Table of Contents

A couple of years ago when I first published this post, I wrote that one of my main hobbies was personal finances.

There was 8-9 year period of time where I obsessed over personal finances. I consumed everything I could get my hands on.

Through all of my research, there was one topic that had a great impact on our lives. It was the topic of savings rate.

I have since broadened my experience, and found new hobbies. But, savings rate continues to be an important part of our financial plan.

It was something that I learned approximately 5 years ago now. And it’s amazing to look back at our financial progress, in large part due to this topic.

Understanding savings rate has changed the way that we manage our money. It is still the most important metric that I pay attention to, and I’m not over-emphasizing this. While there are many important metrics to track for financial independence, savings rate is the most important.

There’s no question about it.

If this is a new concept to any of you, as it was for me several years ago, savings rate is the percentage of your annual household income that you are saving.

Now, the use of the word “saving” doesn’t mean that it has to go into a savings account. If you are pursuing financial independence, I suspect that most of these dollars that you are setting aside are being invested. Saving in this instance simply implies that you are not spending this money during the year.

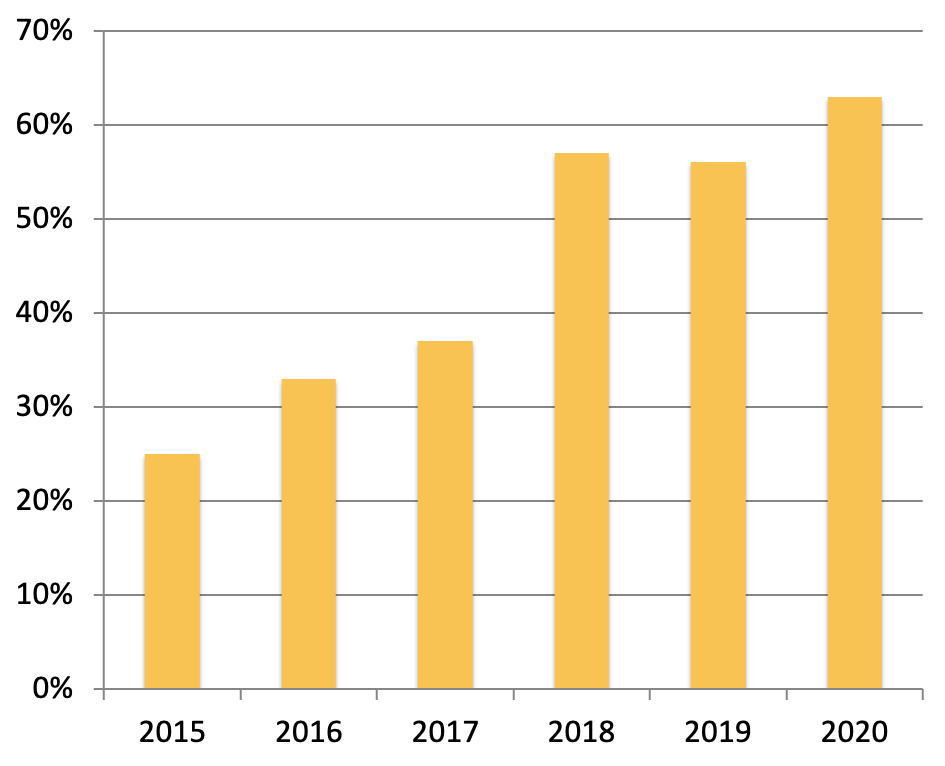

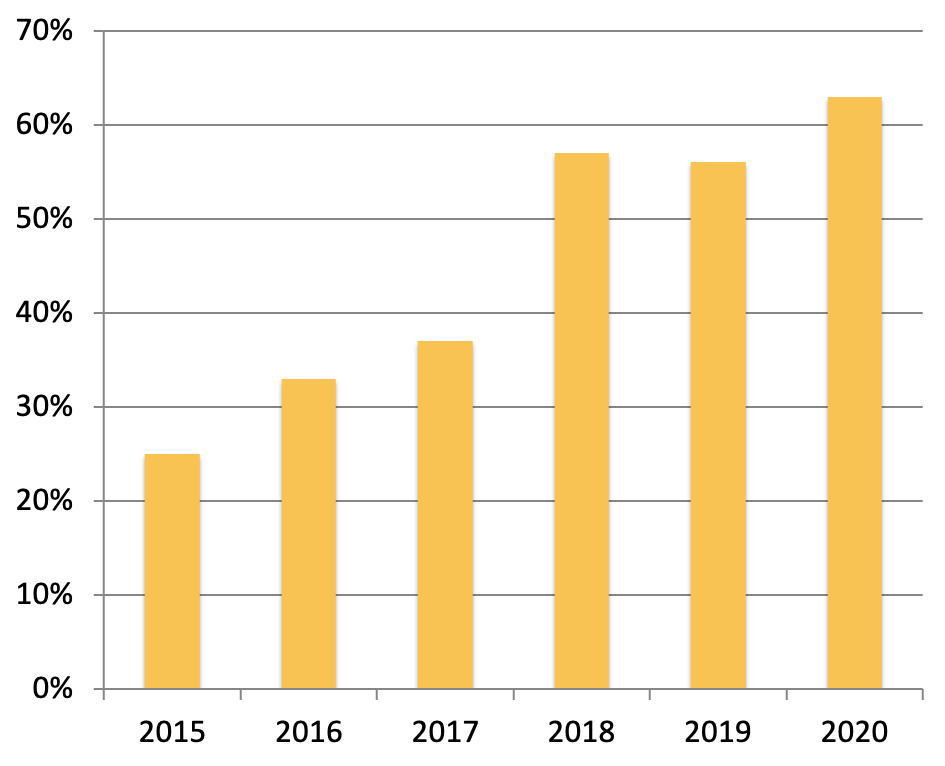

After being introduced to the concept about 5 years ago, I started setting targets and tracking our savings rate on an annual basis. 2015 was the first year that I started tracking our savings rate. It has increased ever since.

My First Introduction to Savings Rate

I have been managing our personal finances for many years prior to discovering savings rate. I was setting financial goals, setting up and monitoring progress towards future large expenses, tracking our net worth, tracking our spending, saving for retirement.

I was doing it all. All of the things that I thought I was supposed to do when it comes to personal finance.

And it WAS working. I was getting the results that I had intended.

