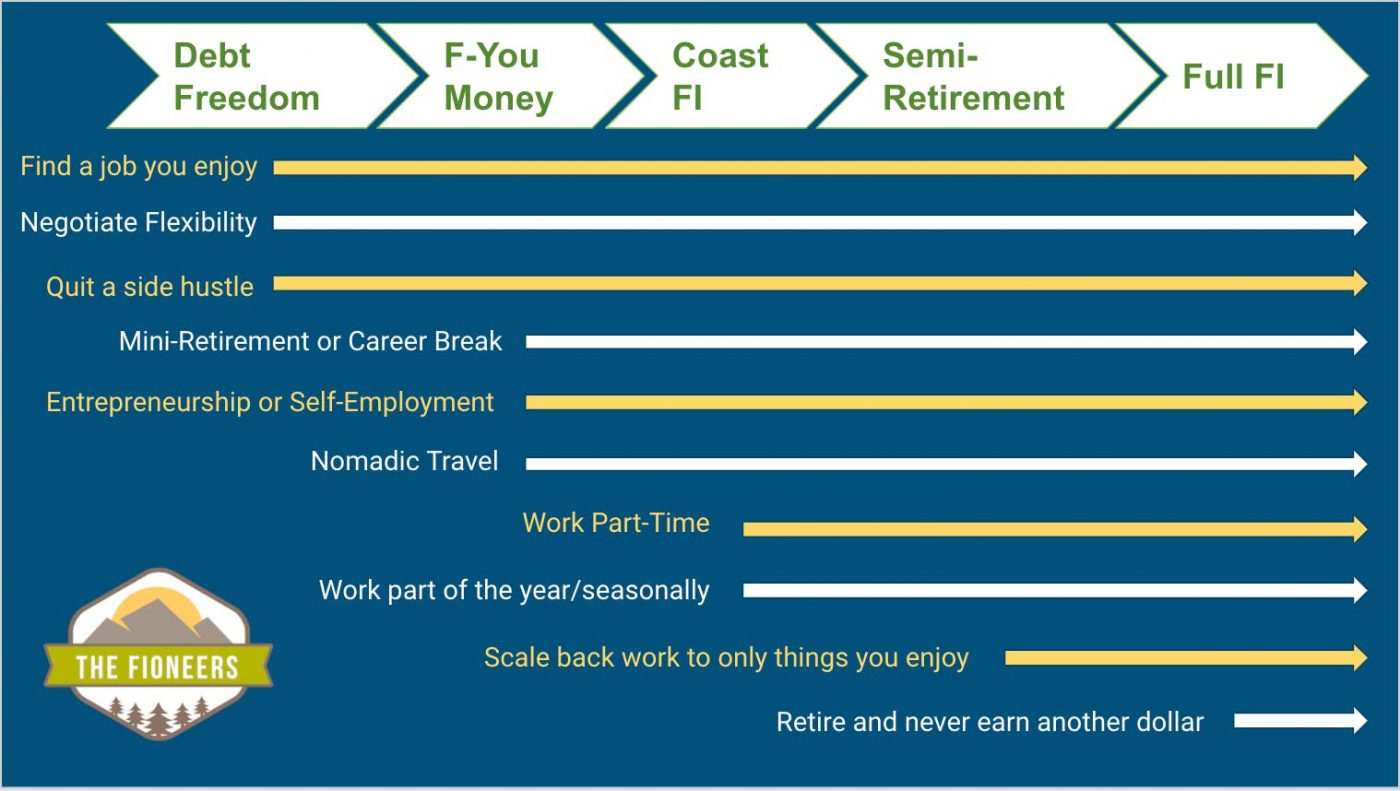

Earlier this year, Corey left traditional employment, and we are now reliant on variable income from our business. We’ve needed to shift the way that we manage our money and our mindset. This post shares how we’ve done that.