The only problem is that it was taking a lot of time and I started to lose interest. I became so good at controlling my spending on a day-to-day basis that I stopped caring whether I had filled out my budget spreadsheet with last month’s spending.

I knew deep down that I didn’t need to do all of the extra work to get the same results.

Thankfully, I found a new way to manage my finances. A way to manage my money that took significantly less time to implement and manage without missing out on the results.

The Anti-Budget

Before learning about savings rate, there was another concept that bridged the gap between my former way of managing our finances and fully embracing savings rate. I had previously read and heard about a new concept to me at the time, known as the Anti-Budget from Paula Pant at AffordAnything.com. As she describes her alternative to budgeting, it’s really as simple as three easy steps:

- Decide how much you want to save.

- Pull this off the top.

- Relax about the rest.

This was revolutionary at the time, for a number of reasons:

1: Changed the Order of Spending & Savings

It was deciding how much you wanted to save FIRST and then LATER deciding how to create your lifestyle around that goal. I had heard of the phrase “paying yourself first,” but this new approach helped me see the true value of doing so.

Previously I had my savings at the bottom of my budget so that it looked something like this (Note – actual numbers and the full list of budget categories have been replaced to emphasize the key idea):

| Sample Budget | Month |

|---|---|

| Take-home Pay | $3,000 |

| Expenses | |

| Housing | $1,000 |

| Transportation | $250 |

| Other | $750 |

| Total Expenses | $2,000 |

| Savings (Take-home pay minus total expenses) | $1,000 |

Changing the order of how I approached things (saving first, then spending money second) made a huge impact. It made it easier to achieve the results because it helped me change my mental approach to money.

In the old way of thinking about finances, money saved was the money left over – the money after you spent to cover all of your current expenses.

In the new approach, money was money saved until it was spent on something. It’s a mental switch, but one that can help you curb your spending and prioritize saving.

Instead of relying on self-control and constant monitoring my spending, I was savings first (and automating those savings so I couldn’t get off track) and then spending second. I literally set up a new annual budget spreadsheet that had my savings goal at the top, right under income.

It sounds so simple, but changing the order was revolutionary.

BIG IDEA: SAVING MONEY WENT FROM AN AFTERTHOUGHT TO A PRIORITY.

2: Simplified the Process of Managing Our Finances

Another reason that the anti-budget was instrumental for me was that it simplified managing our finances. As I already implied above, doing all of the things to manage my finances, while enjoyable, became too much work.

This removed all of that.

It inherently made everything else simpler because the other stuff was unnecessary.

I didn’t have to worry about tracking expenses by category. As long as I was saving the amount that I wanted to save, none of the rest of the stuff mattered.

I no longer would say things like, “We spent more in food this month than we wanted to,” or “We spent less on X, but that makes up for overspending in Y.” I spent less time making these adjustments in my mind, and more focused on the new goal.

I spent less time thinking about our finances and got the same results (if not more).

BIG IDEA: YOU CAN SOMETIMES ACHIEVE MORE BY DOING LESS.

The Simple Math Behind Early Retirement

It was around this same time that I came across what has come to be a very pivotal post from an early Fioneer who was blazing a new trail, which is the shockingly simple math behind early retirement.

The post above contains a really powerful spreadsheet that looks something like this:

| Savings Rate (Percent) | Working Years until Retirement |

|---|---|

| 5 | 66 |

| 10 | 51 |

| 15 | 43 |

| 20 | 37 |

| 25 | 32 |

| 30 | 28 |

| 35 | 25 |

| 40 | 22 |

| 45 | 19 |

| 50 | 17 |

| 55 | 14.5 |

| 60 | 12.5 |

| 65 | 10.5 |

| 70 | 8.5 |

| 75 | 7 |

| 80 | 5.5 |

| 85 | 4 |

| 90 | under 3 |

| 95 | under 2 |

| 100 | zero |

While the post itself has value, it was the spreadsheet that convinced me. There were several observations that stood out to me:

1: If you save 10-15% of your income, you’re going to work at least 43 years (51 if you save only 10%).

This was a key motivation for me. While we were saving closer to 20-25% of our income at the time, I often hear people say that they are saving 10% or less for retirement, thinking that they are meeting the recommended standards.

It’s almost like they puff up their chest with pride when they say those words. What they fail to realize is that this is setting themselves up for a long working career. I don’t know about you, but I don’t want to work for 43 years. I may enjoy my job, but I don’t want to be bound to it.

This spreadsheet helped me see that the average savings amount is enough only if you want to work 43-51 years.

2: The higher % of your income that you save, the earlier you can retire. Not only this, but exponentially so.

Seeing this information presented in a chart helps illustrate this very simple concept in a neat way. While it should be intuitive that the more you save, the earlier you can retire, seeing the tangible numbers from making an increase in your savings rate is very motivating.

For example, if you are currently saving 20% of your income, you are on track to retire in 37 years. If you can somehow boost your savings rate to 50%, you can retire in 17 years. That’s a difference of twenty years.

The relationship between savings rate and working career isn’t a straight 1:1 relationship. In fact, it’s an exponential one. You receive more of a benefit (in terms or years saved) in incremental jumps at the lower end of the savings rate, but you still receive a benefit (in terms of less years that you have to work) as you increase your savings.

3: You Can Trade Money for Time

The last and perhaps most important takeaway from this chart is that you CAN trade money for time. Time is in limited supply. You can’t live forever. But by saving a higher percentage of your income, you can buy your freedom.

With the concrete numbers in the spreadsheet, and doing some of the mental math in trying to increase your savings, you begin to see the power of saving rate. It becomes a game of what can I trade for my freedom earlier.

For example, if I were to reduce my expenses by 5% by doing A, B, and C, I gain X number of years that I don’t have to work.

While I didn’t realize it at the time, this takeaway would later become one of the driving forces behind our recent pursuit of financial independence.

Between Paula’s Anti-budget and MMM’s simple spreadsheet, I began to see a world of opportunity that never existed before. Not only could increasing our savings rate reduce how long we HAD to work, but more importantly that we could actually make a real impact to buy our freedom.

Achieving financial independence early on in life was possible.

Why Savings Rate Matters So Much

The savings rate is so powerful because of two reasons:

1: Savings Rate does not Discriminate based on Income. It Matters for Everyone

I used to think of early retirement or financial independence at an early age as a pipe dream for middle-class earners. It was something that those high-income earners achieved. Nothing more.

But this isn’t the case at all.

Your savings rate, as you may have noticed, has nothing to do with your actual income. It does not assume a six-figure salary. Instead, it’s based on YOUR household’s take-home pay. Not your neighbor or friends. Yours.

It does not discriminate based on income. It’s inclusive. Anyone can do this.

Note – While I do believe that anyone can do this, I am not naïve enough to think that there aren’t advantages or certain privilege that is afforded to me or others. It’s not a fair playing field, but that does not exclude anyone from working to achieve their own financial independence, even if the timeline is longer.

While it does include the numbers in the background (you get to the percentage or ratio by dividing real dollars of saving by household income), it’s relative. I’ve seen so many simplified statements on compound interest that look something like this:

If you save $200 per month for 40 years, and you earn 10% rate of return, compounded over 40 years you would have $1,118,920.

While these statements are trying to make a point around the importance of saving early, the problem with these statements is that it doesn’t take into account someone’s own financial situation. Not only do some people not have $200 extra dollars to save, but some people don’t have 40 years.

The savings rate does not have this same problem. By using a ratio or percentage, and identifying the amount of time to retirement, it is inclusive.

2: It is directly related to how early you can retire

If you take a step back and look at what the savings rate is, you’ll see the second reason that it is so powerful. It may be one number, but it implicitly factors in three numbers to give you a helpful tool to track your spending.

Savings Rate = Percent of Household Income dedicated to savings

That’s another way of saying,

Savings Rate = Savings / Household Income

Savings can also be calculated by Household income [minus] Expenses.

So while you can calculate this with just income and savings, it is related to expenses as well.

Household Income

Expenses

Savings

Three numbers rolled into one. All related.

As one of these numbers changes, so does your savings rate, and as a result, the time frame in which you can retire changes. It really is that simple, and powerful.

These three numbers are therefore not just numbers, but levers that you can pull to achieve financial independence earlier.

Want to retire earlier? Increase your income, decrease your expenses, or increase your savings. It really is that simple. Simple, but not easy.

Example of Savings Rate’s Importance

Let me give you an example of why the savings rate is important.

Bob works as at the executive level for a large $100M corporation. As such, he earns well beyond a livable wage, and his high salary allows him to save a lot of money. Each year he saves $50,000 between his 401k retirement account at work and taxable investment accounts but also enjoys living large. He and his wife (who does not work), own their own 2,500 square foot home in the nicer part of town and have two brand new cars.

Sally works for a large nonprofit organization, but has been there for 7 years and has demonstrated her importance. While she makes less than her counterparts in the private sector, Sally does pretty well for herself. Because she doesn’t live a fancy life, she commits to saving a high percentage of her income. Sally saves $30,000 each year between her 403b retirement account at work and Roth IRA.

Here’s the catch: Bob’s take-home pay is $250,000 and Sally’s take-home pay is $100,000. Both incomes are presented after taxes for simplicity.

Of the two people, normally you would think that Bob is better off because he has a higher income and contributes more to his retirement. Dedicating $50,000 to savings would seem like a lot of money, but when you relate it to his take-home pay, he is only contributing 20% of his income. Sally, on the other hand, is contributing 30%.

Because of Bob’s lifestyle, he would have to work approximately 37 years while saving 20%, whereas Sally has to 28 years at her 30% savings rate. Sally may not have as much money, but she has a lot more freedom. Approximately 9 more years of freedom.

How We Calculate Our Savings Rate

As I said earlier, Savings Rate is defined simply as the percentage of household income committed to savings. There are several ways to calculate the savings rate, so I wanted to walk you all through how we calculate our savings rate.

I believe our approach the most honest and helpful way to do so, and it should eliminate some of the questions that you will inevitably come up against as you start to track your own savings rate.

The first thing to do, which is more of a procedural note, is to define the time frame in which you will be calculating your savings rate. The most common time frames for calculating savings rate are monthly or annually. I prefer annually because it smooths out both income (if you are paid bi-weekly) and expenses (for example, car insurance or other expenses that happen less frequently than monthly). It may be fun to watch the savings rate adjust throughout the year, but that’s just noise. Focus on the annual timeframe.

With that established, here are the steps that we use to calculate our savings rate:

Step 1: Identify & Use Take-home Pay (Income)

There are some who say that you should use your gross (pre-tax) income when calculating savings rate. That’s one way of calculating your savings rate. It’s just an inferior way for a few reasons:

- You should focus on what you can control, and taxes are not something you can control. Well, technically you can minimize or reduce your taxes through some tax strategies, but while you are working during your career, you have to pay them.

- It’s counter-productive. Generally speaking, as your income increases, your effective tax rate will increase thanks to the marginal tax bracket system. As a result, if you were to use gross income, increasing your income might decrease your savings rate (even if you were to spend the same % of your take-home pay).

- It’s not comparable to now & the future. In addition to paying more or less as you progress in your career, you also won’t be paying the same taxes after you stop working.

It’s best to just eliminate taxes from the equation, and use take-home pay. This means as you start to think about retirement, you’ll want to focus on after-tax income. But for now, let’s just simplify it, and use take-home pay.

As a point of clarification, take-home pay is not simply the amount that is deposited into your bank account (or printed on your check if you don’t have direct deposit). There are two ways that you can calculate your actual take-home income. Here’s the simplest way to calculate your take-home pay if you want to do it yourself.

- Identify what was deposited into your account for the entire year

- Review your last pay stub for the year, and add the deductions for health insurance, retirement contributions, and any other benefits deducted from your paycheck.

- Adjust your take-home pay based on your tax return. If you get a refund of $1,000, increase your take-home pay $1,000.

If you are like me and would like to calculate your take-home compensation prior to the year starting, or in other words, look forward into next/current year, there’s another way of doing it. Here’s the more accurate way of calculating your take-home pay before the end of the year:

- Enter your gross annual compensation or salary into a spreadsheet

- Estimate and subtract your anticipated taxes, including Federal and state income tax (if your state has income tax), Medicare, and Social Security.

- Make sure to calculate your taxes based on your taxable income (after subtracting your pre-tax retirement contributions and health insurance costs)

Step 2: Calculate your Total Savings

Calculating our total savings is much easier than determining our take-home pay. The biggest question when it comes to savings is what to count as savings. Here’s a list of what we include when adding up our total savings:

- Retirement Contributions to employer-sponsored plans (i.e. 401k, 403bs, Simple IRAs, etc.)

- Employer matches to employer-sponsored plans

- Contributions to IRA accounts (either Roth or Traditional)

- Contributions to a taxable investment account

- Contributions to dedicated savings accounts (preferably a high-interest online savings account)

- Extra Mortgage Principal

Note – this last item is more debatable than others. If you own your own home, your mortgage payment consists of at least two parts: principal and interest. The principal is the amount of which your mortgage is reduced each month. Some in the FI community choose not to count the principal on their mortgage because there’s no guarantee in the value of your home. Others do because unless your home value drops, you are adding to your net worth. While I agree with the 2nd group more (because my net worth reflects this change), I have chosen a nice compromise: count only the extra payments towards the principal when calculating my savings rate. This means my savings rate should be more conservative, or lower than I calculate it to be.

That’s it. Add up all of these items and you have your total savings.

Step 3: Divide Total Savings by Total Take-Home Pay (Income)

The last step is the easiest of all three. Take the 2nd number (total savings) and divide it by take-home pay. On a technical note, you need to multiply it by 100 in order to get it to be represented in a percentage.

For example, let’s go back to Sally. Her total savings was 30,000. We know her take-home pay is $100,000.

So, $30,000 / $100,000 = 0.3

Multiply .3 x 100 to get 30%.

That’s how you can calculate your own savings rate. If you want to know what we have done over the past 5 years to increase our savings rate and drastically reduce the number of years that we have to work, keep reading.

How We Set our Target Savings Rate Each Year

After being influenced by the anti-budget, we have not only tracked our savings rate each year for the past 5 years, but we have also set savings rate targets or goals each year. I’ve bulleted out what our process looks like below, and am sharing with all of you because I find it to be a helpful process. In the first three years of doing this process, we more than doubled our savings rate.

We did make some intentional decisions in the last two years to slow down on our path to FI, but as you can see below, our savings rate is continuing to rise.

Our Process of Setting Goals Each Year

- Towards the end of the year, in November or December, we start to adjust our anti-budget / savings rate spreadsheet.

- The first step is to estimate our take-home pay. We can usually estimate any increases in compensation when we start this process, but can always adjust once we are notified by employers. If there were no anticipated increases, this makes the process simple – simply put in our current salaries and factor in taxes, etc. to get our take-home pay.

- After calculating our take-home pay, start a conversation around whether we are comfortable with this savings rate after we look at our savings rate for the previous (or year that we are currently finishing up). For example, if our savings rate was 37% (as it was in 2017), we may look at that, and reference to the Savings Rate / # of Years left working table above to see how many more years we would have to work at that rate, knowing that what we already have saved also lowers the # of years left until financial independence.

- This discussion may start there, but we are also talking about how hard it was to save that much money, whether we feel like we are missing out on anything in life, etc. The thing is that increasing your savings rate isn’t just about numbers. It’s about finding that balance between what makes you happy and what gives you long-term freedom. As Fioneers, we don’t want to sacrifice the now for some distant future. We want both – and believe that it is possible.

- After that initial discussion, we use our spreadsheet to understand the implications of any increase in our savings rate. We convert the % into real dollars. How much more would this mean we have to save, and what would that leave us for expenses. For example, if we talk about increasing our savings rate from 37% to 45%, we look at how many years of working that would cut off, and look at how we could accomplish that. In other words, between increasing our household income and lowering our expenses, is it realistic?

- We continue this circular process until we land on a point that we both feel comfortable with a savings rate that will challenge us, but not be unrealistic.

Why This Approach is So Powerful

In addition to getting the results that we would like to see (doubling our savings rate in 3 years), there are several things that make this approach so powerful.

1: It gets us both on the same page

The importance of this first point can’t be overstated. When you have a partner or family, it’s so important to be partners in this process.

You won’t accomplish your goals if, well, you have different goals. You won’t have the same goals if you aren’t talking through them in an honest manner.

2: This Process Forces us to Push the Envelope

This process is set up in a way that pushes us to do more. Instead of asking “Are we doing enough?” we are asking “Can we do more?” This is a mindset change that is so critical for any Fioneer to embrace if you want to accomplish your goals.

3: It’s Personalized to Us

Whatever process you use to increase your savings rate, it has to be true to you.

Instead of setting an arbitrary percentage or number that we will increase each year, we are personalizing it each and every year. As you may know, life changes a lot in one year. You should continue to reassess your plan on a regular basis.

After doubling our rate within a 3 year period, we have decided to change our approach. We saved a little less in 2019 than 2018, as Jess shifted to working part-time.

What We’ve Done to Increase Our Savings Rate

We had always been pretty good with savings – or so I thought. When we started tracking our savings rate in 2015, our “aggressive” savings rate goal was 25%. That felt like an amazing number. I’m sure I was one of those people that spoke with pride as I shared my savings rate.

I now understand that we were just getting started. The next 3 years saw us more than double our savings rate. It didn’t happen overnight and it was a gradual process to get there.

In the past two years, our savings rate has increased, but it hasn’t been linear. Here’s a look at our annual savings rate over the past 5 years:

While the process that I described above is helpful, it’s not where the real work was done.

The real work was done on two fronts: increasing our income and lowering our expenses. I wanted to share some real-life changes that we implemented to increase our savings rate. Here are the three biggest things that allowed us to go from 25% to 57% in just 3 years.

1: Increased our Income through Promotions

One of the biggest contributors to our success has been our ability to increase our income through our day jobs. I’ve done this primarily through increasing my value for my organization as it continues to grow.

When I started with my employer, we had 5 employees. We now have 39 full-time employees. That is tremendous growth and one that does not happen every day. Naturally, my responsibilities have increased over that time as well.

Jess has a similar story. She joined a growing organization, refined her skills and competencies, and earned several promotions. Because of this, we’ve been able to save most of our increases and boost our savings rate each and every year. In the past few years, she decided to return to work part-time and then just quit her job to pursue self-employment. But promotions several years ago helped increase our income and give us the freedom to do what she is doing now.

2: Pay off Debt

We made the huge jump in our savings rate from 2017 to 2018 because we finished paying off a small loan. We were paying about $9,000 / year towards this loan to pay it off over a three year period. After we had this loan paid off, we instantly had $9,000 extra to throw at savings.

We could have made the decision after this debt was paid off to add other luxury items to our budget (i.e. lake house, elaborate vacations, etc.), but we didn’t.

We chose to put it towards savings. I’m just grateful that we already had this framework in place by the time we paid the loan off because it made this decision to increase our savings rate so much easier.

3: Keep Transportation Costs Low

We also recently bought a newer car to upgrade our one car that was almost 14 years old. There was a short period of time where we had two cars. This period was very convenient, especially when I wanted to go places after work before Jess got home.

Financially we could afford to keep the 2nd car, but we decided against keeping it. We did the math and decided that it would be better financially to keep our transportation costs low. We’ve taken this approach for most of our marriage, and it has helped us tremendously.

4. Decreased Our Food Spending

When we first published this post, it was our goal to continue to decrease our spending. We prioritized cutting our food expenses. We now eat out less often, use an ugly veggie delivery service, and buy food in bulk.

This was a big part of the reason our savings rate was only 1% less in 2019 than 2018 after Jess started working part-time, and her take-home pay was cut in half. Reducing our food expenses helped us tremendously.

5. Increase our Income through Side Hustles

In the past two years, we’ve also been focusing on side hustles that generate income. While we haven’t come close to replacing our day job incomes, we did generate extra income last year, helping us reach a 63% savings rate.

With Jess working full-time on the blog and as a coach, we should be able to grow the business revenue significantly in 2021 and beyond.

Our Savings Rate Moving Forward

We’ve made a lot of progress on our savings rate. We’re finally at a point where we are no longer focused on growing our savings rate. Two years ago we were targeting a 60-70% savings rate. We have achieved that.

We feel comfortable with our annual expenses. We’re able to enjoy life, travel (when there isn’t a global pandemic), and buy things that we want. Our savings rate may continue to increase if/when our business revenue increases.

But that is no longer our focus. Instead, we are focused on leveraging the financial freedom that we have now to create our ideal lives. If our savings rate increases while we do that, great. If not, that’s okay too.

Recap: Key Takeaways

We covered a lot in this post, so I thought it would be helpful to recap the major points. Here are some key takeaways from this post:

- Savings should happen first. It’s not an after-thought or a result. If you want to make a dent in your personal finances, it should be a starting point or a priority.

- It’s best to keep things simple. This was one of the big takeaways from the anti-budget, and it continues to have a profound impact on me moving forward.

- Savings rate is a metric that can help you predict the # of years until retirement because it includes total household income, savings, and expenses. 3 Numbers in one.

- The higher the savings rate, not only the less time do you need until retirement, but also the smaller nest egg to retire.

- You can trade money for time. Earn more or spend less and you gain back some of that time that is truly limited.

- Many can increase their savings rate. It may be easier for some with higher incomes, but making a change to your savings rate is possible for many.

- Tracking your savings rate should be an annual process for every household – and one that you do as a household. Not one person, but the entire family (or both partners/parents/etc.).

- When looking to increase your savings rate, start with the big-ticket items. Start with the items that can have the greatest impact on your savings rate.

This is a great how-to article on calculating your savings rate. I have only started to keep track of this number for 2018. We average around 40%. There can be great variability in this number depending on how it is calculated. For ease of use, I have gone to gross income for calculating.

Thanks so much, Shawn. You’re right – there is a lot of variability with how it’s calculated. I don’t blame you for going with gross, because it is easier to calculate, but I really like net income because it takes out of the equation. In it’s truest form, savings rate is about how much money do I take home, and of that, how much do I save. Ignoring taxes not only gives you a better reflection of what your expenses are and what they will be, but also how long you have until reaching FI. For example, if you earn $100 gross, and save $40, you might think your savings rate is 40% and that you need $60 to live off of, but your savings rate is actually much higher because uncle sam is taking a percentage (and your denominator is too high), and the amount you need to live off of is actually much lower. You might say this is okay if you want to be conservative, but it won’t give you as accurate of a picture.

This was a really good how to on savings, do you have something actual investing? I would like to learn more about where to save money, which funds are good, etc

Hi Stania,

Great questions! We don’t yet have a how to on investing, but it’s something that’s on our short list of posts to write. Stay tuned, and we’ll have it out soon.

Thanks,

Jessica (aka Mrs. Fioneer)

Very insightful post on savings rate. The Shockingly simple math post by MMM was also the first visual evidence for me that really kicked my savings focus into hyperdrive. Seeing that exponential effect was all that was needed to make sure we were maximizing our savings possibilities throughout our monthly expenses.

THanks for this awesome post!

Hi! Great piece. Do you include / exclude property tax on your primary residence please? Why / why not? Thanks!

Hi Andrew, thanks for stopping by and the comment. We do not include property tax in our savings amount because it is an expense. As it relates to Savings Rate, there is no difference between property tax and any other housing maintenance expense (like replacing your locks). If you are interested, you could include the principal since it is likely positively impacting your net worth as I mentioned above in the post (but I choose to ignore it since there is no guarantee when it comes to the home value).

Corey – thanks for coming back on this. To be clearer, I meant property tax as a municipal tax which one pays to the city council. I understand from your answer that in contrast to certain other taxes — specifically national / state income tax and social security which are deducted by employers from the monthly salary — you advise against deducting property tax from the gross income for calculating net income (and thence savings rate), but rather to treat it as just another housing expense like maintenance. Thanks again!

Great article, thank you. For those of us with pensions from the military and government, how do you factor that into the savings rate and retirement planning in general? Also, do you factor Social Security into your retirement planning?

Hi Eric,

For a pension, you can factor it in as cashflow, similar to cashflow type investments where you aren’t selling principal. We don’t currently factor social security into our retirement planning. For us, that’ll just be “extra.”

Fantastic post. I wonder how many people started on the journey to FI solely because they read MMM’s Shockingly Simple Math?! I definitely qualify.

hi guys – just becoming familiar with your site and what you have to say re: finances. I’m intrigued – i write about pers finances as well (my site isn’t published yet – still tweaking. . researching)

I am looking for a bit more clarification on this line re: retirement from your article on “Savings Rate”:

You state:

“For example, if you are currently saving 20% of your income, you are on track to retire in 37 years. If you can somehow boost your savings rate to 50%, you can retire in 17 years.

How do you figure this? What age and income are you estimating from ?

how do you calculate this?

Your chart doesn’t indicate age that the saver starts saving and what percentages are taken from . . $50K per year? . . 75K per year? . . less? . . more

thanks in advance

and thanks for all the work you do

regards – Denise

Hi Denise,

This is the power of savings rate. It incorporates both your current income and your current spending, so the percentages are the same regardless of income level. It also doesn’t matter when the saver starts saving. If they start with $0 and save 20% of their income for 37 years, they will reach FI. If they start with $0 and save 50% of their income, they will reach FI in 17 years.

Best,

Jessica

That’s great you are able to double your savings rate. I know my fluctuates so much lately and I definitely get the math. It’s good to be reminded though when I fall back into “living in the now”. Which I will say is important too. But i’ve been finding great ways to do “free” things and still meet a lot of my goals in terms of my hobbies. Priorities. I suppose